Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

-

Citibank Korea committed to supporting ESG drive in corporate sector

Citibank Korea, the South Korean unit of Citigroup, has ramped up efforts to gain an upper hand in sustainable financing, focused on environmental, social and governance factors, to support local companies’ ESG management, the lender said Sunday. Sustainable financing refers to a bank’s financial services, ranging from loans to bonds, designed to provide financial support for sustainable economic activities and projects of private companies or public entities. The prolonged COVID-19

Nov. 7, 2021

-

Banks in Korea to see mass voluntary retirement this year

South Korea’s banking sector is expected to no longer guarantee job security the way it once did. This year, the industry is seeing a mass exodus of its workforce, with lenders offering lucrative early retirement packages to accelerate digitalization of banking services and trim down their physical operations for the transition, data showed Sunday. The Korea Herald looked at individual employment data from six banks released this year. Along with Citibank Korea shutting down its consume

Nov. 7, 2021

-

Blockbuster IPO shares fear price fall this week as lockups expire

Stocks that began trading through blockbuster initial public offerings this year might see a downturn in stock prices as lockup periods that hindered large shareholders from selling expire this week, according to market insiders Sunday. A stock lockup is a device to prevent large shareholders from selling their shares too quickly and causing a sudden change in stock prices after a company goes public. Institutional investors are expected to trade roughly 11 trillion won ($9.3 billion) worth o

Nov. 7, 2021

-

Why are NFTs more disruptive than cryptocurrencies?

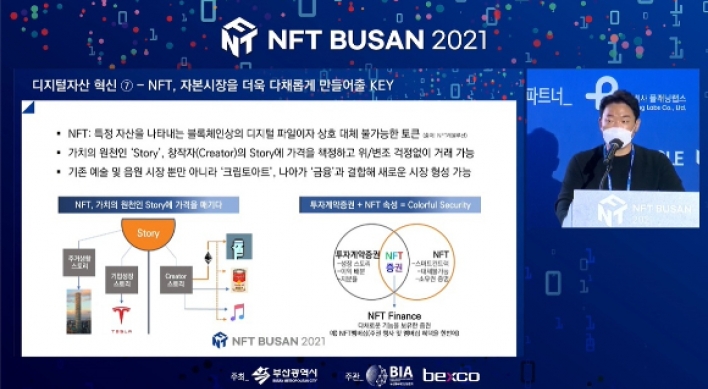

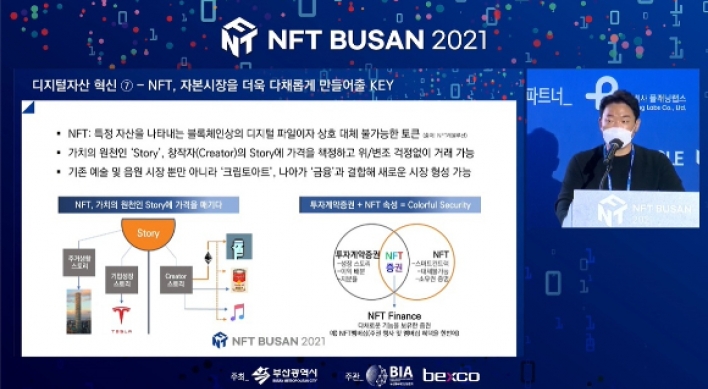

Nonfungible tokens, otherwise known as NFTs, are more disruptive than cryptocurrencies because of its potential to be applied to a plethora of sectors, blockchain experts said last week. “At the moment, the cryptocurrency market, which is a fungible market, outscales the NFT market, but the cryptocurrency market still falls within the realm of conventional finance. On the other hand, NFTs present an unlimited potential to expand beyond existing conceptions of financial assets,” Kim

Nov. 7, 2021

-

With assessment of NFTs done, financial companies actively seek opportunites

Rather than discussing the question of whether non-fungible tokens are a fad, traditional financial institutions are instead asking how they can be incorporated within their business models, according to speakers from major financial firms who gathered at a three-day conference on NFTs. The tokens are digital counterparts of real-world assets, largely visual art and music. More importantly, each NFT is unique, with ownership being traced and protected through blockchain technology. Given that

Nov. 6, 2021

-

KOSPI likely to move in tight range next week on policy uncertainties

South Korea's benchmark stock index is likely to move in a tight range next week, although volatility may increase due to policy uncertainties, analysts said. The benchmark Korea Composite Stock Price Index (closed at 2,969.27 points Friday, nearly unchanged from 2,970.68 points a week ago. The KOSPI fluctuated as investors waited and digested the U.S. Federal Reserve's meeting results, particularly its stance over potential rate hikes. According to the FOMC meeting results, the US central b

Nov. 6, 2021

-

KKR closes W2.4tr deal to invest in SK E&S in eco push

US investment firm KKR & Co. said Friday it has acquired newly issued redeemable convertible preferred shares of South Korean energy company SK E&S for 2.4 trillion won ($2 billion). The investment, via KKR‘s Asia Pacific Infrastructure Fund, will provide KKR with an opportunity to receive cash or in-kind redemption for repayment in the future, as well as an opportunity to convert the securities into common shares of SK conglomerate’s natural gas arm, according to KKR. The

Nov. 5, 2021

-

Mamamoo’s agency aims to morph into global content provider via IPO

Rainbow Bridge World, the South Korean entertainment agency behind girl group Mamamoo, said Friday that it is looking to spur growth globally by raising funds through its initial public offering scheduled for later this month. “We will further accumulate experience in producing high-quality content by making active investments (after the IPO). We are poised for a leap in the global market as an integrated content provider,” Kim Jin-woo, co-chief executive officer at Rainbow Br

Nov. 5, 2021

-

Gaming giant Netmarble’s development unit pulls IPO plan

Netmarble Neo, the development unit of South Korea’s top gaming company Netmarble, has scrapped its plan to go public, on the back of its lackluster performance and underperforming gaming stocks listed on the local market, according to investment banking sources on Friday. The company withdrew its preliminary application for an initial public offering a day earlier, which was submitted to the Korea Exchange in June. Blaming “stagnant market situation” for the thwarted plan,

Nov. 5, 2021

-

Seoul stocks retreat on institutional sell-offs

South Korean stocks retreated on Friday, led by institutional sell-offs. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) lost 13.95 points, or 0.47 percent, to close at 2,969.27 points. Trading volume was moderate at about 676 million shares worth some 12.4 trillion won ($10.5 billion), with losers outnumbering gainers 608 to 269. Institutions sold a net 446 billion won, while retail investors purchased 388 billion won. Foreigners bought a ne

Nov. 5, 2021

-

BGF shares hit price ceiling on takeover of engineering plastic maker Kopla

Convenience store chain operator BGF has confirmed Friday its plan to acquire a stake in engineering plastic resin maker Kopla for at least 180.8 billion won ($152.6 million), in a strategic move to enter into a new business, sending its shares jumping nearly 30 percent at some point. According to filings with the Financial Supervisory Service, BGF is poised to acquire 11 million common shares of Kopla from Kopla President Han Sang-yong and his affiliated parties and through a new rights offer

Nov. 5, 2021

-

Seoul stocks open lower on financial, bio losses

South Korean stocks opened lower Friday, largely amid losses in the financial and bio stocks. The benchmark Korea Composite Stock Price Index (KospiI) fell 10.23 points, or 0.34 percent, to 2,972.99 points in the first 15 minutes of trading. Market bellwether Samsung Electronics increased 0.57 percent to 71,000 won, No. 2 chipmaker SK hynix advanced 1.42 percent to 107,500 won, and Hyundai Motor, the country's largest carmaker, moved up 0.7 percent to 215,500 won. Among losers, pharmaceutical

Nov. 5, 2021

-

Desire for digital interaction defines where finance is headed: KakaoBank CEO

Human desire for constant, convenient and unique interactions in digital spaces defines where the future of finance, as well as KakaoBank, is headed, the CEO of South Korea’s largest online lender said Wednesday. “People say the ‘uncontact’ phenomenon has triggered digitalization of industries under the pandemic, but they still love to contact, they just want to do it in a digital space. And we are going to see how such human desire will reshape the future of industrie

Nov. 4, 2021

-

DP presidential candidate vows to push for MSCI World Index inclusion

The presidential candidate of the ruling Democratic Party of Korea said Thursday that he would push for winning a developed market status for South Korea from Morgan Stanley Capital International to revive the undervalued stock market here, if elected. “The price-earnings ratio in the domestic stock market is about one-third compared to other advanced economies. We must mitigate the so-called ‘Korea discount,’” Lee Jae-myung said during a conference with a group of repo

Nov. 4, 2021

-

Shinhan Financial chief highlights net-zero goals at COP26

Shinhan Financial Group Chairman Cho Yong-byoung vowed to contribute to South Korea’s swift transition into a carbon neutral society with the financial giant‘s net-zero goals at the 2021 United Nations Climate Change Conference in Glasgow, Scotland, the firm said Thursday. The chief of Korea’s second-largest banking group by total assets on late Wednesday introduced Shinhan Financial’s own plans to achieve carbon neutrality in finance dubbed the “zero carbon drive

Nov. 4, 2021

-

BTS agency teams up with Korean crypto exchange to venture into NFT market

Hybe, the K-pop powerhouse behind BTS, said Thursday that it has teamed up with South Korea’s top cryptocurrency exchange operator to establish a joint venture to branch out into the nonfungible token marketplace. The music agency is poised to acquire a 2.48 percent stake in Dunamu for 500 billion won ($423.7 million), as the operator of cryptocurrency exchange Upbit plans to issue 861,004 ordinary shares for third-party rights, offering to invite Hybe as a new shareholder. Dunamu also

Nov. 4, 2021

-

Seoul stocks advance on Fed's comments over tapering

South Korean stocks advanced Thursday, as the US Federal Reserve signaled "patience" in raising interest rates. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) rose 7.51 points, or 0.25 percent, to close at 2,983.22 points. Trading volume was moderate at about 759 million shares worth some 14.4 trillion won ($12.2 billion), with losers outnumbering gainers 580 to 295. Foreigners bought a net 326 billion won, while retail investors s

Nov. 4, 2021

-

Korean investors commit 90m euros to coinvest with BlackRock's infra fund

South Korean institutional investors have allocated a combined 90 million euros ($104 million) of commitment to a separately structured coinvestment vehicle of a fourth flagship fund by BlackRock Infrastructure Solutions, industry sources said Thursday. Seoul-based investment house IPM Asset Management said Thursday it has created the vehicle for Korean investors, allowing them to implement a coinvestment strategy alongside BlackRock’s fund, dubbed Global Infrastructure Solutions 4. Thr

Nov. 4, 2021

-

Blockchain firm AMAXG enters NFT business

Blockchain company AMAXG said on Thursday it has entered the nonfungible token platform business to trade unique and noninterchangeable data stored on digital ledgers. AMAXG said it recently opened a digital asset NFT transaction platform named BIZA-UVIT, and built strategic partnerships with the Federation of Artistic and Cultural Organizations of Korea (FACO), the Global Medical Aesthetic Exchange Association (GMAEA) and the Korea Blockchain Enterprise Promotion Association. FACO plans to di

Nov. 4, 2021

-

Seoul stocks open steeply higher over Fed's tapering

South Korean stocks opened steeply higher Thursday, following the US Federal Reserve's decision to start to taper its bond purchases. The benchmark Korea Composite Stock Price Index (KOSPI) rose 29.91 points, or 1.01 percent, to 3,005.62 in the first 15 minutes of trading. Overnight, the tech-heavy Nasdaq composite added 1.04 percent and the Dow Jones Industrial Average gained 0.29 percent as the Federal Reserve said it will start to taper its massive asset purchases later this month amid the

Nov. 4, 2021

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)