Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Sungdong Shipbuilding averts liquidation with W200b deal

A consortium led by HSG Heavy Industries signed a contract Tuesday to buy debt-saddled South Korean shipbuilder Sungdong Shipbuilding & Marine Engineering for 200 billion won ($173 million), allowing the shipbuilder to avert liquidation of its assets.So far the consortium has paid 10 percent of the total, with the balance due by February.This came a month after the consortium, composed of HSG Heavy and private equity firm Curious Partners, was chosen as the preferred bidder for the Tongyeong

Market Dec. 31, 2019

-

M&As to keep Korean industries going in 2020

South Korea was brimming with billiondollar mergers and acquisitions in 2019, mainly propelled by large business groups in search of new growth opportunities, along with the divestment of their noncore business units.Throughout 2019, Korean entities announced a record-high volume of M&A transactions worth a combined 37.7 trillion won ($32.6 billion), according to Maeil Business Newspaper’s capital market tracker Radar M.Experts say this uptrend will continue and will eventually fuel an

Market Dec. 31, 2019

-

W4.1tr Korean hedge fund Lime Asset faces fraud accusations

The Financial Supervisory Service, South Korea’s financial watchdog, intends to take legal action against Lime Asset Management, a Korean hedge fund that manages 4.1 trillion won ($3.5 billion) worth of assets, on allegations that it concealed losses from its investors.The news comes as its 600 billion won fund dedicated to trade finance was found to have been associated with a debacle involving New York-based investment adviser International Investment Group, which was accused of running

Market Dec. 30, 2019

-

[News Focus] Can NPS shareholder engagement curtail power of chaebol?

The world’s third-largest pension fund, South Korea’s National Pension Service, may opt to present shareholder proposals to its portfolio companies in Korea -- which number as many as 800 -- starting from Korea’s upcoming proxy season in March next year.The move, long awaited by civic groups that denounced chaebol families’ alleged misdeeds, comes as the public pension fund approved its shareholder engagement guidelines Friday, effective immediately. The latest action wou

Market Dec. 29, 2019

![[News Focus] Can NPS shareholder engagement curtail power of chaebol?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2019/12/29/20191229000142_0.jpg&u=20191229175329)

-

KB Kookmin Bank to acquire Cambodian lender for $603.4m

South Korea’s commercial lender KB Kookmin Bank said Thursday its board has agreed to acquire a 70 percent stake in Cambodia’s lender Prasac Microfinance Institution for $603.4 million from Sri Lanka-based nonbanking lender LOLC Holdings.Prasac Microfinance is the No. 1 microfinance deposit-taking institution, taking up over 40 percent of market share in Cambodia with 177 branches.KB Kookmin will close the deal within three months, after a due diligence and approval from financial au

Market Dec. 26, 2019

-

S. Korea emerges as major player in global gaming M&As: report

South Korean companies are increasingly becoming key players of mergers and acquisitions in the global game industry, in pursuit of fresh revenue sources and growth engines, data showed on Thursday.From 2013 to 2018, Korea ranked No. 4 in global M&A transactions in the industry, according to Samjong KPMG in its report titled “Global M&A Trends in Game Industry.” Of the total 528 deals globally, Korean entities proposed, signed and closed a combined 45 deals, followed by

Market Dec. 26, 2019

-

Indebted CJ Group moves to generate cash through divestment

Korean food-to-entertainment conglomerate CJ Group is moving to generate cash through divestment efforts by its affiliates this month, making potential room to tackle the group’s snowballing liabilities.The group’s debt -- which stood at 16.6 trillion won ($14.3 billion) as of end-June according to Korea Ratings -- has cast a shadow on Chairman Lee Jae-hyun’s “Great CJ 2020” initiative to secure 100 trillion won in annual group revenue, pushing the conglomerate to t

Market Dec. 25, 2019

-

Kakao M carries on M&A push with $23m deal

Kakao M, a subsidiary of South Korean internet giant Kakao, is again adding momentum to mergers and acquisitions to consolidate its content production capacity and generate synergy among its media units.In the latest move, Kakao M subsidiary Starship Entertainment inked a deal to buy a 100 percent stake in a local performing arts company, Shownote, for 26.8 billion won ($23 million) in cash. Starship Entertainment also announced a plan to raise 11 billion won in capital, part of which will come

Market Dec. 25, 2019

-

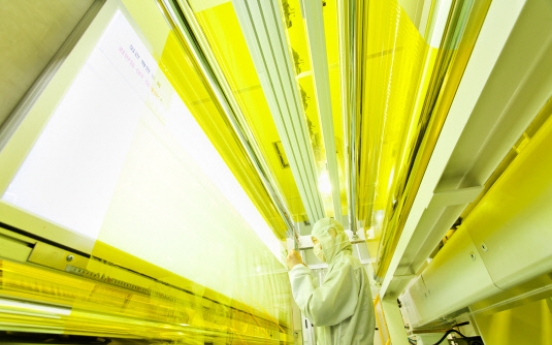

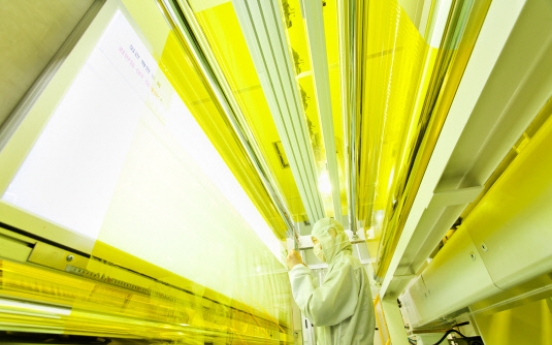

Glenwood PE signs W608b deal to acquire SKC Kolon PI

South Korea’s investment house Glenwood Private Equity has inked a deal to buy a controlling stake in the world’s leading polyimide film maker SKC Kolon PI for 608 billion won ($523.2 million) from its two major stakeholders, according to regulatory filings on Tuesday. The purchase price of a 54.07 percent stake in SKC Kolon PI has shrunk from earlier market estimates of some 700 billion won. The transaction is poised to take place by Feb. 28. SKC Kolon PI is a joint venture of Korea

Market Dec. 24, 2019

-

Hyundai Investments partners with La Francaise to create European office-focused fund

Seoul-based Hyundai Investments said Tuesday it has joined hands with French investment house La Francaise to create a blind pool fund that focuses on small and midsized office buildings in Western Europe. The new fund seeks 8 percent internal rate of return through a 10-year investment, according to Hyundai Investments. The Korean vehicle did not disclose the fund’s volume and its limited partners committed to the fund. The fund will target core-plus commercial buildings in key citie

Market Dec. 24, 2019

-

IMM PE to invest W134.7b to become HanaTour’s top shareholder

Seoul-based private equity house IMM Private Equity will become the largest shareholder of HanaTour Service, in a capital increase by South Korea’s No. 1 travel agency, HanaTour said on Monday. IMM PE will buy HanaTour’s newly issued 2.3 million common shares, or 16.7 percent of the outstanding shares, for 134.7 billion won ($115.8 million) -- with a 16.3 percent premium to its market price -- according to HanaTour’s disclosure. The funding will be raised from IMM PE&rsquo

Market Dec. 24, 2019

-

Naver-backed VC names head of Startup Alliance as new co-chief

South Korea’s internet giant Naver-backed venture capital TBT said Tuesday it has named Startup Alliance Managing Director Lim Jung-wook as the new co-chief of the investment vehicle. Lim will take office in March, when his term at Startup Alliance expires.He is serving his seventh year as the head of the nonprofit organization, dedicated to startup ecosystem advocacy and community building. Formerly a career journalist, Lim served as the head of web portal operator Lycos and global b

Market Dec. 24, 2019

-

KTB backs acquisition of logistics facility in Ireland

Seoul-based KTB Investment & Securities and KTB Asset Management have backed a 160 million euros ($177.2 million) acquisition of Tesco’s Distribution Center in Dublin, Ireland, by DTZ Investors, its adviser Cushman & Wakefield said Monday.It was the largest single-asset logistics transaction in Ireland by volume. The 73,000 square meter-wide warehouse is a logistics facility for dry goods distribution to some 150 Tesco stores across Ireland within three hours. KTB partnered w

Market Dec. 23, 2019

-

ATU Partners to acquire DragonX through esports-focused fund

Private equity house ATU Partners said Monday that it had signed a deal to buy a controlling stake in South Korean professional esports team DRX through its esports-focused fund worth 20.2 billion won ($17.4 million).The terms of the deal involving the League of Legends team, rebranded from Kingzone Dragon X, remain undisclosed. Alongside the deal, ATU Partners also reached an agreement to buy an undisclosed stake in esports agency Azyt. The fund is backed by limited partners including Kaka

Market Dec. 23, 2019

-

Telecoms get conditional approval for M&As

The Fair Trade Commission said Friday that it has conditionally approved two separate merger and acquisition deals, one led by SK Telecom and the other by LG Uplus, reshaping the local pay TV industry as it is already undergoing a major transformation toward digital services.The decision clears regulatory hurdles for a 4.7 trillion won ($4 billion) merger between SKT’s internet protocol TV service arm SK Broadband with t-broad, the country’s No. 2 cable TV multiple system operator, a

Technology Nov. 10, 2019

Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

![[News Focus] Can NPS shareholder engagement curtail power of chaebol?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2019/12/29/20191229000142_0.jpg&u=20191229175329)

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)