[News Focus] Korea 6th highest in household debt in OECD

Ranking up 2 notches in 2019 amid credit loan fever

By Kim Yon-sePublished : Nov. 17, 2020 - 16:03

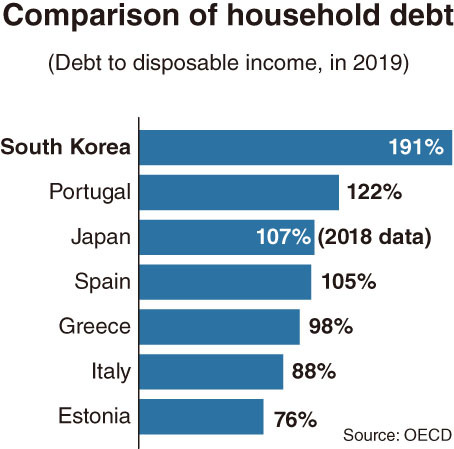

SEJONG -- South Korean households saw their collective debt reach 191 percent of their net disposal income as of 2019, up from the ratio of 184 percent posted a year earlier, data from the Organization for Economic Cooperation and Development showed.

As a result, Korea placed at sixth on the list of OECD countries in the household debt-disposal income ratio last year, up from No. 8 in 2018.

The France-based organization compared the latest available data for 33 of its total 37 members. The excluded four economies in the comparison were Ireland, Israel, Mexico and Turkey.

The figure of 191 percent indicates that a Korean household with disposable income of 2 million won ($1,800) a month was typically saddled with monthly debt of 3.82 million won.

The OECD comparison showed that only nine of the 33 countries studied had ratios surpassing 150 percent.

The figure for Korea contrasted to 142 percent in the UK, 119 percent in France, 107 percent in Japan, 104 percent in the US and 95 percent in Germany.

Latvia and Hungary recorded the lowest figures, both with at 42 percent. The next-lowest were Lithuania at 46 percent, Colombia at 47 percent, Slovenia at 57 percent, Poland at 63 percent and Chile at 73 percent.

Among other members with figures below 100 percent were the Czech Republic (76 percent), Estonia (76 percent), Slovakia (81 percent), Italy (88 percent) and Austria (90 percent), which means their disposable income exceeded their household debt.

Among English-speaking countries, Australia posted 217 percent, Canada 181 percent and New Zealand 122 percent.

The top three with the highest ratios of household debt to disposable income were Denmark with 256 percent, Norway with 239 percent and the Netherlands with 236 percent.

A large portion of ordinary Koreans as well as local analysts share the view that de facto failure in real estate policies have caused the failure in curbing mounting consumer debt.

The Moon Jae-in administration has implemented a variety of regulations in the housing market, including restrictions on mortgages. But more people, including younger people in their 20s and 30s, have actively joined the move to buy apartments since mid-2019 by taking out credit-based loans to make up for lowered permission in the ratio of bank mortgages to house value.

The situation has been aggravated in 2020 amid young people’s impetuosity -- or a Korean syndrome that they feel they might not be able to buy homes forever if the timing is delayed -- amid quickly climbing apartment prices despite the government-led anti-speculation measures.

Further, the low benchmark interest rate has fanned a fever of loans. During Moon’s term since May 2017, the rate has ranged between 0.5 percent and 1.75 percent per annum. It has been set at a record low of 0.5 percent since May 2020.

According to the Bank of Korea, outstanding household debt -- the total of financial loans and credit-based payment services extended to households -- reached a record high of 1,637.3 trillion won as of June 2020.

The balance has climbed by about 250 trillion won during the first three years of the Moon administration. This could suggest that the incumbent administration has failed to put the brakes on the increase in debt that started in the previous Park Geun-hye administration.

Dozens of real estate polices introduced by the Land Ministry and the Finance Ministry to curb speculation were ineffective or even counterproductive.

In just one year, average housing prices in Seoul rose by 20.3 percent from 27.65 million won per 3.3 square meters in November 2019 to 33.29 million won in November 2020, according to KB Real Estate.

This means that housing prices for a standard 84-square-meter unit came to 847 million won on average in the capital. Apartment prices for the same size in Seoul’s 25 districts are estimated to have already surpassed 1 billion won, with average prices in two wealthy Gangnam and Seocho districts among the 25 approaching 2 billion won or over.

By Kim Yon-se (kys@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)