Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

-

[Special] AMAXG Group launches NFT-metaverse platform

South Korean blockchain research company AMAXG has launched a metaverse platform where people can trade nonfungible tokens, strengthening its initiative for blockchain commercialization. AMAXG recently launched the platform, dubbed BIZA-UVIT, after joining hands with K2SOFT, a metaverse platform and ANISTAR, a provider of cultural content. According to AMAXG, BIZA-UVIT users can trade NFTs in the metaverse, virtual worlds shared by people online, and expand their own virtual worlds. NFTs are

Nov. 18, 2021

![[Special] AMAXG Group launches NFT-metaverse platform](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/11/18/20211118000589_0.jpg&u=20211118160106)

-

Seoul stocks open lower on US losses

South Korean stocks opened lower Thursday, tracking overnight losses on Wall Street, with tech and chemical shares weighing on the market. The benchmark Korea Composite Stock Price Index (KOSPI) fell 11.76 points, or 0.4 percent, to 2,950.66 in the first 15 minutes of trading. The Dow Jones Industrial Average retreated 0.58 percent, and the tech-heavy Nasdaq composite declined 0.33 percent amid concerns about the growing inflation pressure. The Korean stock market opened at 10 a.m., one hour

Nov. 18, 2021

-

Property technology sees boom in pandemic era, but caution is needed: experts

Property technology startups, companies that provide digital services in the real estate industry, are enjoying the spotlight due to the digital transformation sparked by the COVID-19 pandemic, but challenges lie ahead, experts said Wednesday. “Before COVID-19, the real estate industry was one of the most hesitant to implement innovative digital technology. That was largely because clients needed to visit and see the interior work for themselves before making any investment decisions,&rd

Nov. 17, 2021

-

D&C Mineun, Wanfeng Group team up for development project in Laos

Real estate investment firm D&C Mineun has signed a business partnership with Shanghai-based Wanfeng Property to take part in the company’s development project in the Thatluang Lake Special Economic Zone in Laos, supported by the Laotian government, officials said Wednesday. Chairmen of the two companies held the signing ceremony with Sinlavong Khoutphaythoune, president of the Lao Front for National Construction, who also serves as a politburo member of the Central Com

Nov. 17, 2021

-

Seoul stocks dip over 1% amid inflation worries

South Korean stocks retreated more than 1 percent Wednesday, as strong US economic data raised concerns about an earlier than expected rate hike by the US Federal Reserve amid rising inflation. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) lost 34.79 points, or 1.16 percent, to close at 2,962.42 points. Trading volume was moderate at about 533 million shares worth some 10.5 trillion won ($8.9 billion), with losers outnumbering gainers 730 to

Nov. 17, 2021

-

Analysts divided over 2022 Kospi outlook

Analysts in and out of the country remained divided on their outlooks for South Korea’s benchmark Kospi next year this week, noting volatilities stemming from inflationary pressures, a memory down cycle and Korea’s presidential election in March. Morgan Stanley analysts on Wednesday slashed their growth target for South Korea’s benchmark Kospi by 250 points to 3,000 for end-2020, citing an ongoing unfavorable environment for the equity market and pointing to the upcoming pres

Nov. 17, 2021

-

MBK Partners reaches $1.8b close for 2nd special situations fund

Private fund house MBK Partners said Wednesday it had reached a final close for its second flagship fund at $1.8 billion to invest under a “special situations” strategy. The East Asia-focused opportunistic fund, named MBK Partners SSF II, is estimated to be the largest special situations fund managed by an Asia-based investment firm since 2019, according to market intelligence service firm Preqin. Special situations refer to an investment strategy in which a fund manager bets on a

Nov. 17, 2021

-

Kyobo Life to complete IPO by H1 2022, hints at expanding financial services

South Korean insurer Kyobo Life Insurance plans to go public on the Korea Exchange by 2022, a process stalled due to a shareholder feud over the past few years, the company said Wednesday. The initial public offering will lay the groundwork for the company to turn into a financial group with a holding company structure to offer a wider range of financial services other than insurance, setting aside its yearslong battle against minority shareholders, according to the company. The life insurer,

Nov. 17, 2021

-

Seoul stocks open lower on tech, auto losses

South Korean stocks opened lower Wednesday, largely by losses in tech, auto stocks. The benchmark Korea Composite Stock Price Index (Kospi) fell 9.95 points, or 0.33 percent, to 2,987.26 points in the first 15 minutes of trading. Market bellwether Samsung Electronics edged down 0.14 percent, No. 2 chipmaker SK hynix lost 0.45 percent, and pharmaceutical giant Samsung Biologics retreated 0.92 percent. Hyundai Motor, the country's largest carmaker, moved down 0.73 percent, with its smaller affi

Nov. 17, 2021

-

Top comedian Yu Jae-seok joins Kakao Entertainment’s capital increase

Korea’s top comedian Yoo Jae-suk became a shareholder of Kakao Entertainment, the agency said Tuesday. “Yoo Jae-suk participated in the agency’s most recent capital increase, largely to strengthen his trust-based partnership with Yu Hee-yeol,” a Kakao Entertainment official said. Yu, CEO of K-pop agency Antenna, had invested 7 billion won ($5.9 million) in Kakao Entertainment after selling all the shares of his own company. Yu currently holds 0.07 percent of Kakao Ente

Nov. 16, 2021

-

Seoul stocks edge down after US-China talks

South Korean stocks inched down Tuesday as investors digest the results of video talks between the presidents of the United States and China. The Korean won fell against the US dollar. The benchmark Korea Composite Stock Price Index (KOSPI) slipped 2.31 points, or 0.08 percent, to close at 2,997.21 points. Trading volume was moderate at about 567 million shares worth some 10.5 trillion won ($8.9 billion), with losers outnumbering gainers 547 to 304. Foreigners bought a net 241 billion won, wh

Nov. 16, 2021

-

Mirae Asset Securities named to Dow Jones Sustainability World Index

Mirae Asset Securities said Tuesday it was listed on the Dow Jones Sustainability World Index for the 10th consecutive year, receiving recognition for its commitment to socially responsible investment. As the first global sustainability benchmark, the DJSI World Index selects the top 2,544 listed companies based on their free-float market capitalization. It then evaluates the companies’ environment, social and governance performance and only picks the top 10 percent to be added to the i

Nov. 16, 2021

-

KRX sends warning on speculative transactions as NFT frenzy shakes up market

The Korea Exchange, the sole stock market operator of Korea, placed gaming company NCSoft under an investment caution on Tuesday, a day after an unnamed individual investor was disclosed to have sold 530,000 shares, or a 2.4 percent stake, in the company. The news came as a surprise to market watchers, as the same day trader was seen buying over 703,000 shares and sold 211,000 shares on Thursday -- when NCSoft shares hit the price ceiling at 786,000 won ($666.50) apiece from the previous closi

Nov. 16, 2021

-

Co-buying: Survival strategy for MZ generation amid real estate bubble

Kang, an office worker in his 20s, recently became a co-owner of a commercial building located in Seoul’s Gangnam district worth 10 billion won ($8.47 million) with a capital of only 5,000 won. “Earlier in December last year, I participated in a joint investment project led by a local fintech firm to buy a building named Yeoksam London Vill, a recently built eight-story commercial property in Gangnam. I invested 5,000 won and received 38 won as dividends in July, acquiring one sha

Nov. 16, 2021

-

Seoul stocks open lower on profit-taking

South Korean stocks opened lower Tuesday as investors attempted to cash in gains from the recent rally. The benchmark Korea Composite Stock Price Index (KOSPI) fell 4.66 points, or 0.16 percent, to 2,994.86 points in the first 15 minutes of trading. The KOSPI got off to a lackluster start amid losses in tech and auto heavyweights. Overnight, the tech-heavy Nasdaq composite and the Dow Jones Industrial Average both retreated 0.04 percent amid lingering inflation concerns. Top cap Samsung E

Nov. 16, 2021

-

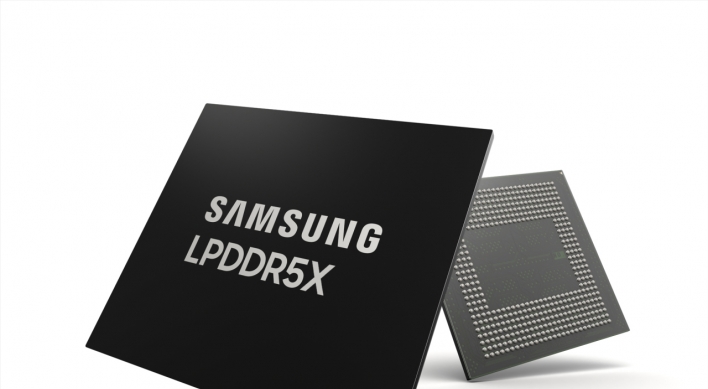

Small shareholders in Samsung Electronics top 5 million

The number of small shareholders in global tech giant Samsung Electronics surpassed 5 million amid massive stock investment by local retail investors, data showed Monday. Some 5.18 million investors held shares in the top-cap company as of the end of September, triple the tally a year earlier, according to the data from Samsung. Market watchers said a considerable number of local retail investors had bought into Samsung Electronics this year, given foreigners' continued selling of the mos

Nov. 15, 2021

-

SC Bank Korea sees quarterly profit jump 87-fold

Standard Chartered Bank Korea saw its quarterly net profit jump 87.2 times on-year to 79.4 billion won ($67.3 million) on a decrease in its future bad debts, filings showed Monday. The surge is attributable to a shrink in provision for credit losses -- an indicator of a financial institution’s future bad debt -- during the third quarter, as well as the increased interest income, according to filings submitted to the Financial Supervisory Service Monday. Notably, the provision for credi

Nov. 15, 2021

-

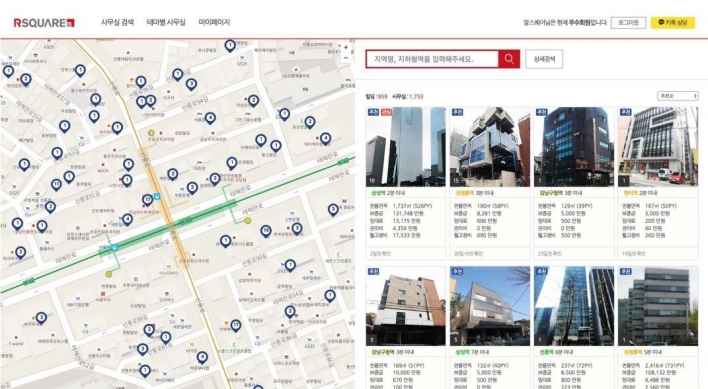

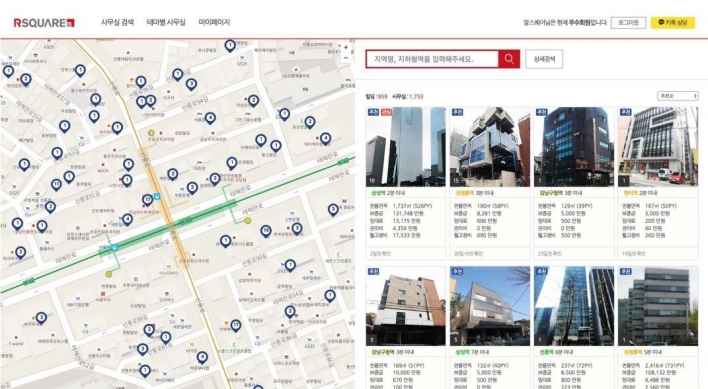

Real estate services startup Rsquare snaps up $72m funding

South Korean commercial real estate services startup Rsquare said Monday it has raised $72 million in series C funding from private equity firm STIC Investments. The proceeds will be used to enhance its property technology that powers its real estate services, strengthen its foothold in the Vietnamese market with a new business launched in June, expand its presence in other Southeast Asian countries including Singapore and Indonesia and hire new talents. STIC Investments is the sole investor

Nov. 15, 2021

-

More Korean REIT debuts garner investor attention

South Korea is poised to welcome a series of listings of real estate investment trusts by the end of this year, with their underlying assets increasingly diversifying, filings showed Monday. A REIT refers to a vehicle designed to offer dividend returns to its investors through incomes from securitized real estate assets, largely perceived as a risk-averse strategy. Seeing stronger investor demand for public REIT stocks this year, Korea will move onward to welcome at least three new REITs bef

Nov. 15, 2021

-

Seoul stocks close just shy of 3,000 on foreign and institutional buying

The South Korean stock market closed just shy of the 3,000-point mark Monday after a bullish session, led by strong foreign and institutional buying. The Korean won rose against the US dollar. The benchmark Korea Composite Stock Price Index (Kospi) rose 30.72 points, or 1.03 percent, to close at 2,999.52 points. Trading volume was moderate at about 631 million shares worth some 11.2 trillion won ($9.5 billion), with gainers outnumbering losers 626 to 238. Foreigners bought a net 397 billion w

Nov. 15, 2021

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

![[Special] AMAXG Group launches NFT-metaverse platform](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2021/11/18/20211118000589_0.jpg&u=20211118160106)