Articles by 이선영

이선영

-

Businesses see opportunities after sanctions lifted in Iran

Following the lifting of international sanctions on Iran, Korean companies are expected to rush to explore business opportunities in the resources-rich country, with constructors and oil refineries at the vanguard. The Korean government is also moving swiftly to respond, scrapping Sunday a local rule that forced Koreans to seek prior central bank permission for any financial transaction with Iran. Tehran-based Mellat Bank's branch office in Seoul (Yonhap)Korea, in September 2010, joined world p

Latest News Jan. 17, 2016

-

Markets take another hit from China

Another rout on the Chinese stock market sent Korean shares and currency tumbling Thursday, even as they were reeling from the repercussions of a purported hydrogen bomb test by North Korea the previous day. The country’s main stock index KOSPI slipped 1.1 percent to close at 1,904.33 points, as a second market crash in China in a week rattled already shaky investor sentiment. The won-dollar exchange rate crashed through the psychologically important 1,200 won-per-dollar mark. Extending its loss

Jan. 7, 2016

-

Shares, currency fall on N.K. bomb test

North Korea’s purported hydrogen bomb test rocked financial markets in South Korea on Wednesday, bringing down local stocks and currency and putting Seoul authorities on emergency footing again just two days after China’s stock market crash triggered a global market rout.The South’s benchmark stock index KOSPI dipped 0.26 percent to close at 1,925.43. In the morning, shortly after the news broke, the gauge slid to as low as 1,911.61, but recovered some of the losses in the afternoon. Foreigners

Jan. 6, 2016

-

Mirae Asset still thirsty for growth

Mirae Asset Financial Group chairman Park Hyeon-joo speaks at a press conference in Seoul on Monday. (Yonhap)Park Hyeon-joo, the founding chairman of Mirae Asset Financial Group, said Monday the proposed acquisition of Korea’s second-largest brokerage KDB Daewoo Securities will bring his self-built empire one step closer to becoming Asia’s leading investment bank, calling it “a perfect fit” for Mirae Asset. “The value of Daewoo Securities depends on the synergy it would bring to its proposed buy

Dec. 28, 2015

-

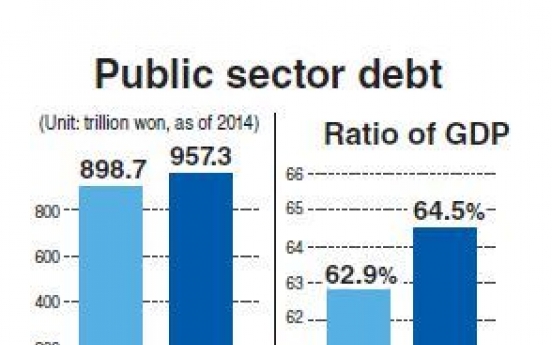

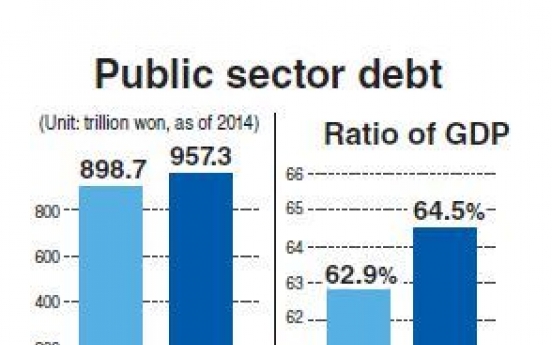

Public debt growth outpaces GDP

Korea’s public-sector debt relative to gross domestic product is much smaller than advanced countries, but it is growing faster than the economy, government data showed Thursday. The Korean government and nonfinancial public institutions owed 957.3 trillion won ($816 billion) to creditors at the end of 2014, up 6.5 percent from a year ago, the Finance Ministry said in a report. The pace of debt growth was faster than the 3.3 percent of the Korean economy last year. The debt was tantamount to 64.

Dec. 24, 2015

-

Tough time to be a central banker, says BOK chief

Bank of Korea Gov. Lee Ju-yeol (Yonhap)A little less than a decade ago, the job of a central banker could be described as important but simple: With one tool -- short-term interest rate -- they targeted inflation. In a downturn economy, when signs of low inflation emerged, they loosened the monetary policy, lowering interest rates. In an upcycle, they prevented economic overheating and high inflation with monetary tightening by raising the rates. Nowadays, the job is much more complex, with s

Dec. 24, 2015

-

[Newsmaker] Kakao in spotlight for fat paychecks

Kakao, Korea’s fast-sprawling mobile empire built on the omnipresent phone messaging service KakaoTalk, is in the public spotlight for fat paychecks. The KOSDAQ-listed firm was the highest-paying workplace among the top 100 companies by market capitalization in Korea last year, leading by a big margin a pack of older and larger corporate players such as Samsung Electronics.According to data compiled by CEO Score, an online business information provider, Kakao employees took home an average of 17

Technology Dec. 23, 2015

![[Newsmaker] Kakao in spotlight for fat paychecks](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2015/12/23/20151223001542_0.jpg&u=20151224162042)

-

Mirae Asset likely to win Daewoo Securities bidding race: reports

A controlling 49 percent stake in Daewoo Securities Co. is up for sale. YonhapMirae Asset Securities Co. is the likely winner of the bid for Daewoo Securities Co., local reports said Monday, in a deal that could create a new leader in Korea’s brokerage industry. In the bid which closed Monday, Mirae Asset, part of the eponymous asset management-focused group, offered to pay about 2.4 trillion won ($2 billion), substantially higher than the amounts that its three competitors have penciled in, Yon

Dec. 21, 2015

-

Household debt burden grows in 2014

An average Korean household spends nearly 24 percent of its total disposable income on meeting debt obligations data showed Monday, amid concerns over record-level household debt. As of March, an average Korean household has 342 million won ($290,800) in total assets, 61.8 million won in debt and an annual disposable income of 39 million won. All three grew modestly from a year ago, but the income marked the fastest gain of 2.7 percent. (123rf)These are some of the key findings contained in

Dec. 21, 2015

-

Credit upgrade mitigates risk of capital flight: Choi

Deputy Prime Minister Choi Kyung-hwan speaks at a press conference in Seoul on Sunday. (Yonhap)Deputy Prime Minister Choi Kyung-hwan said Sunday that Moody’s recent upgrade of Korea’s credit rating mitigates the potential risk of capital flight from Korea, a key concern for emerging economies after the U.S. initiated its first interest rate hiking cycle in nearly a decade. "There have been worries that Korea could be at the same risk with newly emerging markets, but Moody’s move could be seen a

Dec. 21, 2015

-

Financial markets rally on Fed relief

U.S. Federal Reserve Chair Janet Yellen speaks at a press conference in Washington on Wendesday. YonhapSeoul officials heaved a sigh of relief Thursday, as a U.S. move to end the seven-year era of near-zero interest rates led to no major turmoil in global and local markets as some feared. On the contrary, financial markets rallied across Asia, as the U.S. Federal Reserve on Wednesday delivered just what markets had expected -- a small rise in interest rates and a clear signal of a slow tighteni

Dec. 17, 2015

-

BOK to target 2% inflation

The Bank of Korea on Wednesday set the inflation target for the next three years at 2 percent, as the economy braces for a future of low growth and lower price levels. The annual target for the 2016-2018 period is higher than this year’s projected inflation of 0.7 percent. The rise in consumer prices stayed below 1 percent for 11 months this year until November, when it reported an uptick to a 1 percent gain from a year ago. In October, the central bank projected next year’s inflation rate at 1.

Dec. 16, 2015

-

Korea on guard against fallout from U.S. rate hike

As the countdown begins for the U.S. interest rate hike, Korea is on edge to guard against its potential fallout on local financial markets. The Bank of Korea is in an emergency response mode -- monitoring global markets round-the-clock since Monday -- getting ready to intervene if there is excessive volatility. After a two-day policy meeting, the U.S. Federal Reserve is widely expected to increase its benchmark borrowing rate Wednesday, ending a seven-year era of near-zero interest rates that h

Dec. 15, 2015

-

Goldman Sachs invests $33m in local property app

Local property app Zigbang has raised 38 billion won ($33 million) from Goldman Sachs and other investors, the company said Tuesday. The U.S. investment bank’s private equity arm led the investment, its second funding of a Korean start-up after last year’s 40 billion won investment in food delivery app Baedal Minjok. Zigbang, launched in 2002, links realtors and customers across the country on its mobile platform that is equipped with a handy search engine, lots of photos and an aggregate listin

Dec. 15, 2015

-

Citi sells consumer finance arm

Citibank Korea signed an agreement with Apro Service Group to sell its consumer finance subsidiary Citigroup Capital Korea Inc., as part of the U.S. banking group’s efforts to streamline businesses and divest non-core assets, the company said Tuesday.The transaction is expected to close in the first quarter of 2016 subject to regulatory approvals. The financial terms of the transaction were not disclosed. Citigroup Capital Korea accounted for less than 5 percent of Citi’s total revenues in Korea

Dec. 15, 2015

![[Newsmaker] Kakao in spotlight for fat paychecks](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2015/12/23/20151223001542_0.jpg&u=20151224162042)