Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

-

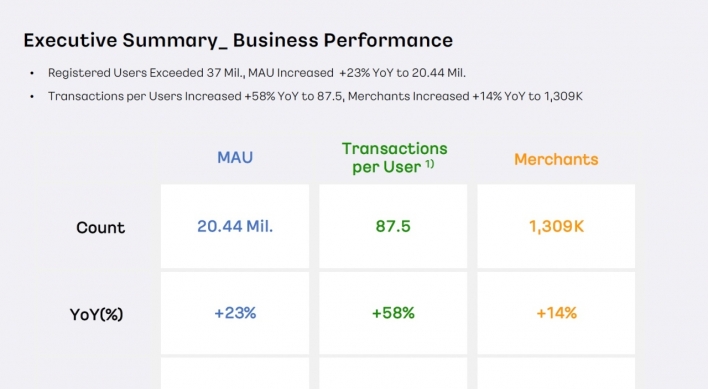

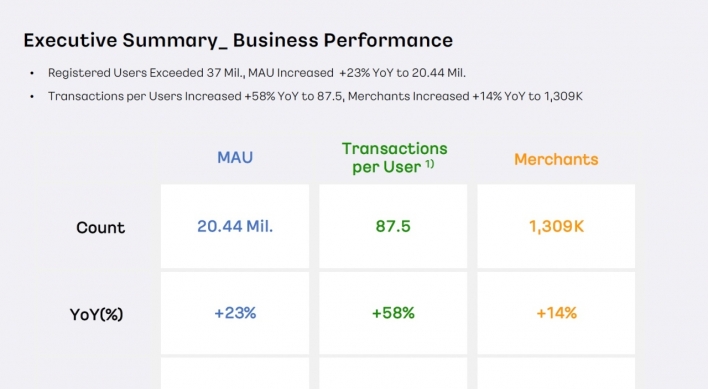

Kakao Pay in red over rise in expenses

Kakao Pay said Wednesday that it logged a net loss in the third quarter due to increased expenses and investments. The company’s third-quarter revenue rose 73 percent on-year to 331.2 billion won ($280 million) on the growth of transaction volume and financial business. With an operating loss of 1.01 billion won, however, its net loss came to 1.8 billion won in the July-September period, data from the company showed. Kakao Pay, the financial technology arm of mobile giant Kakao Corp.

Nov. 10, 2021

-

Efforts needed to improve ESG disclosure system: report

In the midst of the COVID-19 pandemic, South Korea’s financial groups have been gearing up for the so-called “sustainable financing,” centered on environmental, social and governance factors, or ESG, but global ESG experts urged them to make their ESG disclosure system more sophisticated, according to research shared with the Korea Herald report Wednesday. Sustainable financing refers to a bank’s financial services like loans for companies’ sustaina

Nov. 10, 2021

-

Seoul stocks dip over 1% amid inflation concerns

South Korean stocks slumped more than 1 percent Wednesday amid concerns about the rising inflation pressure. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) decreased 32.29 points, or 1.09 percent, to close at 2,930.17 points. Trading volume was moderate at about 559 million shares worth some 9.5 trillion won ($8 billion), with losers outnumbering gainers 807 to 86. Institutions sold net 236 billion won, while retail investors bought 235 bill

Nov. 10, 2021

-

Foreign ownership of Seoul stocks plunges below 28%

South Korea has suffered continuous capital outflows of foreign stock funds amid the recent lackluster performance of the domestic market. Thanks to their selling spree, Asia’s fourth-largest economy has seen a further decrease in foreign ownership, data showed Wednesday. Offshore investors sold a net 31 trillion won ($26.2 billion) of local stocks from January to October, having already surpassed last year’s combined net sales of 24.3 trillion won, according to data from the Financ

Nov. 10, 2021

-

Seoul stocks open lower amid inflation concerns

South Korean stocks opened lower Wednesday, tracking losses on Wall Street that stemmed from rising inflation pressure. The benchmark Korea Composite Stock Price Index (Kospi) decreased 11.3 points, or 0.38 percent, to 2,986.06 in the first 15 minutes of trading. Stocks came off to a lackluster start, as investors are worried the rising inflation pressure may advance the Federal Reserve's tapering timeline. Overnight, the tech-heavy Nasdaq composite lost 0.6 percent, and the Dow Jones Industr

Nov. 10, 2021

-

Foreigners turn net sellers of S. Korean stocks in October

Foreign investors turned net sellers of South Korean stocks in October and their net investment in local bonds also shrank, data showed Wednesday. Foreigners sold a net 3.34 trillion won ($2.84 billion) worth of local stocks last month, compared with their net purchase valued at 2.51 trillion won in September, according to the data from the Financial Supervisory Service (FSS). As of end-October, foreigners held 742.17 trillion won worth of local stocks, down 27 trillion won from a month earlie

Nov. 10, 2021

-

1 in 10 SMEs seek buyers as heirs refuse to inherit: survey

One out of 10 small and midsize company owners are selling their firms because their children are refusing to take over the family business, preferring a cash inheritance by selling the companies their parents built, a survey showed Tuesday. According to Korea M&A Exchange, a platform that mediates buyers and sellers of small and medium-sized enterprises, of the 5,481 business owners looking for buyers, 515 said they were looking for new owners to take over their firms as their children di

Nov. 9, 2021

-

Seoul stocks inch up on institutional buying

South Korean stocks edged up Tuesday after a choppy session, led by institutional buying. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) added 2.26 points, or 0.08 percent, to 2,962.46 points. Trading volume was moderate at about 699 million shares worth some 9.6 trillion won ($8.1 billion), with gainers outnumbering losers 540 to 317. Institutions bought a net 274 billion won, while foreigners sold 138 billion won. Retail investors offloade

Nov. 9, 2021

-

Citigroup’s retail closure in Korea to cost max W1.8tr: reports

The US-based global banking giant Citigroup will reportedly spend up to $1.5 billion, or 1.8 trillion won, on the withdrawal of its retail business in South Korea, according to news reports Tuesday. The group said in a regulatory filing that its expenditure on severance pay for employees at the Korean subsidiary’s retail banking operations will range between $1.2 billion and $1.5 billion. It will pay the envisioned personnel costs in phases by the end of next year, the Wall Street Jour

Nov. 9, 2021

-

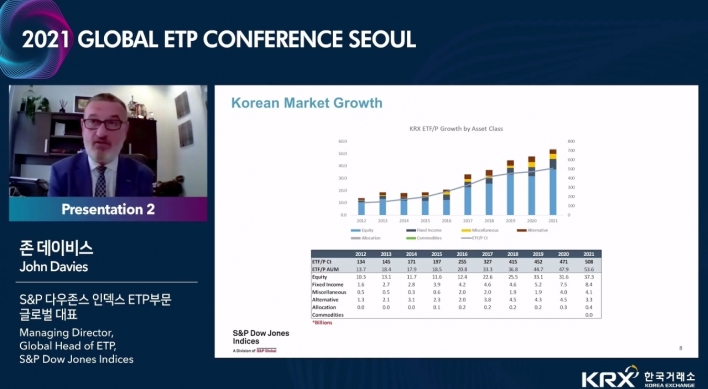

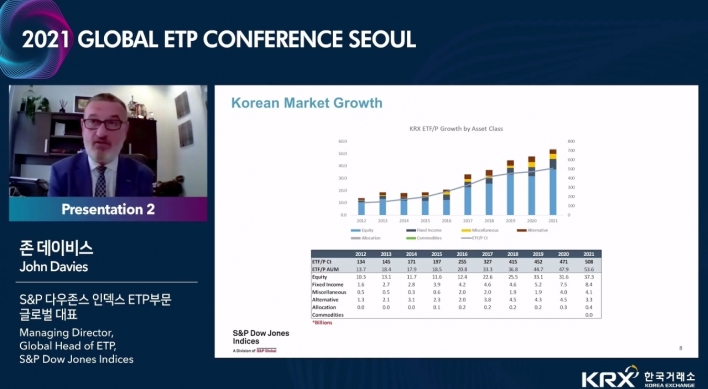

S&P ETP expert says Korean ETF market is growing in healthy way

South Korea’s exchange-traded fund market is getting very competitive and growing in a healthy way, in line with local asset management firms’ fierce competition, an executive from S&P Dow Jones Indices said Tuesday. “The Korean ETF market’s 10-year compound annual growth rate is around 25 percent, which is way above the global market’s rate of growth of 16 percent,” John Davies, global head of exchange-traded products at S&P Dow Jones Indices, said

Nov. 9, 2021

-

S. Korean banking groups race for global ESG approval

With carbon neutrality pledges and awareness in sustainability reshaping markets and industries around the globe, South Korean bank giants are in a fierce race to win global recognition on their respective drives designed to adopt environmental, social and governance values. KB Financial Group, the nation’s No.1 banking group by assets, said last month that it was officially endorsed by the Science Based Targets Initiative, stressing that it has become the first financial institution in A

Nov. 9, 2021

-

Family office TCK wins asset management license

Seoul-based family office Topor & Co. Korea, co-led by investment banking professional and TV celebrity Mark Tetto, said Tuesday the company has obtained an asset management license in South Korea to expand services for its client base. The move is aimed at expanding its current client offerings to include the privately placed fund business for qualified professional investors under Korean law, TCK said. In line with the move, TCK was rebranded as Topor & Co. Korea Asset Management in

Nov. 9, 2021

-

Seoul stocks rebound on Wall Street gains

South Korean stocks opened higher Tuesday as investor sentiment was uplifted by overnight gains on Wall Street. The benchmark Korea Composite Stock Price Index (Kospi) rose 24.47 points, or 0.83 percent, to 2,984.67 points in the first 15 minutes of trading. Overnight, the Dow Jones Industrial Average added 0.29 percent amid market optimism that the economic recovery is able to accommodate the inflation risks. The tech-heavy Nasdaq composite rose 0.07 percent. In Seoul, top cap Samsung Electr

Nov. 9, 2021

-

Yoon & Yang partners with Cadmus to meet new demand for legal services

South Korean full-service law firm Yoon & Yang said Monday it has partnered with US-based consulting service company Cadmus Group to address the new demand for legal services in the wake of Korea’s toughening regulation over occupational safety. The partnership will allow Yoon & Yang to assist Korean companies with identifying risks and help them be better prepared for their disaster response mechanism, Yoon & Yang said in a statement. Under a memorandum of understanding si

Nov. 8, 2021

-

Seoul stocks down for 2nd day on bio losses

South Korean stocks lost for the second straight session Monday as financial, bio and tech stocks plunged. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) fell 9.07 points, or 0.31 percent, to close at 2,960.2 points. Trading volume was moderate at about 551 million shares worth some 10.2 trillion won ($8.6 billion), with gainers outnumbering losers 502 to 352. Foreigners sold a net 122 billion won, while retail investors bought 366 billion w

Nov. 8, 2021

-

Korbit adopts P2E scheme to upgrade metaverse platform

Korbit, a local cryptocurrency exchange, said Monday that it adopted a “play to earn” scheme as part of efforts to upgrade its nascent metaverse platform. Play to Earn, commonly known as P2E, is a system in which players can gain rewards for playing games within the platform. Korbit’s attempt to incorporate P2E is a move meant to attract not only cryptocurrency traders, but also to reflect growing interest in the metaverse. “In Korbit Town, people without any exposur

Nov. 8, 2021

-

The hits keep coming: 2022 set for parade of blockbuster IPOs

South Korea’s initial public offering market is expected to regain momentum as a number of big players are set to go public next year. But the stock market needs to gain its upward momentum first to revive investor interest, according to investment banking sources and market experts Monday. Some mega deals, such as lithium-ion battery maker LG Energy Solution, local builder Hyundai Engineering, and online grocery delivery platforms SSG.com and Market Kurly, are getting ready for listings

Nov. 8, 2021

-

[Herald Interview] Landmark Seoul hotels become homes, offices

Reeling from diminishing demand for cross-border business and tourism in the COVID-19 pandemic, South Korea’s hotel industry has been undergoing a drastic transition in recent months. Landmark hotels in Seoul are turning into residential apartments and offices through redevelopment projects as owners look for a more lucrative business. At the same time, others are looking to upgrade their accomadations to ultraluxury brands, both foreign and local, according to a local real estate profe

Nov. 8, 2021

![[Herald Interview] Landmark Seoul hotels become homes, offices](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/11/08/20211108000241_0.jpg&u=20211109180245)

-

Would insurers pay out if ‘Squid Game’ happened in real life?

The megahit Netflix series “Squid Game” depicts a dystopian world where 456 people compete in a series of extreme survival games on a remote island. The sole winner takes all the prize money, while everyone else bites the dust. In the real world, all the “Squid Game” deaths would be eligible for insurance coverage, according to a local insurance company. The question is whether those death benefits would differ depending on how the player died, it added. According to a

Nov. 8, 2021

-

Seoul stocks open lower on tech, financial slump

South Korean stocks opened lower Monday on losses in financial, bio and tech stocks. The benchmark Korea Composite Stock Price Index (Kospi) fell 23.41 points, or 0.79 percent, to 2,945.86 points in the first 15 minutes of trading. Stocks got off to a weak start amid foreign and institutional sell-offs. Market bellwether Samsung Electronics edged up 0.14 percent to 70,300 won, while No. 2 chipmaker SK hynix retreated 2.34 percent to 104,500 won. Hyundai Motor, the country's largest carmaker,

Nov. 8, 2021

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

![[Herald Interview] Landmark Seoul hotels become homes, offices](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/11/08/20211108000241_0.jpg&u=20211109180245)