Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Eximbank Korea to create health care funds worth W400b

The state-run Export-Import Bank of Korea said Monday that it intends to create two funds worth a total of 400 billion won ($325.2 million) to help South Korean health care companies go global. The money will go to Korean companies devoted to immunotherapy, gene therapy, health care systems, diagnostic kits and medical devices. It will be used to support them in exporting more products, clinching more overseas investment and expanding to foreign markets. Of the total, Eximbank Korea has comm

Market April 6, 2020

-

NHIS commits W1.4tr to alternative investment

The National Health Insurance Service unveiled on Monday plans to commit up to 1.4 trillion won ($1.14 billion) to its first alternative investment in history as an institutional investor. It plans to select two lead partners to manage the assets for four years, officials said. This comes as the South Korean state agency, with some 20 trillion won worth of assets under management, moves to shift away from a conservative portfolio and turn to alternative assets, ranging from real estate to

Market April 6, 2020

-

Hana Bank, Woowa Brothers to create rating model based on online food orders

Restaurants available on delivery app Baedal Minjok will have a broader access to loans from a commercial bank, if they show proof that they were winning more online food delivery orders. This will be part of commitments in a memorandum of understanding by Korea’s mobile food delivery unicorn Woowa Brothers and commercial lender Hana Bank, Woowa Brothers said Friday. Under the MOU, the door-to-door food delivery company and the bank pledged to create a credit rating model that uses the

Market April 3, 2020

-

Korea's proposed M&As shrink to half in Q1

The volume of proposed mergers and acquisitions in South Korea has shrunk to about half in the first quarter of 2020, reflecting the impact of the novel coronavirus, data showed Thursday. The first quarter saw 5.23 trillion won ($4.22 billion) worth of deals announced, falling 50.6 percent on-year, according to a league table by news outlet thebell. This comes as the coronavirus pandemic is causing delays in reaching agreements between parties due to market uncertainties. Major deals annou

Market April 2, 2020

-

BlackRock offloads W130b stake in NCSoft

US investment house BlackRock Fund Advisors has offloaded its 1.01 percent stake in South Korea’s game software developer NCSoft to cash out 129.57 billion won ($105.1 million), a filing showed Thursday. As a result, BlackRock Fund Advisors and its 13 specially related parties hold 6.05 percent voting rights in the company as of March 25 as a nonengagement shareholder. NCsoft share price rose 6.15 percent. The investor said its transactions from September to March were “meant to se

Market April 2, 2020

-

[Market Close-up] Doosan Heavy looks to sell affiliates

Debt-saddled Doosan Heavy Industries & Construction was once considered South Korea’s leading power equipment maker for coal fire, nuclear and gas energy. But over the past few years, it has been losing investors’ interest, as it won fewer bids amid the global attempt to shift reliance on fossil fuel and nuclear energy, leaving its businesses dependent on debt to continue its faltering operations. In the wake of the coronavirus pandemic, Doosan Heavy is facing a liquidity cris

Market April 1, 2020

![[Market Close-up] Doosan Heavy looks to sell affiliates](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/01/20200401000724_0.jpg&u=20200401174057)

-

Mirae Asset chairman donates W25b in decade

South Korea’s Mirae Asset Financial Group said Tuesday that Chairman Park Hyeon-joo has donated his dividends for 10 years in a row -- amounting to 25 billion won ($20.5 million). In 2019, as a shareholder of Mirae Asset Global Investments and Mirae Asset Capital, Park earned a combined 1.7 billion won. The donations went to Mirae Asset Park Hyeon-joo Foundation, dedicated to scholarships for exchange programs for Korean college students. According to the firm, over 5,800 students have

Market March 31, 2020

-

Financial regulator backs KDB ownership of insurer

South Korea’s financial regulator Monday cleared uncertainties, allowing the Korea Development Bank to take control of a local insurer unit for the time being and buy the time to sell it off. A private equity firm jointly created by KDB and Consus Asset Management -- which controls a combined 92.73 percent of KDB Life Insurance -- reached the end of a 10-year grace period before being regulated as an insurance holding company in February. Under the Capital Markets Act, the private equity

Market March 30, 2020

-

Korea’s short-term funding market reels from coronavirus

South Korea’s short-term funding market is showing no signs of stabilizing, despite the central bank’s relief package to help ease the credit crunch amid the global coronavirus pandemic. The interest rate of commercial papers with 85-91 days of maturity -- a frequent short-term debt instrument by nonfinancial companies -- soared to 2.09 percent Friday, up 5 basis points from the previous day’s close, according to data from the Korea Financial Investment Association. The figur

Market March 28, 2020

-

Calls for basic income subsidy support grow

Provincial governors and mayors urged the central government Saturday to shoulder the cost of basic income subsidies to help citizens. “It is imperative for the (central) government to take more aggressive and proactive measures to bring the society‘s safety net back to normal,” the Governors Association of Korea, composed of the heads of 17 local governments, said in a proposal to Korea‘s central government. “Facing a national emergency, the (central) governmen

Economy March 28, 2020

-

Hanjin KAL’s proxy war to intensify despite activist fund's defeat

South Korea’s activist private equity fund Korea Corporate Governance Improvement on Friday vowed to restore Hanjin Group “back on track,” signaling its push for activism despite the Friday defeat. “We could feel the shareholders' desire to change Hanjin KAL’s management by the owner family,” the coalition led by KCGI wrote in a letter to shareholders. “The most crucial is for Hanjin Group to make a breakthrough, and we believe that the only solut

Market March 27, 2020

-

Korean firm buys stake in Russian liver cancer therapy developer for $20m

Seoul-based Thelma Therapeutics said Friday it has closed a deal to buy 27 percent stake in Russian liver cancer therapy developer for 24.3 billion won ($20 million), to tap the overseas health care market. The stake was of NBT, a parent company that wholly owns radioembolization therapy device developer Bebig, both located in the Dubna Special Economic Zone on the northern outskirts of Moscow. Bebig is known for selling the therapy device called Microsphere, used to cure liver cancer -- a the

Market March 27, 2020

-

[Market Close-up] Battered brokerages to get breather after risky assets tank

South Korea’s brokerage houses suffering from recent losses on risky structured products that placed bets on foreign stock indexes are expected to get some relief after the government allocated a larger-than-expected slice of its stimulus package to the sector. Reporting on the results of a meeting presided by Moon Jae-in on Tuesday, the Financial Services Commission said authorities would inject 5 trillion won ($4.1 billion) to help securities firms deal with the stress, as part o

Market March 25, 2020

![[Market Close-up] Battered brokerages to get breather after risky assets tank](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/25/20200325000711_0.jpg&u=20200325182403)

-

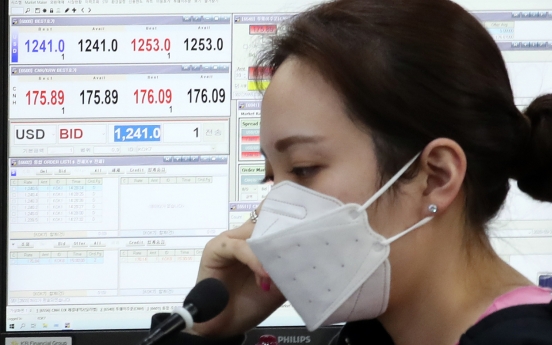

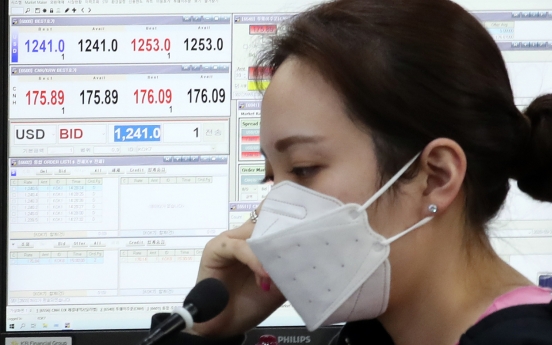

Forex pressure looms over Korea's outbound investments

Facing a weakening local currency amid the escalating novel coronavirus crisis, companies are hedging their cross-border investment plans, including mergers and acquisitions, filings showed Tuesday. The deals denominated in foreign currency are facing increasing exchange rate pressure. as some of the investment decisions were made before the coronavirus outbreak. Over the past three weeks, South Korea’s local currency has weakened 4.6 percent against the greenback and fell 2.4 percent a

Market March 24, 2020

-

Coronavirus wipes off IPO plans in March

The coronavirus pandemic and ensuing market volatility are disrupting listing plans of South Korean firms that could otherwise have raised at least 289.5 billion won ($227.8 million), filings showed Monday. Seven companies have withdrawn or put off their initial public offerings in March. They include stem cell therapy developer SCM Life Science, telemarketing service provider Metanet Mplatform, electric vehicle parts maker LS EV Korea, diabetes treatment developer NovMetaPharma and construct

Market March 23, 2020

Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

![[Market Close-up] Doosan Heavy looks to sell affiliates](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/04/01/20200401000724_0.jpg&u=20200401174057)

![[Market Close-up] Battered brokerages to get breather after risky assets tank](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/25/20200325000711_0.jpg&u=20200325182403)

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)