Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

[Weekender] Red, white and rose chase coronavirus blues away

In South Korea, wine has long been largely considered a drink for the well-off, with Korean distilled alcohol soju and beer being more popular choices for dinner. But with the nationwide stay-at-home policies this year, combined with the coronavirus blues, more people are seeking the kind of excitement that the fruity alcoholic drinks can offer. With the growing popularity of imported wine -- mostly affordable wines from ever-diversifying regions, including Eastern Europe -- a major shift in K

Food Oct. 31, 2020

![[Weekender] Red, white and rose chase coronavirus blues away](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/10/30/20201030000123_0.jpg&u=20201031212329)

-

NPS reaps 5% return as measures to boost gains are underway

South Korea’s public pension fund, the National Pension Service, said Friday that it has reaped a 5.07 percent return on its total investments from January to August this year. The nation’s largest institutional investor, overseeing 789.9 trillion won ($695.3 billion) worth of assets, also unveiled measures to pursue additional gains by wooing more hedge fund partners and enhancing its foreign currency management. At a meeting Friday of the NPS’ Fund Management Committee, We

Market Oct. 30, 2020

-

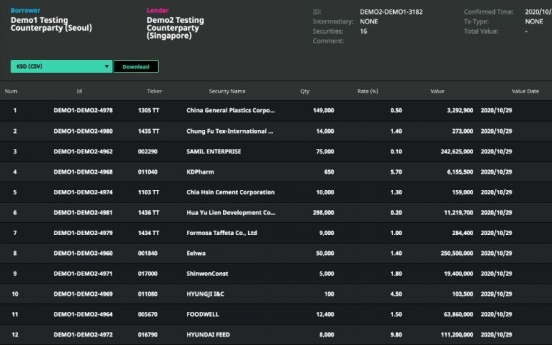

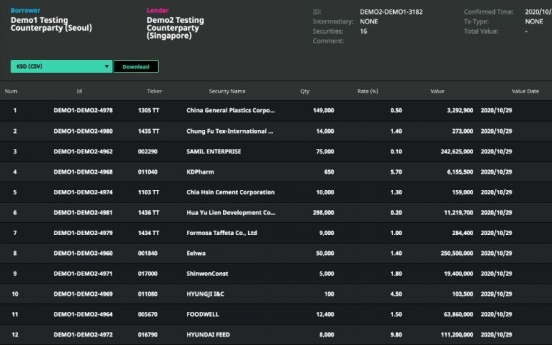

Local fintech startup unveils Korea’s first commercial system to rule out naked short selling

A local startup on Wednesday unveiled the nation‘s first commercial securities lending system targeting institutional investors at home and abroad to help them prevent errors that can lead to naked short selling activities against the law, often unintended. TruWeb, new securities lending platform developed by financial technology startup Tru Technologies, allows an institutional investor -- investment banks or brokerage firms -- to take advantage of automated process when making arrangeme

Market Oct. 28, 2020

-

Hanwha Asset gains PFM license for mainland China

Hanwha Asset Management said Tuesday its wholly owned Chinese unit has been granted a private fund management license for mainland China. A PFM license, approved by the Asset Management Association of China, allows foreign asset managers to create and sell funds investing in onshore stocks and bonds in China to local institutional and wealthy investors. This comes four years after South Korea’s third-largest asset management company with over 93 trillion won ($82 billion) in assets unde

Market Oct. 27, 2020

-

Market in close watch over Samsung inheritance tax

With heirs to the Samsung empire facing a colossal amount of inheritance tax on stocks owned by their late father Lee Kun-hee, the market is closely watching how they will raise the necessary funds to pay it. Any moves they make are likely to affect the market. Samsung Group Chairman Lee, who died Sunday, left Samsung affiliate stocks valued at 18.2 trillion won ($16.1 billion) as of Friday closing. Questions have been raised on how Lee’s heirs -- particularly his only son, Samsung Ele

Market Oct. 26, 2020

-

Woori Financial to acquire Aju Capital for W572.4b

Woori Financial Group said Friday its board of directors agreed to buy a controlling stake in nonbanking lender Aju Capital from private equity firm Well to Sea Investment for 572.4 billion won ($507.2 million). The move heralds the move of South Korea’s fourth-largest banking group to enhance its nonbanking business and diversify its business portfolio. According to the filing Friday, Woori’s board agreed to acquire 42.6 million common shares, or a 74.04 percent stake, in the co

Market Oct. 23, 2020

-

Lock-up free institutions’ selloff behind Big Hit stock plunge: market watchers

An instant 425.8 billion-won ($375.1 million) selloff by major shareholders of South Korean pop music agency Big Hit Entertainment appears to have caused a sharp decline of the Big Hit stock price in the days after its listing, market watchers said Thursday. Two special purpose companies including the fourth-largest shareholder Mainstone -- which owned a combined 9.16 percent of common shares -- immediately sold nearly half of their holdings in Big Hit, after the company went public o

Market Oct. 22, 2020

-

Kakao to raise $300m in Singapore to muster up M&A dry powder

South Korea‘s internet giant Kakao is planning to issue $300 million worth of exchangeable bonds to accumulate the dry powder for its future mergers and acquisitions activities, the company said in a filing Thursday. The US dollar-denominated exchangeable bonds will be issued privately on Wednesday on the Singapore Exchange. Investors in the hybrid securities will be offered straight bonds with zero interest. Once the bonds mature in April 2023, the hybrid security investor will be offe

Market Oct. 22, 2020

-

Authorities seek to revoke Lime Asset license

South Korea’s financial watchdog on Tuesday recommended that Lime Asset Management lose its license, the toughest penalty possible, for defrauding its investors and costing them trillions of won. The FSS decision followed a meeting to decide the level of sanctions it would advise the regulator, the Financial Services Commission, to impose on the Seoul-based hedge fund manager. If the FSC agrees, Lime’s license as a privately pooled fund manager could be revoked as early as Nov

Market Oct. 20, 2020

-

JPMorgan cuts Kiwoom Securities stake for W26.1b

JPMorgan Asset Management has reduced its stake in South Korean securities brokerage house Kiwoom Securities to cash out 26.1 billion won ($22.9 million), in an apparent profit-making move, a filing showed Tuesday. Since August, Hong Kong-based JPMorgan Asset Management Asia Pacific and five affiliated parties had unloaded a combined 1.11 percent stake in the Seoul-based brokerage house without a brick-and-mortar branches. The transaction cut JPMorgan’s stock holding to 3.9 percent, stee

Market Oct. 20, 2020

-

KIC under fire for investing in money-losing marijuana stocks

South Korea’s sovereign wealth fund Korea Investment Corp. was seeing a stock price fall in Ontario-based marijuana maker Canopy Growth, as its $18 million bet on the company lost glitter in the first half of 2020, a lawmaker said Monday. The ruling Democratic Party of Korea’s Rep. Jung Sung-ho added the investment in the pot producer is a point of contention, not only because KIC’s bet has not led to an instant success, but also because investing in marijuana makers is an &l

Market Oct. 19, 2020

-

PDI Seoul Forum turns virtual in 2020

London-based financial intelligence company PEI said Sunday it planned to hold PDI Seoul Forum Virtual Experience on Nov. 10. The virtual event, organized by PEI’s publication Private Debt Investor, is expected to offer participants a glimpse of private debt investment strategies, debt investor preferences in asset allocations and fund manager selection and monitoring processes amid challenges posed by the COVID-19 pandemic in the global capital market, PEI said. The event will feature

Market Oct. 19, 2020

-

IMM PE looks to exit from Taihan Electric Wire

South Korea’s buyout firm IMM Private Equity is looking for a buyer for Taihan Electric Wire starting November, five years after it invested 300 billion won ($261.7 million) in the then-debt-saddled company for a controlling stake, according to sources Friday. Shares of Taihan, the nation’s No. 2 power transmission wire maker, rose sharply on the Korea Exchange’s main bourse Kospi on Friday. At 12:30 p.m., Taihan shares were trading 9.8 percent higher than the previous day&rs

Market Oct. 16, 2020

-

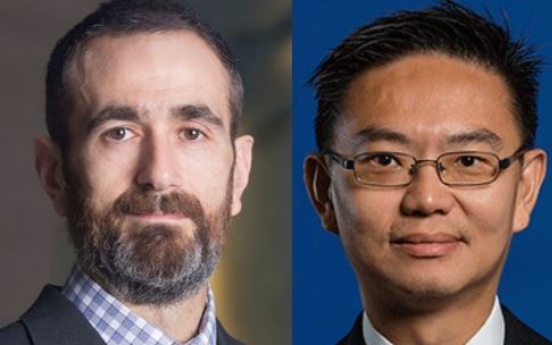

Economic powder keg remains despite Korea's virus containment: S&P

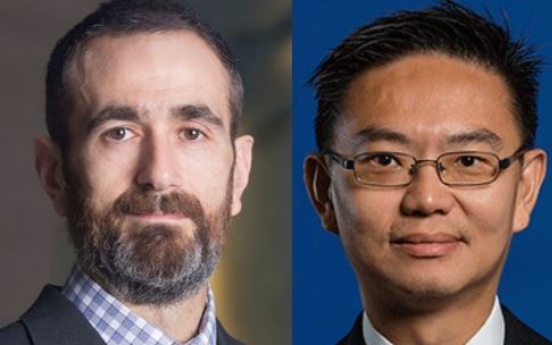

Despite the containment of the coronavirus pandemic nationwide, South Korea, Asia’s fourth-largest economy, is still sitting on an economic powder keg, high-ranking officials of credit rating agency S&P Global Ratings said Thursday. While Korea and other Asia-Pacific economies are seeing a relatively swift recovery from the COVID-19 pandemic thanks to timely policies and boosted trade, they appear to be far off from pre-COVID levels, Shaun Roache, chief Asia-Pacific economist at S&am

Economy Oct. 15, 2020

-

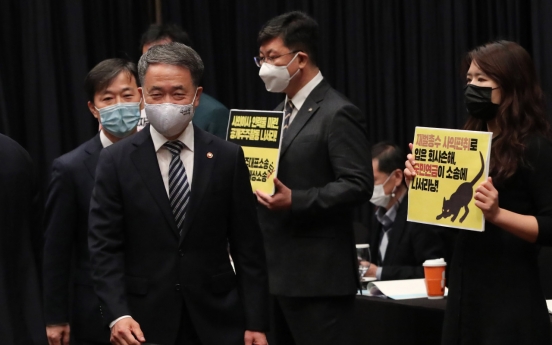

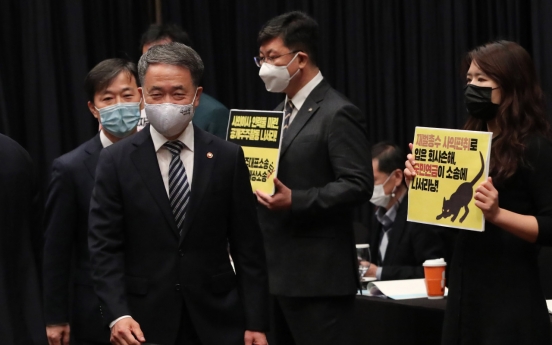

Yoon under siege in Assembly audit over hedge fund fiasco

Troubled hedge fund mis-selling scandal that led to losses for South Korean investors and the fund managers’ alleged collusion with ruling party lawmakers and former Cheong Wa Dae officials were at the center stage during the parliamentary audit on the Financial Supervisory Service on Tuesday. FSS Gov. Yoon Suk-heun pledged to take stern actions against those responsible for the mis-selling, as the financial watchdog‘s investigation into managers such as Lime Asset Management and O

Market Oct. 13, 2020

Most Popular

-

1

Acting minister, US defense chief reaffirm 'ironclad' alliance regardless of politics

-

2

Ruling, opposition parties butt heads over acting president's authority

-

3

Medical student sentenced to 26 yrs in prison for murdering his girlfriend

-

4

After Disney+ adaptation, 'Light Shop' webtoon sees explosive popularity

-

5

[Editorial] Bracing for Trump

-

6

Vincent van Gogh's exhibition in Seoul explores his decade-long career

-

7

National Assembly’s impeachment committee readies for 1st hearing next week

-

8

[Lee Byung-jong] The perils of political leadership

![[Lee Byung-jong] The perils of political leadership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)

-

9

Actor Kim Tae-ri to showcase hanbok on Times Square billboard on Christmas Eve

-

10

Heavy snow, cold wave expected this weekend

![[Weekender] Red, white and rose chase coronavirus blues away](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/10/30/20201030000123_0.jpg&u=20201031212329)

![[Lee Byung-jong] The perils of political leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/12/19/20241219050082_0.jpg&u=)