Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Watchdog accuses Optimus hedge fund of alleged fraud, embezzlement

The nation’s financial watchdog said Thursday its probe revealed that scandal-ridden hedge fund Optimus Asset Management faked the fund portfolio to its investors, misappropriated their money and obstructed the authorities’ investigation. “Optimus misguided fund investors to pool their money, which led to fraudulent transactions,” Financial Supervisory Service Deputy Governor Kim Dong-hoe, who is in charge of financial investment services supervision, said in a briefing

Market July 23, 2020

-

Local PEF zeroes in on Mr. Pizza acquisition

TR Investment has been given exclusive rights to negotiate with shareholders of MP Group, the operator of pizza restaurant chain Mr. Pizza, to buy a 41.39 percent stake for 35 billion won ($29.19 million), a disclosure showed Thursday. Under the binding memorandum of understanding, the South Korean private equity firm has agreed to buy 10 million existing shares of MP Group -- which operates pizza restaurants and coffeehouse chain -- from its current major shareholders including founder and e

Market July 23, 2020

-

'Korean investors’ growing interest in US tech stocks risky'

Persisting economic uncertainties due to the coronavirus outbreak appear to have only made blue chip tech stocks in the United States more expensive, while growing retail investors’ appetite for US stocks on global monetary expansion have left them prone to risks, said a strategist at global asset management firm AllianceBernstein. “On the issue of COVID-19 risk, we would just very simply say why bet on things that we don’t know?” David Wong, a senior investment strateg

Market July 22, 2020

-

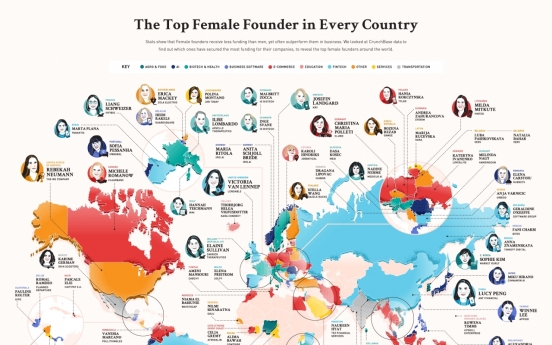

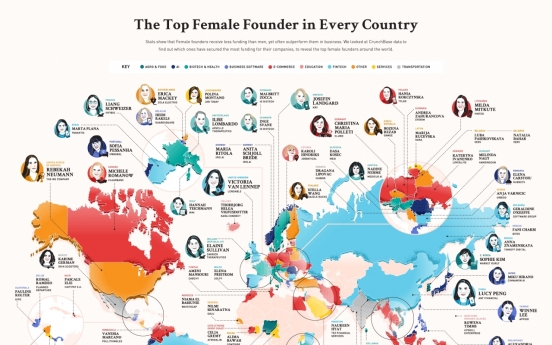

Kurly founder named among world’s top female fundraisers

Founder of Seoul-based same-day deliery startup Kurly, Sophie Kim, was listed among the top 10 female founders in the world by fundraising, data showed Tuesday. The founder of Market Kurly had raised the eighth-most money on the list as of June, raking in a combined $282 million since Kurly’s inception in 2014, according to data compiled by Businessfinancing.co.uk, a research and information provider in UK. Kim was the only Korean and one of four from Asia. The list of Asian entreprene

Market July 21, 2020

-

Seoul's commercial properties market less affected by coronavirus: reports

South Korea‘s commercial real estate market has been relatively less affected by the pandemic as the demand for both prime offices and logistics assets remains stable partly thanks to high liquidity and profit-seeking investors, reports showed Tuesday. The higher market liquidity coupled with the resilience of the economy, has instead beefed up competition for deals involving “core assets,” or prime office buildings that offer investors a stable source of income. “The

Market July 21, 2020

-

[Market Close-up] Snowballing fiasco shows Korea's failure to create healthy hedge fund environment

This is the first in a two-part series exploring South Korea’s troubled hedge funds market. -- Ed. Yoo Hye-kyung, 76, discharged herself from a hospital a day early to participate in a rally on Wednesday in Seoul to demand full compensation for her 500 million won ($450,000) investment in Optimus Asset Management. Claiming that she hadn’t even heard of the hedge fund manager when she signed a contract with NH Investment & Securities, a leading brokerage here, Yoo was furious th

Market July 19, 2020

![[Market Close-up] Snowballing fiasco shows Korea's failure to create healthy hedge fund environment](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/07/19/20200719000193_0.jpg&u=20200719201706)

-

Kakao Pay vows to expand e-bills service

Electronic payment service provider Kakao Pay said Thursday it aims to expand its service to enable bills to be created, delivered and paid online to spearhead Korea’s aim to transform into a paperless society. Capitalizing on the group’s popular mobile messenger platform KakaoTalk, Kakao Pay is likely to dominate the e-bills market by inviting more e-bill distributors to its platform, Lee Seung-hyo, chief product officer of Kakao Pay, said in a seminar held in Seoul. “At th

Market July 16, 2020

-

Mastern to invite W110b for French office acquisition through REIT IPO

Seoul-based property investment house Mastern Investment Management said Wednesday it plans to invite 110 billion won ($91.6 million) in South Korean retail money through its new real estate investment trust to take over part of equities in an office building in the suburb of Paris. Mastern plans to list the REIT’s 22 million shares, each priced at 5,000 won, on Korea’s main bourse Kospi in August. The listing schedule will be determined after an initial public offering that is set

Market July 15, 2020

-

NH-Amundi names new deputy CEO

Seoul-based joint venture NH-Amundi Asset Management said Tuesday that it named Nicolas Simon as the deputy chief executive officer of the France-based asset management house’s South Korean arm on Monday. Simon is formerly a deputy CEO of State Bank of India Funds Management, a joint venture of State Bank of India and Amundi to lead Amundi’s Indian operation. He served the term for five years until March. The start date has yet to be determined, according to NH-Amundi. Simon wi

Market July 14, 2020

-

K bank resumes consumer loan service

South Korea’s oldest online-only lender K bank said Monday it has resumed its consumer loan business through its mobile apps. The new loan products will be offered either in the form of personal loans for consumers with mid- to high-credit scores or overdrafts. The annual interest rate for borrowers will be 2.08 percent at its lowest. Borrowers’ credit-worthiness will be assessed under K bank’s own credit scoring system that applies machine-learning techniques and big data

Market July 13, 2020

-

IMM pauses acquisition of Kolmar CMO units

IMM Private Equity’s plan to acquire Kolmar Korea’s contract-based pharmaceutical business assets for 512.52 billion won ($427.24 million) has been postponed indefinitely, filings showed Monday. In a renewed disclosure, the prearranged deadline for IMM’s all-cash deal to buy the assets owned by Kolmar Korea Holdings’ stake by July 31 was scrapped on Friday, without setting a fresh due date. This comes two months after Korea’s third-largest private equity fund ink

Market July 13, 2020

-

COVID-19 shocks on wane in Seoul’s office leasing market

The prime office market in Seoul has recently showed signs of normalization, as uncertainties due to the economic impact of the coronavirus outbreak have been on the wane in key business districts, data showed Sunday. Demand from the information technology industry remained healthy, allowing major prime buildings to sign leases with large tenants, according to an estimate from real estate service firm Colliers International. In Gangnam, one of the larger business districts of the city, financ

Market July 12, 2020

-

Doosan’s plan to meet bailout requirements gathers momentum

Debt-saddled Doosan’s efforts to secure cash in response to the policy lenders’ bailout appears to be coming to fruition, as the construction-to-equipment giant is finding new investors to help the conglomerate improve its balance sheet. In line with ongoing moves, Doosan is looking to embark on talks with Daewoo Development Engineering & Construction, the Korean subsidiary of Chinese real estate developer JL Global, to sell Doosan Engineering & Construction. The final de

Market July 10, 2020

-

NPS ups domestic chemical stocks exposure

South Korea’s National Pension Service has bagged more domestic chemical stocks over the course of three months, filings showed Thursday. The world’s third-largest public pension fund increased its exposure to chemical stocks dedicated to second-life electric vehicle batteries -- such as LG Chem, Posco Chemical and Korea Petrochemical Ind. -- from April until Tuesday, according to respective disclosures. LG Chem has been vying to be the world’s top passenger vehicle cell s

Market July 9, 2020

-

SkyLake signs MOU to buy Doosan’s EV battery foil arm

Debt-ridden Doosan Group’s holding firm said Wednesday it has signed a memorandum of understanding with local private equity firm SkyLake Investment to sell a majority stake in its battery foil maker unit. “Doosan Corp. has signed an MOU with SkyLake Investment with regards to the sale of Doosan Solus,” the construction-to-energy conglomerate said in a filing. “The company will immediately disclose the details of the stake transaction once the terms are finalized.”

Market July 8, 2020

Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

![[Market Close-up] Snowballing fiasco shows Korea's failure to create healthy hedge fund environment](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/07/19/20200719000193_0.jpg&u=20200719201706)

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)