Articles by Son Ji-hyoung

Son Ji-hyoung

consnow@heraldcorp.com-

Former deputy prime minister to head KTCU

Former Deputy Prime Minister and Education Minister Kim Sang-gon will take the top post of the Korea Teachers’ Credit Union, the institution said Wednesday. Effective Thursday, Kim will serve as chairman of the KTCU, the state-sponsored credit union dedicated to Korean teachers’ financial welfare and benefits. Kim was selected as the final candidate to head the KTCU on Friday and subsequently gained the approval of Education Minister Yoo Eun-hae. Kim will serve his three-year term

Market Nov. 11, 2020

-

At least W436b to evaporate from Optimus hedge fund scam: FSS

The Financial Supervisory Service said Wednesday that Optimus Asset Management, a local hedge fund house involved in an alleged fraud case, has incurred at least 436.3 billion won ($393 million) in financial losses that effectively went nowhere. The loss stems from the hedge fund manager’s botched real estate development project financing and failed investments in stocks and bonds, as well as its embezzlement and Ponzi scheme, according to the watchdog. The revelation comes as four month

Market Nov. 11, 2020

-

Weak dollar triggers 15 month-high foreigner influx into stock market

The weakening US dollar against South Korean won has invited the highest amount of foreign investment in Korean stocks in 15 months, data showed Monday. Foreign investors net bought Korean listed stocks worth 1.36 trillion won ($1.22 billion) in October, the highest monthly figure since August 2019, according to data by the Financial Supervisory Service. As a result, foreigners owned some 30 percent of listed shares in Korea, valued at a combined 584.8 trillion won as of end-October. Beforehan

Market Nov. 9, 2020

-

Seoul prime office transactions pick up in search of safety

Prime office transactions in South Korea’s capital city of Seoul came to 4.6 trillion won ($4.13 billion) during the third quarter of 2020, as real estate investors have searched for safety in times of ongoing uncertainties, data showed Monday. This surpassed the 4.2 trillion-won figure for the first half of 2020, according to data compiled by commercial real estate services firm Savills Korea. If combined, the transaction of the January-September period took up 75 percent of the yearly v

Market Nov. 9, 2020

-

Investors watchful after Biden victory

With the election of Democrat Joe Biden as the next US president, investors here and abroad are paying keen attention to the impact of the outcome on the financial market. What was widely perceived as a worst-case scenario in the eyes of market watchers -- a Biden presidency combined with Republican control of the US Senate -- has so far instead given a boost to the market. The results defied predictions of a bearish gridlock that might derail stock markets, primarily centering on the Democrat

Market Nov. 8, 2020

-

Shinhan BNP Paribas draws W52b commitment to finance wind turbines

South Korea’s asset management company Shinhan BNP Paribas Asset Management said Thursday it has snapped up a combined 52 billion-won ($46 million) commitment to a new private fund to finance a wind turbine project in South Jeolla Province. The new fund, dubbed SH BNPP Green New Deal Fund No. 1, will target 17.325-megawatt wind turbines in Wando County, South Jeolla Province. Shinhan BNP Paribas said it managed to reduce the price volatility by entering into a 20-year supply contract wit

Market Nov. 5, 2020

-

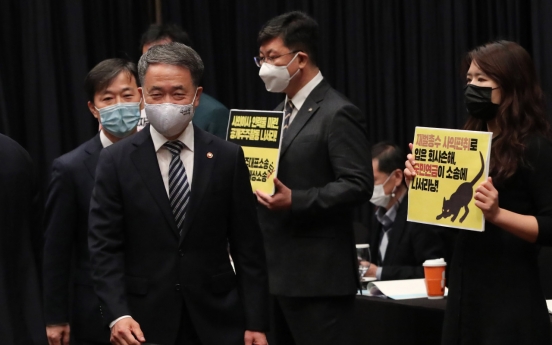

[KH Finance Forum] COVID-19 provides financial firms new opportunities to go digital, global

Despite the uncertainties posed by the pandemic, South Korea’s financial industries are met with fresh opportunities to accelerate digitalization in response to the major changes in financial consumers’ behavior, as more people turn to mobile phones instead of brick-and-mortar branches to use financial services in times of COVID-19, said speakers at The Korea Herald’s first finance forum Wednesday. At Korea Herald Finance Forum 2020, held under the tagline “Korean Econo

Economy Nov. 4, 2020

![[KH Finance Forum] COVID-19 provides financial firms new opportunities to go digital, global](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/11/04/20201104000925_0.jpg&u=20201105143842)

-

Pricey Gangnam apartments stand out as homeowners' safe haven

Apartment units in southern Seoul's Gangnam-gu stood out among housing options in South Korea’s capital city in October in terms of their valuation, as they are increasingly regarded as a safe haven in times of uncertainty in housing market regulation. The estimate comes as multiple-home owners are struggling to keep multiple flats in their portfolio due to tougher housing regulations to stamp out the speculative buying. The price gap between Gangnam-gu and adjacent districts in southeas

Economy Nov. 3, 2020

-

Samsung family in line to inherit W17tr of stocks

Members of the bereaved Samsung ownership family are expected to see major net worth boosts, as the late Chairman Lee Kun-hee left behind massive amounts of stocks they -- including heir apparent Lee Jae-yong -- stand to inherit, data showed Monday. Late Chairman Lee’s personal fortune in the form of stocks -- subject to a handover to the families -- was worth a combined 17.7 trillion won ($15.6 billion) as of Thursday’s market closing, according to data from financial market infor

Market Nov. 2, 2020

-

[Weekender] Red, white and rose chase coronavirus blues away

In South Korea, wine has long been largely considered a drink for the well-off, with Korean distilled alcohol soju and beer being more popular choices for dinner. But with the nationwide stay-at-home policies this year, combined with the coronavirus blues, more people are seeking the kind of excitement that the fruity alcoholic drinks can offer. With the growing popularity of imported wine -- mostly affordable wines from ever-diversifying regions, including Eastern Europe -- a major shift in K

Food Oct. 31, 2020

![[Weekender] Red, white and rose chase coronavirus blues away](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/10/30/20201030000123_0.jpg&u=20201031212329)

-

NPS reaps 5% return as measures to boost gains are underway

South Korea’s public pension fund, the National Pension Service, said Friday that it has reaped a 5.07 percent return on its total investments from January to August this year. The nation’s largest institutional investor, overseeing 789.9 trillion won ($695.3 billion) worth of assets, also unveiled measures to pursue additional gains by wooing more hedge fund partners and enhancing its foreign currency management. At a meeting Friday of the NPS’ Fund Management Committee, We

Market Oct. 30, 2020

-

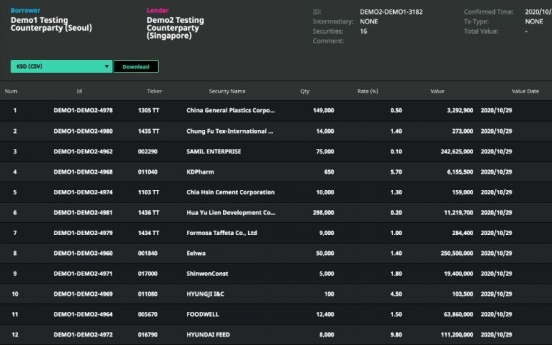

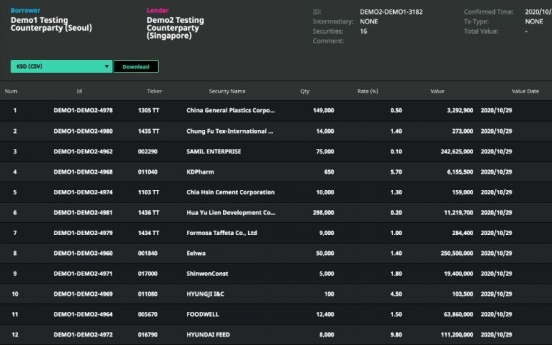

Local fintech startup unveils Korea’s first commercial system to rule out naked short selling

A local startup on Wednesday unveiled the nation‘s first commercial securities lending system targeting institutional investors at home and abroad to help them prevent errors that can lead to naked short selling activities against the law, often unintended. TruWeb, new securities lending platform developed by financial technology startup Tru Technologies, allows an institutional investor -- investment banks or brokerage firms -- to take advantage of automated process when making arrangeme

Market Oct. 28, 2020

-

Hanwha Asset gains PFM license for mainland China

Hanwha Asset Management said Tuesday its wholly owned Chinese unit has been granted a private fund management license for mainland China. A PFM license, approved by the Asset Management Association of China, allows foreign asset managers to create and sell funds investing in onshore stocks and bonds in China to local institutional and wealthy investors. This comes four years after South Korea’s third-largest asset management company with over 93 trillion won ($82 billion) in assets unde

Market Oct. 27, 2020

-

Market in close watch over Samsung inheritance tax

With heirs to the Samsung empire facing a colossal amount of inheritance tax on stocks owned by their late father Lee Kun-hee, the market is closely watching how they will raise the necessary funds to pay it. Any moves they make are likely to affect the market. Samsung Group Chairman Lee, who died Sunday, left Samsung affiliate stocks valued at 18.2 trillion won ($16.1 billion) as of Friday closing. Questions have been raised on how Lee’s heirs -- particularly his only son, Samsung Ele

Market Oct. 26, 2020

-

Woori Financial to acquire Aju Capital for W572.4b

Woori Financial Group said Friday its board of directors agreed to buy a controlling stake in nonbanking lender Aju Capital from private equity firm Well to Sea Investment for 572.4 billion won ($507.2 million). The move heralds the move of South Korea’s fourth-largest banking group to enhance its nonbanking business and diversify its business portfolio. According to the filing Friday, Woori’s board agreed to acquire 42.6 million common shares, or a 74.04 percent stake, in the co

Market Oct. 23, 2020

Most Popular

-

1

Selected NK troops, generals may be deployed to front lines: NIS

-

2

'Pongpongnam' row exposes South Korea's gender divide

-

3

Fox Sister: A Korean tale darker than your average ghost story

-

4

From 'superstars' to 'privileged and spoiled': Doctors fight souring image

-

5

NIS says North Korean leader’s daughter clearly in line to rule

-

6

Hybe apologizes over controversial internal documents, reassigns writer

-

7

Seoul City to spend W6.7tr to encourage couples to have kids

-

8

Why one man's move is shaking Korea: Child rapist’s relocation sparks controversy, fear

-

9

[KH Explains] How LG Energy Solution’s bold bet paid off with Tesla, Mercedes deals

![[KH Explains] How LG Energy Solution’s bold bet paid off with Tesla, Mercedes deals](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/10/29/20241029050614_0.jpg&u=20241029214503)

-

10

Seventeen’s Seungkwan releases lengthy message amid Hybe controversy over internal documents

![[KH Finance Forum] COVID-19 provides financial firms new opportunities to go digital, global](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/11/04/20201104000925_0.jpg&u=20201105143842)

![[Weekender] Red, white and rose chase coronavirus blues away](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2020/10/30/20201030000123_0.jpg&u=20201031212329)

![[KH Explains] How LG Energy Solution’s bold bet paid off with Tesla, Mercedes deals](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/10/29/20241029050614_0.jpg&u=20241029214503)