Articles by 박윤아

박윤아

-

Hyundai Cement decides on W58b capital increase

[DISCLOSURE] Hyundai Cement (006390) announced on Oct. 21 that it has decided on a capital increase worth 58.4 billion won (US$51.42 million) through third-party allotment. A total of 14,243,268 stocks will be distributed to 23 of creditor banks, which accepted a debt-equity swap.By Park Yuna (yunapark@heraldcorp.com)

Oct. 21, 2016

-

Apple iPhone 7 arrives in Korea in absence of Samsung Galaxy Note 7

[THE INVESTOR] Sales of Apple’s iPhone 7 and iPhone 7 Plus began in South Korea on Friday, amid high expectations that the US tech giant might reap more success here in the absence of Samsung Electronics’ Galaxy Note 7. Apple officially launched its latest iPhone series through Korea’s three major mobile carriers SK Telecom, KT and LG Uplus as well as local Apple retailer Frisbee, with sales starting from 8 a.m. on Friday. Korea has long been a tough market for Apple, as Samsung has maintained

Oct. 21, 2016

-

[EQUITIES] ‘Huneed Technologies’ operating profit to rise 673%’

[THE INVESTOR] Huneed Technologies’ operating profit in the third quarter is expected to rise 673 percent on-year reaching 400 million won (US$352.20), and sales will mark 10.6 billion won up 24 percent, according to Shinhan Investment on Oct. 21.“We expect sales of 3.6 billion won from domestic defense projects, 5.7 billion won from overseas operations and 1.3 billion won from civil aircraft parts,” the securities firm said on the company’s sales in the period. For 2016, Shinhan forecasts that

Oct. 21, 2016

-

Exports rise in first 20 days of Oct.

[THE INVESTOR] South Korean exports climbed 1.2 percent on-year in the first 20 days of October, customs data showed on Oct. 21.The country’s exports totaled US$24.99 billion on Oct. 1-20, up from $24.7 billion tallied over the same period last year, according to the Korea Customs Service.It turned around from an 18.2 percent plunge tallied over the first 10 days of the month.A rise in the semiconductor and shipbuilding sectors led the rebound, with exports of chips gaining 2.5 percent on-year

Oct. 21, 2016

-

Hanjin Shipping to sell stake in US affiliate

[THE INVESTOR] Hanjin Shipping plans to sell 54-percent stake in a US affiliate that runs a terminal in the Port of Long Beach, California, industry sources said on Oct. 21. Total Terminals International, established in 1992, operates two facilities in Long Beach and Seattle, and handles some 30 percent of cargo along the US West Coast. The move came as the country’s No. 1 shipper is seeking to sell its Asia-US route, vessels, and 10 overseas operations.Hanjin Shipping was put under court receiv

Oct. 21, 2016

-

Brazil-focused funds show stellar returns

[THE INVESTOR] South Korean funds flowing into Brazilian stocks and resources have seen stellar returns this year, according to a fund evaluation on Oct. 21.According to Zeroin, this year’s cumulative return of local Brazil-related investment funds with net assets of 1 billion won (US$890,000) or more stood at a whopping 60.5 percent as of Oct. 18, far outshining other overseas funds.Overseas equity funds came next with a cumulative yield of 36.7 percent, trailed by funds investing in stocks of

Oct. 21, 2016

-

Exports to China plunge for 15th straight month

[THE INVESTOR] South Korean exports to China decreased 9 percent on-year in September, the 15th consecutive month of decline, data showed on Oct. 21. Shipments to China stood at US$10.96 billion in September, compared with US$12.04 billion for the same month last year, according to the data from the Korea International Trade Association.China, grappling with slow growth, is South Korea’s biggest export destination, and the neighboring country is seeking to boost demand for its own products on i

Oct. 21, 2016

-

Huge capital flows to MMFs amid US rate woes

[THE INVESTOR] Investors in South Korea are turning their eyes to short-term financial instruments ahead of possible US rate hike in December, according to a market tracker on Oct. 21.According to fund rater Zeroin, local money market funds registered a net capital inflow of 12.2 trillion won (US$10.9 billion) in the first 18 days of October, a turnaround from a net outflow of 13.8 trillion won the previous month and 4.8 trillion won in August.MMFs are short-term debt securities such as Treasury

Oct. 21, 2016

-

Korean Air, Asiana Airlines lose debt investors’ appetite

[THE INVESTOR] Korean Air Lines and Asiana Airlines are losing institutional investors’ appetite in the local debt market, industry sources said on Oct. 20.According to the sources, Korean Air attempted to sell bonds worth 150 billion won (US$134 million) earlier this week, to repay maturing debts, but not a single institutional investor expressed an intention to buy the proposed debt offering. In February and April, the air carrier also failed to sell its proposed debt worth 400 billion won thr

Oct. 20, 2016

-

Duty-free sales up 36% in first nine months

[THE INVESTOR] Sales at South Korea’s duty-free stores climbed 36.4 percent on-year in the first nine months, data showed on Oct. 20. Sales at 50 duty-free stores nationwide came to 8.93 trillion won (US$7.90 billion) in the January-September period, compared with 6.55 trillion won a year ago, according to data compiled by Korea Customs Service.If the current sales trend continues, annual sales at the duty-free stores could top 10 trillion won for the first time this year.Foreign goods accounted

Oct. 20, 2016

-

Large firms need more incentives to support smaller companies: survey

[THE INVESTOR] Top business conglomerates in South Korea have expanded investment in their smaller companies but little incentives hinder such efforts, a survey showed on Oct. 20. In a survey conducted by the Federation of Korean Industries, the country’s 30 largest business groups and their subsidiaries said they have increased their combined cash payment to their suppliers to 81.7 percent from 64.3 percent six years earlier when the government launched the state commission on corporate partner

Oct. 20, 2016

-

U&I signs trust contract to repurchase stocks worth W2b

[DISCLOSURE] U&I (056090), an orthopedic device manufacturer, announced on Oct. 20 that it has decided to sign a trust contract with Hyundai Securities (003450) to repurchase its stocks worth 2 billion won (US$1.78 million). The company made the decision as “its stock price have fallen excessively,” the company said. The contract lasts from Oct. 21 to April 20, 2017. By Park Yuna (yunapark@heraldcorp.com)

Oct. 20, 2016

-

FSC urges financial firms to act on pay reform

[THE INVESTOR] South Korea’s top financial regulator urged the financial firms to encourage the performance-linked pay system for employees. “A board of directors representing shareholders should demand a change (in the pay mechanism), wisely judging what’s important in the growth and development of their companies,” Yim Jong-yong, Chairman of the Financial Services Commission, said.He was speaking at a meeting with the heads of public financial firms here on the government’s drive to introduce

Oct. 20, 2016

-

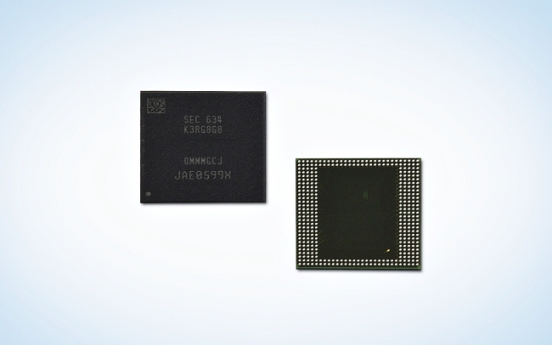

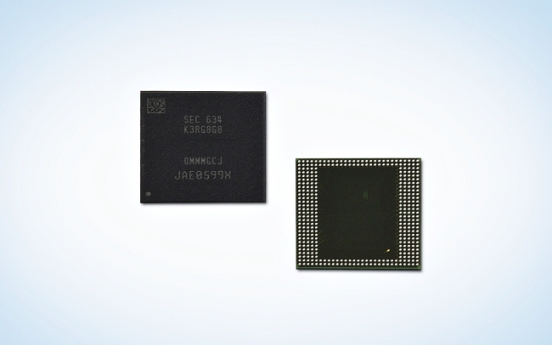

Samsung launches industry’s first 8GB mobile DRAM for smartphones

[THE INVESTOR] Samsung Electronics has rolled out 8-gigabyte mobile DRAM package for smartphones based on its advanced 10-nanometer production technology, the company said on Oct. 20. The new package of mobile chips is expected to significantly improve mobile user experiences for those using high-definition, large-screen devices, Samsung said in a statement. Choi Joo-sun, executive vice president of Samsung, said in the statement that the new mobile DRAM “will enable more capable next-generation

Oct. 20, 2016

-

Eugene‘s stake in Tongyang increases

[DISCLOSURE] Tongyang (001520) announced on Oct. 19 that Eugene (023410) and Eugene Investment & Securities have increased their stake from 27.5 percent to 30.03 percent, respectively, by acquiring over 6 million stocks between Oct. 6 and 18.Eugene and Eugene Investment & Securities have bought 2.29 million and 3,745,000 stocks, respectively. Eugene recently has been seeking to participate in Tongyang’s management such as calling for an extraordinary shareholders meeting to select director. By P

Oct. 19, 2016