Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

S. Korean companies brace for liquidity crisis in April

South Korean companies are bracing for a possible liquidity crisis in the bond market next month, amid sagging investor sentiment and signs of capital flight due to the coronavirus pandemic, market data showed Sunday. The illiquidity -- triggered by continuously escalating novel coronavirus fears -- will pose a hurdle to companies when they attract new capital or carry out a refinancing scheme. A combined 6.5 trillion won ($5.2 billion) in corporate bonds is due to reach maturity in April, ac

Market March 22, 2020

-

Foreign brokerages suffer big hit amid price-cutting race

Foreign brokerages operating in South Korea have reported a drastic fall in their earnings in 2019, with their commission income falling sharply as domestic rivals chewed on their market share. The five securities arms of foreign investment banks -- Credit Agricole, BNP Paribas, Deutsche, Hong Kong and Shanghai Banking Corp. and UBS -- disclosed that they saw over a 30 percent drop in their annual earnings, according to the Korea Financial Investment Association. The latest was France-based C

Market March 22, 2020

-

Hankuk Paper signs W55b deal to acquire local paper maker Seha

An investor group led by South Korean pulp product manufacturer Hankuk Paper agreed to buy a majority stake in Korea’s third-largest domestic industrial paper maker, Seha, for 55 billion won ($44.2 million) from Korean nonperforming loan manager United Asset Management Co., a filing showed Sunday. This marks the private bad bank’s first exit from a distressed buyout strategy that traces back to 2014. The consortium -- comprising Hankuk Paper and Daesung Industrial -- will acquire

Market March 22, 2020

-

NPS to vote against chiefs of Shinhan, Woori, Hyosung

The National Pension Service, South Korea’s public pension fund, said Thursday it would disapprove of the chiefs of Shinhan Financial Group, Woori Financial Group and Hyosung as board directors in their respective shareholders meetings in March. The decisions came as the pension fund overseeing 736.7 trillion won ($576.7 billion) has moved to ramp up shareholder activism and exercise its voting power to keep large corporations in check as a minority shareholder. The NPS’ nine-membe

Market March 19, 2020

-

Korean firms rush for audit lifeline amid coronavirus spread

South Korea’s financial regulator said Thursday that 69 domestic companies have sought audit relief due to shortcomings in their reports for 2019, as the novel coronavirus has undermined their key operations, especially in China. Over two-thirds of companies that have applied for regulatory relief have a presence in China, and determined their filings cannot be completed by March 30, according to the Financial Services Commission. They include tobacco product maker KT&G, light bulb ma

Market March 19, 2020

-

Coronavirus fears dent corporate bond deals

Coronavirus fears in the financial market are quashing bond investors’ appetite for investment-grade bonds issued by South Korean companies, dragging on their plans to raise capital. From Friday to Wednesday, all corporate bonds of three companies were undersubscribed in the respective institutional tranches in Korea. This stems from the bond price hike along with monetary easing stance at home and abroad. Bond yields, which move inversely with bond prices, were on a downtrend in Kore

Market March 18, 2020

-

[Economy in Pandemic] Coronavirus puts Korean economy into uncharted territory

The Korea Herald is publishing a series of interviews and analysis over looming threats of COVID-19 on the Korean economy and beyond. This is the first installment. -- Ed. Despite a series of emergency actions being taken by governments around the world, the novel coronavirus -- and its resulting disease COVID-19 -- is wielding sweeping power over the global financial market and the real economy, indicating rising global recession risks. The Bank of Korea cut its policy rate Monday to a recor

Economy March 17, 2020

![[Economy in Pandemic] Coronavirus puts Korean economy into uncharted territory](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/17/20200317000750_0.jpg&u=20200825162556)

-

Foreign investors beef up shareholder activism with legal clarity

South Korea introduced a law in February to support a new form of activism by “general” equity investors, enabling minority shareholders to have a say in corporate decisions. The revision of the Capital Markets Act has offered investors legal clarity in their move to boost shareholder value and adhere to stewardship codes. So far, four foreign investors have declared they are “general” investors in eight listed companies,” so that they can be more actively engage

Market March 16, 2020

-

Bandi & Luni’s bookstore chain up for sale

The owners of the Seoul Book Center -- operator of South Korea’s third-largest bookstore chain, Bandi & Luni’s -- are looking to put their stake in the company up for sale through deal manager eBest Investment & Securities, the brokerage house said Monday. Founded in 1988, the Seoul Book Center operates 10 bookstores and stationery stores across the country, as well as an online bookstore. The deal is meant to give its owners, including CEO Kim Dong-kook and his father, Ki

Market March 16, 2020

-

[Herald Interview] ‘Korea’s impact investors should seek cross-border deals’

South Korea was the first country in East Asia to introduce a legal definition for impact investment under the Promotion of Social Enterprises Act in 2007, which paved the way for a mature ecosystem. Impact investments aim to generate specific beneficial social or environmental effects in addition to financial gains -- actively seeking to make a positive impact, for example, by investing in nonprofits that benefit the community or in clean-technology enterprises that benefit the environment.

Market March 15, 2020

![[Herald Interview] ‘Korea’s impact investors should seek cross-border deals’](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/15/20200315000047_0.jpg&u=20200315191814)

-

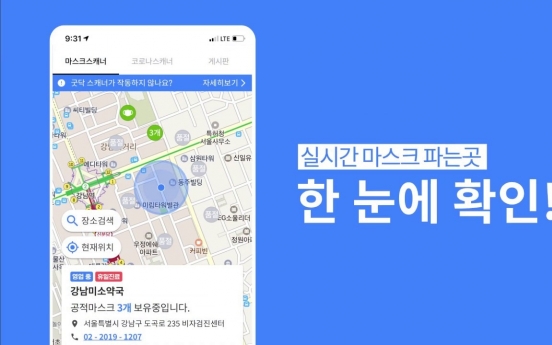

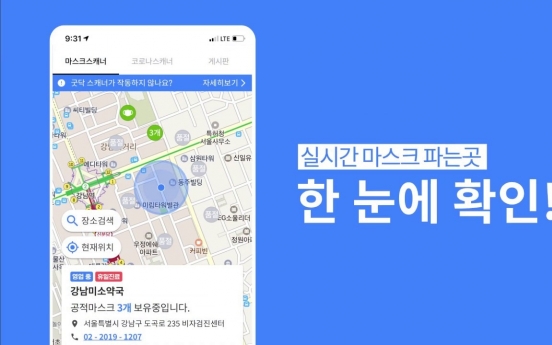

Busan-based VC to control mask inventory app operator Carelabs

Busan-based venture capital Maple Investment Partners has been selected as the preferred bidder to become the largest stakeholder of Carelabs, a South Korean company listed on the development stock bourse Kosdaq, a regulatory filing showed Friday. Carelabs operates a mobile app Gooddoc, which allows users to track the nearest hospitals and drugstores. The app began to feature real-time face mask inventory tracking function earlier in March. Facing a mounting fallout of COVID-19 here and the c

Market March 13, 2020

-

Assetplus ex-CEO returns to top post

Assetplus Investment Management said Wednesday it has named Edward Yang as its new CEO following a shareholders meeting. This marks Yang’s return to the top post in four years -- he served in the top post from June 2012 to May 2016. After his term, he has since led Assetplus’s strategic business division. Yang said he would focus on the firm’s digital marketing scheme that would allow the asset manager to draw retail investments into its funds through mobile trading platfor

Market March 11, 2020

-

Heung-A Shipping to undergo KDB-led debt restructuring

South Korea’s No. 5 shipping firm Heung-A Shipping is planning a corporate workout program as its maritime cargo operations have faltered, with snowballing debt, a regulatory filing showed Wednesday. The company’s board has approved a debt restructuring scheme by the policy lender Korea Development Bank, one of its key creditors, to “improve its finances and normalize business operations.” Under the KDB-led financial rescue package, creditors will take control of the t

Market March 11, 2020

-

NPS to be no barrier for Hyosung chairman to extend term

Despite the National Pension Service’s efforts to actively interfere in the management decisions of scores of domestic companies as a major shareholder, it is likely to leave Hyosung Group untouched. The NPS has yet to change the shareholding purpose of Hyosung Corp., holding firm of the family-controlled conglomerate, to “general investing” from “nonengagement investing,” which would otherwise have allowed it to have a say in issues related to executive salaries

Market March 10, 2020

-

Shinhan Card to buy Hyundai Capital’s W500b assets for rental car biz

Shinhan Card said Tuesday it is poised to buy parts of Hyundai Capital’s assets related to its long-term car rental services for around 500 billion won ($417.3 million). The assets will be composed of vehicles under the South Korean carmaker -- Hyundai, Kia and Genesis -- which Hyundai Capital rents to consumers, as well as rental consumers. The final acquisition price will differ depending on shareholder approval. The two companies signed the deal Monday for the transaction scheduled

Market March 10, 2020

Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

![[Economy in Pandemic] Coronavirus puts Korean economy into uncharted territory](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/17/20200317000750_0.jpg&u=20200825162556)

![[Herald Interview] ‘Korea’s impact investors should seek cross-border deals’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/03/15/20200315000047_0.jpg&u=20200315191814)

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)