[News Focus] Do securities regulators offer level playing field?

By Kim Yon-sePublished : Oct. 28, 2019 - 17:33

SEJONG -- Some local commercial banks have been denounced for having recklessly sold high-risk equity-linked fund products to seniors without properly warning them of the potential losses.

Some retirees saw their severance pay or savings from their working life disappear. Bank salesmen also targeted ordinary salaried workers whose installment savings had matured.

Though investors in funds should be accountable for their own investment losses, the commercial banks have been criticized for improperly promoting their fund products by exaggerating the expected gains and hesitating to actively notifying investors of the risks.

Regarding the situation, some financial industry insiders argue that “there is no return without risk,” saying that many other people have enjoyed stable gains via investment in overseas funds, and bankers were not pressuring customers to purchase the products but just recommending them. But those who lost money from their investments the fund products are demanding the banks compensate them fully, citing their neglect of duties.

For the local benchmark Kospi, some brokerage firms have engaged in low-key dumping of particular stocks after actively touting them to some small investors.

Some retirees saw their severance pay or savings from their working life disappear. Bank salesmen also targeted ordinary salaried workers whose installment savings had matured.

Though investors in funds should be accountable for their own investment losses, the commercial banks have been criticized for improperly promoting their fund products by exaggerating the expected gains and hesitating to actively notifying investors of the risks.

Regarding the situation, some financial industry insiders argue that “there is no return without risk,” saying that many other people have enjoyed stable gains via investment in overseas funds, and bankers were not pressuring customers to purchase the products but just recommending them. But those who lost money from their investments the fund products are demanding the banks compensate them fully, citing their neglect of duties.

For the local benchmark Kospi, some brokerage firms have engaged in low-key dumping of particular stocks after actively touting them to some small investors.

Despite the growth of local bourses after the 1997 currency crisis, quite a number of small investors have had to suffer losses from stock manipulation by institutional investors.

Individuals are still victims of the powers exploiting short-selling, under which institutions aggressively sell borrowed stocks, driving the price down. The institutions then buy them back at a lower price and return them to their owners.

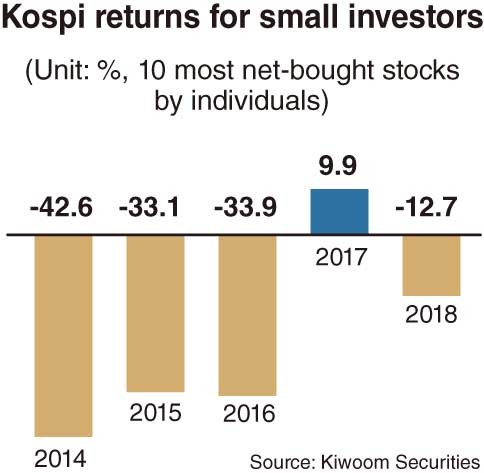

While some estimate that 5 million people in South Korea engage in stock investment, individual investors have lost money almost every year, while the frequent winners were foreign and local institutions.

A research analyst in Seoul said the lack of transparency and credibility in the capital market have somewhat contributed to the wide disparity between stock and real estate markets. “While apartment prices in Seoul have climbed by 50 to 100 percent since 2010, the Kospi has stayed at a similar level.”

In addition, past and incumbent administrations paid relatively little attention to the capital market, while they unveiled a series of policies to boost the construction sector and real estate measures, he said.

A former official of the Financial Supervisory Service cited the lack of transparency in the bookkeeping of some local enterprises and habitually irregular stock trading on the bourses for the lack of competitiveness of the Kospi and local brokerage firms, compared to advanced markets and global investment banks.

He said that “sterner punishment on rule-breakers in the stock market, in accordance with global standards, is a prerequisite for gradual progress of the Kospi, upgrading the securities industry, and creating a level playing field for any investors.”

In the early 2010s, South Korea’s financial authorities pledged to foster major investment banks in the local capital market to rival international players like Goldman Sachs.

Their blueprint had involved active mergers and acquisitions among local stock brokerage firms. But still there is no investment bank in Korea that is equivalent to brokerage firms in the US, Europe and Japan in terms of size, financial skill or analytic research capability.

The authorities had also vowed to create homegrown private equity funds, which would be competitive on the global stage. But it seems that the scheme have fizzled out at the present stage.

Their plan had been aimed at reducing volatility of stock prices in the face of a variety of external risks as well as pursuing globalization of the securities investment sector.

A small investor, who said he had been duped by a listed company’s publicized reports, denigrated the state efforts. “The size of brokerage firms does not guarantee development of the capital market. I hope regulators will work for financial consumers, not for financial firms.”

While a large number of retail investors called for the authority to issue a full-fledged ban on short-selling by institutions, the Financial Services Commission has glossed over their petitions over the past few years or more.

Some officials claim short-sellers are not always harmful to the market soundness, saying that short-selling is a legitimate financial investment skill.

By Kim Yon-se (kys@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)