Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

US investor Capital Group sells W660b stake in Hyundai Motor

US investment firm Capital Group Companies has offloaded a 2.56 percent stake in South Korea’s largest carmaker Hyundai Motor for 660.8 billion won ($570.9 million), according to a regulatory filing on Wednesday. With the stock sale, Capital Group, through its 32 specially related parties including funds and subsidiaries, now owns 4.54 percent voting rights in Hyundai Motor, which controls car brands Hyundai, Genesis and Kia. This comes as a result of over 300 transactions by th

Market Jan. 15, 2020

-

Hanwha Systems’ $25m Overair deal closes

Hanwha Systems reached a final close on its cross-border $25 million investment in California-based electric takeoff and landing, or eVTOL, aircraft developer Overair, the Korean aero systems firm said Wednesday.With the investment, Hanwha Systems will own a 30 percent stake in the US company, which currently runs a development project for eVTOL vehicle Butterfly. The close of Overair’s Series A funding round came immediately after it gained a “deemed export” license from the B

Market Jan. 15, 2020

-

Hi Investment & Securities’ W217.5b fundraising plan hits snag

The fundraising plan of Seoul-based investment bank Hi Investment & Securities to fetch a combined 217.5 billion won ($187.8 million) is facing obstacles due to a possible court injunction.A total of 16 plaintiffs are seeking legal action to halt Hi Investment & Securities’ plan to raise 100 billion won by issuing 62.5 million redeemable and convertible preference shares, the investment bank said in a disclosure Tuesday.The Busan District Court will make a final ruling on the matte

Market Jan. 14, 2020

-

NH-Amundi, SSIAM partner to develop products tracking Vietnam stock indexes

Seoul-based NH-Amundi Asset Management and Ho Chi Minh City-based SSI Asset Management have agreed to partner to develop products that track benchmark indexes in the Vietnamese stock market, according to NH-Amundi on Tuesday.On Monday, they signed a memorandum of understanding guaranteeing an exclusive partnership to launch new financial instruments that track indexes of blue-chip companies, including the VN50 listed on the Hanoi Stock Exchange and VN30 that seeks listing on the Ho Chi Minh Stoc

Market Jan. 14, 2020

-

Goldman Sachs, SK to jointly invest W50b in cold warehouse operator

Global investment bank Goldman Sachs and SK Holdings said Monday they plan to jointly invest 50 billion won ($43.3 million) in Belstar Superfreeze, a South Korean entity that develops and operates cold warehouses powered by liquefied natural gas.Belstar in the first tranche will raise 25 billion won funding each from Goldman Sachs and the holding company of conglomerate SK Group. The two investors may opt to invest an additional 12.5 billion won each within a year. Now controlled by US

Market Jan. 13, 2020

-

Korean realty investments in Europe jump 122%

South Korean investments in European commercial real estate assets in 2019 jumped 122 percent on-year to 12.5 billion euros ($13.9 billion), on the back of Korean investors’ foreign exchange hedging against the euro and lower borrowing costs, data showed Monday.The acquisition binge also signals Korean investors’ need to digest the earlier deals in the region, according to global real estate consultancy Savills.By countries, France boasted the largest volume of Korean investments at

Market Jan. 13, 2020

-

Kakao Bank co-CEO joins ruling party, forfeits W2.6b stock option

Lee Yong-woo, co-chief executive of South Korea’s largest neobank Kakao Bank, said Sunday he had agreed to join the ruling Democratic Party in an apparent bid to run in the general elections here in April.The accompanied move to quit the mobile-only lender comes at the cost of his stock option -- 520,000 shares in the commercial lender that may be converted to at least 2.6 billion won ($2.2 million) starting March 2021. “I’m confident that the Moon Jae-in administration&r

Market Jan. 12, 2020

-

Hanjin KAL proxy fight looms as new investor comes to light

Hanjin KAL, the holding company of South Korea’s No. 1 air carrier Korean Air, is likely to face a proxy fight over its management, after it welcomed affiliates of builder Bando Group as major stakeholders.Eyes are fixed on whether Bando will act in favor of either of late Hanjin Chairman Cho Yang-ho’s scions in the shareholders meeting in March.Incumbent Chairman Cho Won-tae’s tenure is set to expire by March 2020. The successor’s reappointment appears to be facing uncer

Market Jan. 12, 2020

-

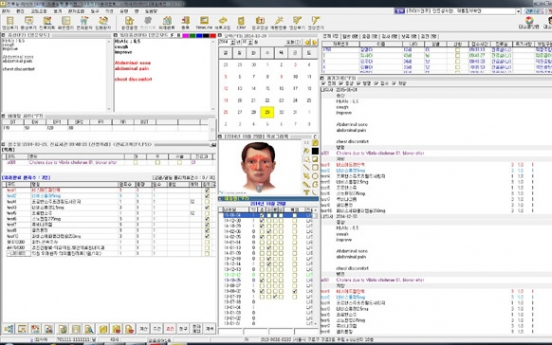

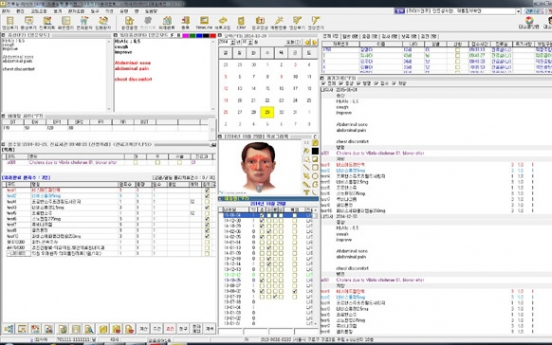

Green Cross eyes W200b acquisition of EMR software vendor

A consortium led by South Korean biopharmaceutical company Green Cross has been selected as the preferred bidder for the majority stake sale of UBCare, the nation’s No. 1 electronic medical records system vendor. The investor group, composed of Green Cross and Synaptic Investment, is looking to buy some 52 percent stake in UBCare from venture capital firms STIC Investment and Kakao Investment, according to investment banking sources on Friday. The shares are roughly valued at 200 billion w

Market Jan. 12, 2020

-

KDB, K-Growth to earmark W400b fund for supply chain autonomy

South Korea‘s state-owned lender Korea Development Bank and state-led fund-of-funds management company Korea Growth Investment (K-Growth) are looking for partners to earmark a combined 400 billion won ($344.9 million) to support materials and components sectors here and ensure national self-sufficiency in manufacturing supply chains.With the state backing 220 billion won, the funds are intended to foster the growth of Korean firms dedicated to materials components and equipment and ultimat

Market Jan. 9, 2020

-

[News Analysis] Can Delivery Hero-Woowa deal reshape Korea’s food delivery market?

For decades, free door-to-door food delivery service has been a common option for all kinds of South Korean restaurants.Not just pizzas, fried chicken and Chinese food, but also soups and meat dishes are just a phone call away – for delivery to homes, offices and even parks and other public spaces. The advent of digitalization, however, has led to the rise of online on-demand food delivery service platforms. Homegrown mobile apps, including Baedal Minjok, Yogiyo, Baedaltong, as well as exp

Market Jan. 8, 2020

![[News Analysis] Can Delivery Hero-Woowa deal reshape Korea’s food delivery market?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/01/08/20200108000670_0.jpg&u=20200109114252)

-

Moon’s shareholder engagement push to empower pension funds

South Korean President Moon Jae-in on Tuesday called for the swift revision of laws to allow institutional investors to ramp up shareholder engagement in the domestic market. This, he stressed, would prevent abuses of power in the business world. In his New Year’s speech, Moon urged the government to amend the Capital Markets Act and the Commercial Act, saying the proposed changes were critical to ensure fairness in the domestic market.“Fairness is the backbone of innovation and incl

Market Jan. 7, 2020

-

Major banks up ante for W2tr Prudential Life bid

Major banking groups in South Korea are revealing their appetite for what could become the largest acquisition deal in the nation’s financial industry this year: a 100 percent stake in Prudential Life Insurance of Korea valued at some 2 trillion won ($1.7 billion).The latest to express an interest was Woori Financial Group Chairman Sohn Tae-seung on Friday. He told reporters at a New Year gathering event of financial circles in Korea that he is “willing to do an M&A” of Pru

Market Jan. 5, 2020

-

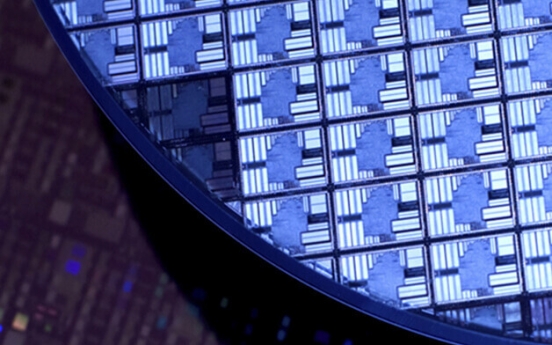

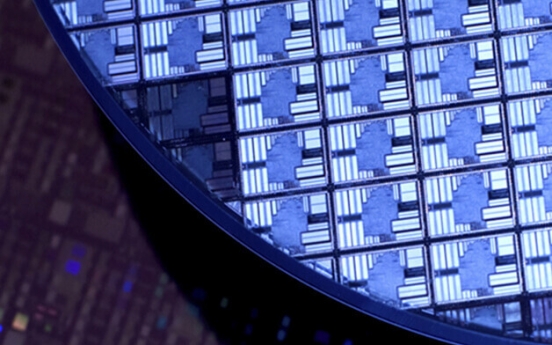

Wonik QnC embraces Momentive’s quartz operation for $266m

South Korea’s fabricated quartz maker Wonik QnC said Friday it had completed an acquisition of quartz and ceramics business units owned by New York-based company Momentive Performance Materials for $266 million, in a bid to achieve a vertical integration of its supply chain.Wonik QnC based in Gumi, North Gyeongsang Province, makes components for semiconductors, displays and other products using quartz. The cross-border deal will allow the company to wholly own the world’s leading fus

Market Jan. 3, 2020

-

Time is ticking for KDB to sell life insurance arm

Shareholders of Seoul-based KDB Life Insurance are under intensifying pressure to find a new owner, potentially facing a host of new complex regulations next month when a 10-year grace period expires. State-run policy lender Korea Development Bank has yet to find a preferred bidder for the life insurance unit, although Chairman Lee Dong-gull anticipated finding one through an open tender by end-2019.The uncertainty casts doubt on the bank’s sell-off by February, which would otherwise resu

Market Jan. 2, 2020

![[News Analysis] Can Delivery Hero-Woowa deal reshape Korea’s food delivery market?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/01/08/20200108000670_0.jpg&u=20200109114252)

![[Graphic News] Generational divide at impeachment rallies stronger among women](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/22/20241222050002_0.gif&u=)