Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

W550b Young City prime office deal closes

A consortium composed of D&D Investment and NH Investment & Securities has completed its acquisition of Young City office complex from UK-based investment house Actis for 550 billion won ($447.2 million), the deal manager Cushman & Wakefield Korea said Thursday. D&D Investment, an affiliate of SK conglomerate’s real estate development arm SK D&D, seeks to establish a real estate investment trust called Young City REITs by securitizing the properties. The deal allowe

Market May 21, 2020

-

[Market Close-up] Doosan Bobcat under credit pressure on US unit’s $300m leveraging plan

South Korea’s construction equipment maker Doosan Bobcat is under credit pressure as its US subsidiary Clark Equipment is looking to leverage $300 million via five-year senior secured notes in May, filings showed Thursday. Clark Equipment’s leveraging plan is adding a financial burden to Doosan Bobcat, as affiliates and subsidiaries of conglomerate Doosan Group‘s liquidity crunch might spill over to Doosan Bobcat that is already suffering a sharp fall in sales due to the ongo

Market May 21, 2020

![[Market Close-up] Doosan Bobcat under credit pressure on US unit’s $300m leveraging plan](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/21/20200521000545_0.jpg&u=20200521160313)

-

Eximbank issues AU$700m Kangaroo bonds

The state-run Export-Import Bank of Korea said Thursday it has issued a three-year Australian dollar-denominated bonds worth AU$700 million ($460 million) to investors. Following the deal, Eximbank said it has become the first Asian financial institution to sell Kangaroo bonds, or Australian dollar-denominated bonds issued by a non-Australian entity, since the coronavirus outbreak. The bonds were oversubscribed as Eximbank received AU$1.7 billion subscriptions from 57 investors. JPMorgan, Mits

Market May 21, 2020

-

NPS to cut back in Korean stock exposure

South Korea’s public pension fund National Pension Service on Wednesday has affirmed its plan to shrink its exposure to domestic stocks in a move to ward off uncertainties due to fallout from the coronavirus outbreak, Welfare Minister Park Neung-hoo told reporters Wednesday. “(NPS) is certainly lowering the allocation of Korean stocks from the mid- to long-term perspective,” said Park, who also heads NPS Investment Management Committee. He added NPS Investment Management Comm

Market May 20, 2020

-

W550b Lotte Mart properties deal in legal dispute

South Korea’s Ryukyung PSG Asset Management and retailer Lotte Shopping are facing legal action from entities that proposed to buy four Lotte Mart discount stores for some 550 billion won ($448.4 million) in 2019, according to industry sources on Tuesday. The prospective buyers, real estate developer Moon Development Marketing and subsidiary the Korea Asset Investment Trust, filed a lawsuit in April against Ryukyung PSG -- a local asset management company that oversaw some 1.59 trillion

Market May 19, 2020

-

Virus-hit firms look to raise capital to ensure liquidity

As the number of moviegoers, air passengers and shoppers shrank sharply largely due to the coronavirus outbreak and social distancing, related companies have recently turned to fundraising efforts to meet the deadline for debt repayment or refinancing. Also, those raising share capital are offering equities at a discounted price to subscribers in order to ensure success. A leading example is multiplex cinema operator CJ CGV, which aims to raise 250.2 billion won ($202.9 million) in July from in

Market May 17, 2020

-

Yuanta Korea offers access to US stock reports

Yuanta Securities Korea said Thursday it has partnered with multinational financial market data provider Refinitiv to mount a new stock search engine function on its trading system for investors in US stocks. The service, dubbed “Reuters tRadar,” will allow users to access Refinitiv’s stock reports related to US stocks and their forecasts on the company performance based on its Institutional Brokers’ Estimate System database, which comprise the combined estimates of som

Market May 14, 2020

-

[Herald Interview] ‘Private investor engagement key to climate-resilient world’

In the climate finance world, money goes not only to the countries most vulnerable to the impacts of climate change, but also to innovative, eco-friendly infrastructure projects that help the world reduce greenhouse gas emissions. Striking the balance between the two themes -- adaptation and mitigation -- is one of the primary missions of the Green Climate Fund, the world’s largest fund dedicated to helping developing countries take climate actions. The fund serving the Paris Agreement on

Market May 13, 2020

![[Herald Interview] ‘Private investor engagement key to climate-resilient world’](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/13/20200513000714_0.jpg&u=20200514135541)

-

Seoul office market to face pandemic impact in Q2: report

Seoul’s prime office building market will face flagging demand due to the coronavirus coupled with new supply in the second quarter, which will create more empty space within the properties and reduce their cash flow, Savills Korea said in a report Wednesday. According to the real estate services firm, real estate investors in South Korea are expected to take a cautious stance as uncertainties in the leasing market are likely to erupt in terms of the proposed buyers’ financing cond

Market May 13, 2020

-

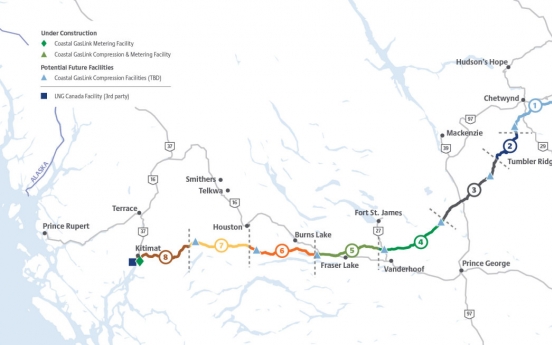

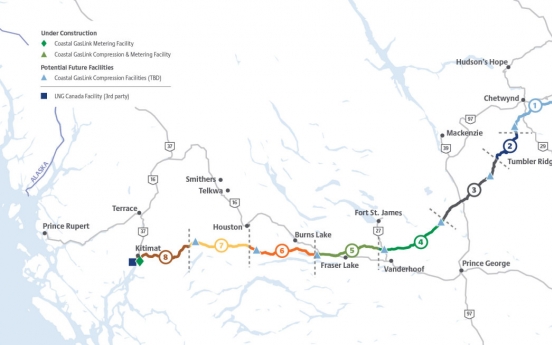

KB Kookmin Bank to finance gas pipeline project in Canada

KB Kookmin Bank said Tuesday that it has signed a commitment of 240 million Canadian dollars ($171 million) to finance a Coastal GasLink natural gas pipeline project in Canada through a senior loan. This is part of the C$6.6 billion project financing from a syndicate of lenders, composed of KB Kookmin Bank and 26 other banks including JPMorgan Chase, Bank of Montreal and Royal Bank of Canada, it added. KB Kookmin Bank was the sole Korean participant. The loans will go to TC Energy, formerly kn

Market May 12, 2020

-

Korea Western Power, NH-Amundi invest in Swedish wind farm project

Korea Western Power and NH-Amundi Asset Management signed a memorandum of understanding to cooperate in their co-investment in a 240-megawatt wind farm project in Sweden, according to NH-Amundi on Tuesday. The infrastructure project to build 56 wind turbines in Ange Municipality in northern Sweden is poised to be completed by the end of 2020. The facility has signed a 29-year sales contract with an undisclosed regional electricity market, promising a long-term source of stable income, NH-Amund

Market May 12, 2020

-

Doosan in talks to sell HQ building for W700b

Debt-ridden Doosan Group is in talks to sell its real estate asset Doosan Tower to Mastern Investment Management for roughly 700 billion won ($572.3 million), according to industry sources. Doosan and Mastern are said to be at the final stage to confirm the price of the commercial building located in Seoul, which the troubled conglomerate has been using as the headquarters of its holding company for over two decades. Doosan looks to sell the asset and lease it back from the proposed buyer Maste

Market May 11, 2020

-

DreamCIS likely to reopen Korea’s IPO market

South Korea is likely to end its monthslong drought in the initial public offering scene with Seoul-based pharmaceutical services company DreamCIS moving to raise 20.2 billion won ($16.5 million). DreamCIS, a company that provides contract-based research services to pharmaceutical and health care firms, said Monday it has fixed its offer price at 14,900 won per share, at the higher end of the price band. Its two-day institutional portion until Friday was 926.11 times oversubscribed. The compan

Market May 11, 2020

-

Korea’s spending for unemployment allowances approaches W1tr in April

South Korea’s monthly spending for supporting unemployed workers hit another all-time high in April, as the fallout from the novel coronavirus is hampering efforts to remedy the damage done to the job market, data showed Monday. In April, when Korea’s virus spread peaked, the amount of unemployment benefits came to 993.3 billion won ($814.3 million), up 35 percent on-year, according to preliminary data from the Labor Ministry. This extended the record streak for the third consecuti

Economy May 11, 2020

-

[M&As Weekly] Infection slowdown pushes deal closures, new bids

The mergers and acquisitions scene in South Korea remains relatively vigorous, as small and medium-sized enterprises are looking for more chances to cash out assets amid the continued COVID-19 threat to markets and industries. With a slowing number of confirmed cases, deals that have been postponed for weeks due to the virus are back on the table. Below is a roundup of major M&A deals here and their progress in the previous week. Centroid to take over Woongjin book unit Woongjin unveiled

Market May 10, 2020

![[M&As Weekly] Infection slowdown pushes deal closures, new bids](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/10/20200510000217_0.jpg&u=20200510161853)

Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

![[Market Close-up] Doosan Bobcat under credit pressure on US unit’s $300m leveraging plan](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/21/20200521000545_0.jpg&u=20200521160313)

![[Herald Interview] ‘Private investor engagement key to climate-resilient world’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/13/20200513000714_0.jpg&u=20200514135541)

![[M&As Weekly] Infection slowdown pushes deal closures, new bids](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/05/10/20200510000217_0.jpg&u=20200510161853)

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)