[DECODED] Shin Dong-bin’s battle wages on

Self-appointed successor still caught in power struggle, faces widening probe into Lotte’s dark past

By Korea HeraldPublished : June 20, 2016 - 17:19

[THE INVESTOR] In front of a phalanx of flashing cameras, Lotte Group chairman Shin Dong-bin took to the witness stand for a parliamentary audit for the first time as a chaebol chief on Sept. 17 last year.

The five-hour grilling took place just as the public’s hostility toward Lotte -- including for its national identity, murky governance and bitter fraternal war -- was reaching its climax.

Lawmakers were eager to drive him into a corner.

But Shin remained outwardly calm even then, though his hands shook as he held the microphone.

Slowly but clearly, he drew a line between Lotte’s past and the present, reaffirming that the 90 trillion-won ($77.5 billion) empire belonged to Korea, not Japan. And that he, himself, was also Korean.

“Lotte is a company born in Korea and (it) belongs to Korea,” Shin said in his heavy Japanese accent.

The chairman had been called to testify, but the session became Shin’s public debut as the self-appointed successor who took control of Lotte’s dual operations in Korea and Japan against his aging father’s wishes.

Projecting himself as the final victor, the chairman claimed the brutal succession battle was over and that he was the only leader capable of ushering in a new era for Lotte.

Despite this, Shin still seems to be at war.

The uncertainty of his leadership over the retail giant is once again growing, fueled by prosecutors’ surprise investigation this month into his family and aides. They are suspected of creating slush funds and lobbying politicians for business favors.

The ongoing investigation has severely shaken Shin’s vision of a new Lotte as well as hampered restructuring efforts, including a planned initial public offering of the hotel unit that is the de facto holding company of Lotte’s Korean operation.

His elder brother, Shin Dong-joo, who claims to be the legitimate heir, has also initiated a fresh round in the succession battle.

“The (succession) war is not over yet,” said Jeong Seon-sub, head of Chaebul.com, a conglomerate tracking research firm in Seoul.

“Shin Dong-joo has bigger stakes in Lotte Holdings and was appointed heir by Shin Kyuk-ho, his father and the founder of Lotte. Shin Dong-bin has played down that part, calling it madness,” he said.

Rumors are circulating that the ultimate target of the prosecution’s investigation is the Lotte chairman himself. Some speculate that it was likely his brother who handed over evidence to prove wrongdoing.

If found guilty, the chairman might lose everything he has fought for.

Despite his hard-won image as a proven leader, the fundamental questions that Shin Dong-bin thought he had answered appear to be returning to haunt him.

“The questions of legitimacy and legality over his leadership will follow him around to the end,” Jeong said.

“Lotte has no tomorrow if the two keep fighting.”

Origins of the feud

Until 2011, the two brothers appeared to have a harmonious relationship, with each of them overseeing their own domain under the guidance of their father, who called himself the general chairman.

Shin Dong-bin said in an interview in 2010 that the dual management system had been set a long time ago, with Lotte Korea under himself and Lotte Japan under his brother.

But his father did not reveal who would take the top position in the company until he was deposed by his younger son last year.

Shin Kyuk-ho’s life as a business tycoon was successful, but pundits say the founder held on to power for too long, instigating the Lotte crisis.

“The core of the Lotte crisis lies in the owner family,” said Kim Woo-chan, a management professor at Korea University in Seoul.

“There are certain governance structures within family enterprises (such as giving a clear picture of who is the successor). But Lotte has none,” he said.

Hence Lotte, with its two “princes,” ended up in dire straits.

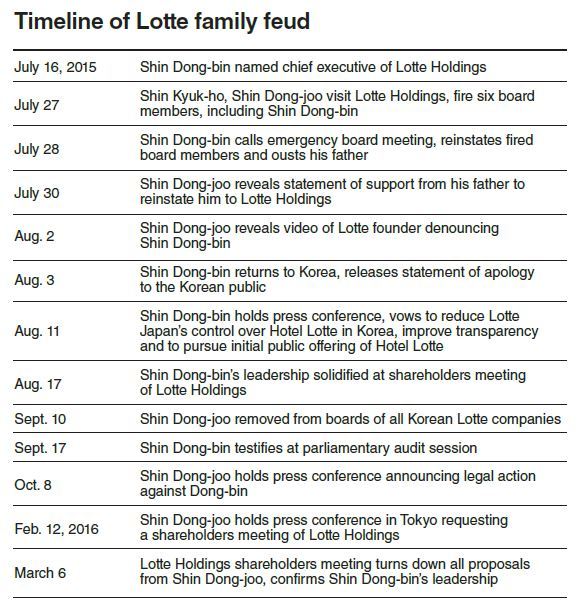

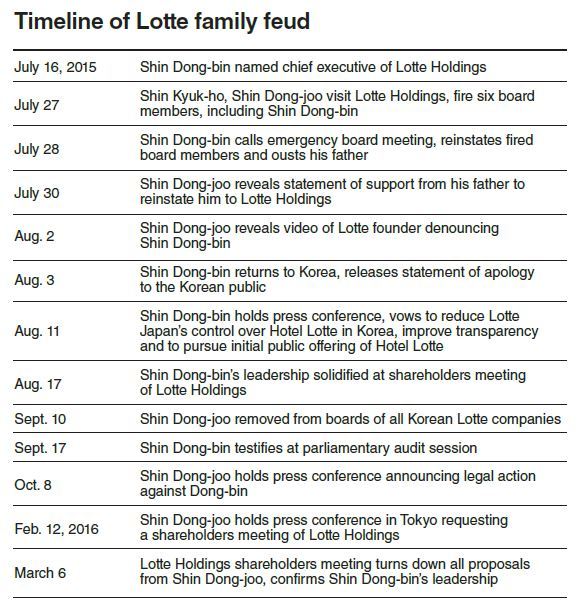

It started in January last year when Shin Dong-joo, the former head of Lotte Japan was ousted from the board of Lotte Holdings. Many viewed the incident as a final decision by the 93-year-old founder to pass the baton to his younger son Shin Dong-bin, and not Shin Dong-joo.

However, on July 27, the founder appeared to have changed his mind, as he fired Lotte Holdings’ board members, including Shin Dong-bin. The following day, the board voted to oust the founder from his chairmanship of the empire’s lynchpin firm, Lotte Holdings.

Shin Dong-joo struck back, claiming his father was enraged with Shin Dong-bin for hiding fiscal records to conceal losses inflicted by Chinese operations.

He said that his father’s sacking had been illegal.

Then, Shin Dong-bin, through another shareholders meeting, stripped his elder brother of his registered executive position in the company, leaving him no chance of gaining a foothold in Lotte Group Korea or Japan.

Shin Dong-joo tried to restore himself by establishing his own company, SDJ Corporation, in Seoul. He put himself in the media limelight, accusing Shin Dong-bin of betraying the family and violating moral codes.

However, Koreans turned a cold shoulder to the founder’s firstborn son.

The reaction was due partly to his poor grasp of Korean and mainly because he was literally unknown here at the time, said Park Ju-gun, president of CEO Score, a market research firm.

In terms of stock ownership ratio, Shin Dong-bin owns relatively small stakes in the group’s key affiliates and in Kojunsha, a small Tokyo-based family firm that sits at the apex of the group’s entire governance structure.

Kojunsha, or Kwang Yoon Sa in Korean, holds a 28 percent stake in Lotte Holdings, which owns 99 percent of Hotel Lotte, the de facto holding company of Lotte’s Korean operation.

Shin Dong-joo holds a 50 percent stake in Kojunsha, while Shin Dong-bin has 38.8 percent.

“Dong-bin faces risks to defend his management rights, according to the governance structure,” Park said. “But Dong-joo could never replace him. He has no foothold here, no one to trust.”

Mixed views

Although Shin Dong-bin started to handle Lotte’s Korean operation almost 30 years ago, few people knew who he was until last year.

He and his brother Shin Dong-joo were born from Shin Kyuk-ho’s second marriage, to Hatsuko Shigemitsu.

By the time Shin Dong-bin was born, his Korean father was already a successful entrepreneur with a chewing gum business in postwar Japan.

When Shin Dong-bin was 12, his father headed back home with the capital he had raised in Japan and launched a separate confectionery business in Seoul. He named the group after Charlotte, the heroine of an 18th-century Goethe novel.

In 1977, Shin Dong-bin, whose Japanese name is Akio Shigemitsu, entered Aoyama Gakuin University, majoring in economics. He later attended Columbia University to pursue an MBA degree, choosing a different path from his brother, who preferred to stay in Japan.

After graduation, he worked six years as an executive director for institutional research and sales in the London office of Nomura International Ltd.

He joined the Tokyo-based Lotte Trading in 1988 and was later ordered by his father to take an executive position at a petrochemicals unit in Korea in 1990.

Sending Shin Dong-bin to Korea instead of Shin Dong-joo seemed to be the natural choice. After all, he spoke better Korean than his brother, say some observers.

Since then, Shin Dong-bin has been aggressive in his business approach, growing the confectionary and retail business through a series of mergers and acquisitions, including those involving electronics chain Hi-Mart, Hyundai Logistics and the New York Palace Hotel.

In 2015, he carried out the largest M&A in the group’s history, taking over the chemical divisions of Samsung, estimated to be worth 3 trillion won.

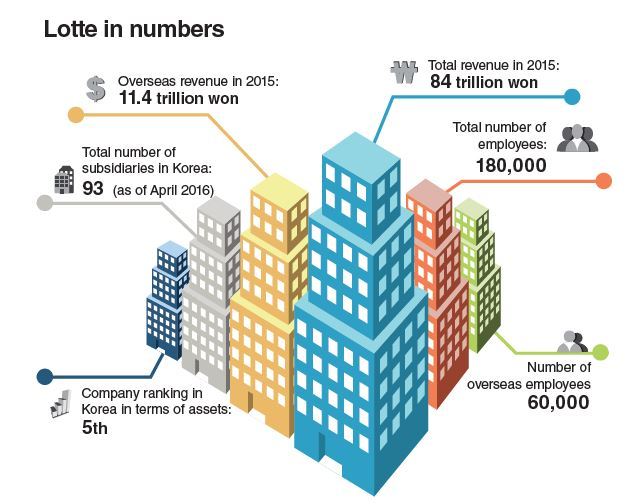

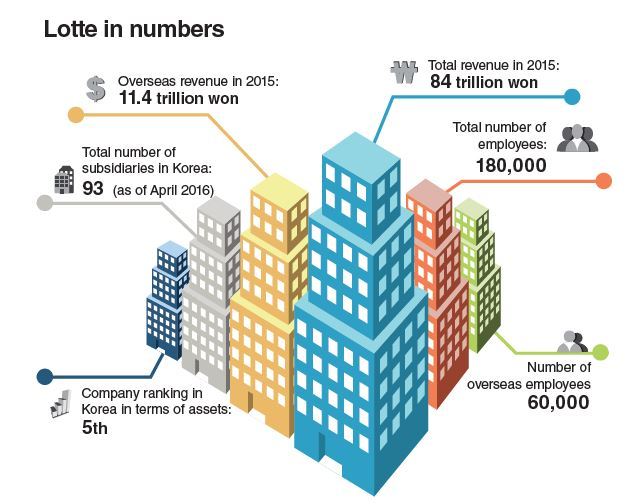

Through his aggressive M&A strategy, Lotte became the nation’s fifth-largest conglomerate. The group owns affiliates in around 20 countries. Its annual revenues reached around 90 trillion won, 20 times larger than Lotte Japan.

Korean employees in Seoul hail Shin Dong-bin as the modern version of Shin Kyuk-ho -- ambitious and aggressive like his father, but more rational and globally minded.

“His management ability has been proven. He has grown the business this much. The numbers prove it all,” said a Lotte official who declined to be named.

Critics, however, point out Shin’s lack of innovative ideas, saying that he has only focused on Lotte’s external growth and nothing else.

“He has just enlarged the size of the group by raising the debt ratio,” said Jeong of Chaebul.com.

“Chemicals? The market is being oversupplied by Chinese rivals. Would Samsung sell that business if it wasn’t that bad?”

The costs of fraternal war

Experts warn the power struggle between the two brothers must end for the sake of Lotte’s future, particularly its more-than 180,000 employees and worldwide shareholders.

Furthermore, the impact of the ongoing prosecution’s probe will be significant, as the authorities are digging up dirt on the conglomerate.

The prosecution has been looking into the alleged creation of slush funds, embezzlement and lobbying by Lotte’s owner families and executives.

Investigators believe that Lotte may have sent secret funds to unlisted subsidiaries in Japan and borrowed-name bank accounts. They also suspect that Lotte lobbied government officials and politicians to win lucrative duty-free operational licenses, a controversial skyscraper project and other favors.

The group’s TV channel, Lotte Home Shopping, was ordered last month to suspend its six-hour prime-time broadcasts for six months, starting from late September, for submitting false documents to renew its business license.

One of its major duty-free store in Jamsil is set to shut down operations after the group lost its operational license last year. Lotte has been pinning hopes on winning the license back later this year, but market insiders say it would be difficult for it to do so. Lotte spent 100 billion won just on relocating the store from Lotte Department Store in Jamsil to the newly built Lotte World Tower, according to a Lotte official.

“The cases reflect how being a conglomerate with opaque corporate governance can have harmful consequences,” said Park of CEO Score.

“It also laid bare Lotte’s limits as a domestic-focused business entity -- that without lobbying officials, it would not have been able to survive.”

Foreign investors are also casting doubts over Lotte.

“Investors are worried about this kind of corporate governance, which partially resulted in the postponement of the IPO of its hotel unit,” said a Hong Kong-based asset manager on condition of anonymity.

“Investors will ask for a larger discount before this incident is fully settled.”

By Cho Chung-un (christory@heraldcorp.com)

The five-hour grilling took place just as the public’s hostility toward Lotte -- including for its national identity, murky governance and bitter fraternal war -- was reaching its climax.

Lawmakers were eager to drive him into a corner.

But Shin remained outwardly calm even then, though his hands shook as he held the microphone.

Slowly but clearly, he drew a line between Lotte’s past and the present, reaffirming that the 90 trillion-won ($77.5 billion) empire belonged to Korea, not Japan. And that he, himself, was also Korean.

“Lotte is a company born in Korea and (it) belongs to Korea,” Shin said in his heavy Japanese accent.

The chairman had been called to testify, but the session became Shin’s public debut as the self-appointed successor who took control of Lotte’s dual operations in Korea and Japan against his aging father’s wishes.

Projecting himself as the final victor, the chairman claimed the brutal succession battle was over and that he was the only leader capable of ushering in a new era for Lotte.

Despite this, Shin still seems to be at war.

The uncertainty of his leadership over the retail giant is once again growing, fueled by prosecutors’ surprise investigation this month into his family and aides. They are suspected of creating slush funds and lobbying politicians for business favors.

The ongoing investigation has severely shaken Shin’s vision of a new Lotte as well as hampered restructuring efforts, including a planned initial public offering of the hotel unit that is the de facto holding company of Lotte’s Korean operation.

His elder brother, Shin Dong-joo, who claims to be the legitimate heir, has also initiated a fresh round in the succession battle.

“The (succession) war is not over yet,” said Jeong Seon-sub, head of Chaebul.com, a conglomerate tracking research firm in Seoul.

“Shin Dong-joo has bigger stakes in Lotte Holdings and was appointed heir by Shin Kyuk-ho, his father and the founder of Lotte. Shin Dong-bin has played down that part, calling it madness,” he said.

Rumors are circulating that the ultimate target of the prosecution’s investigation is the Lotte chairman himself. Some speculate that it was likely his brother who handed over evidence to prove wrongdoing.

If found guilty, the chairman might lose everything he has fought for.

Despite his hard-won image as a proven leader, the fundamental questions that Shin Dong-bin thought he had answered appear to be returning to haunt him.

“The questions of legitimacy and legality over his leadership will follow him around to the end,” Jeong said.

“Lotte has no tomorrow if the two keep fighting.”

Origins of the feud

Until 2011, the two brothers appeared to have a harmonious relationship, with each of them overseeing their own domain under the guidance of their father, who called himself the general chairman.

Shin Dong-bin said in an interview in 2010 that the dual management system had been set a long time ago, with Lotte Korea under himself and Lotte Japan under his brother.

But his father did not reveal who would take the top position in the company until he was deposed by his younger son last year.

Shin Kyuk-ho’s life as a business tycoon was successful, but pundits say the founder held on to power for too long, instigating the Lotte crisis.

“The core of the Lotte crisis lies in the owner family,” said Kim Woo-chan, a management professor at Korea University in Seoul.

“There are certain governance structures within family enterprises (such as giving a clear picture of who is the successor). But Lotte has none,” he said.

Hence Lotte, with its two “princes,” ended up in dire straits.

It started in January last year when Shin Dong-joo, the former head of Lotte Japan was ousted from the board of Lotte Holdings. Many viewed the incident as a final decision by the 93-year-old founder to pass the baton to his younger son Shin Dong-bin, and not Shin Dong-joo.

However, on July 27, the founder appeared to have changed his mind, as he fired Lotte Holdings’ board members, including Shin Dong-bin. The following day, the board voted to oust the founder from his chairmanship of the empire’s lynchpin firm, Lotte Holdings.

Shin Dong-joo struck back, claiming his father was enraged with Shin Dong-bin for hiding fiscal records to conceal losses inflicted by Chinese operations.

He said that his father’s sacking had been illegal.

Then, Shin Dong-bin, through another shareholders meeting, stripped his elder brother of his registered executive position in the company, leaving him no chance of gaining a foothold in Lotte Group Korea or Japan.

Shin Dong-joo tried to restore himself by establishing his own company, SDJ Corporation, in Seoul. He put himself in the media limelight, accusing Shin Dong-bin of betraying the family and violating moral codes.

However, Koreans turned a cold shoulder to the founder’s firstborn son.

The reaction was due partly to his poor grasp of Korean and mainly because he was literally unknown here at the time, said Park Ju-gun, president of CEO Score, a market research firm.

In terms of stock ownership ratio, Shin Dong-bin owns relatively small stakes in the group’s key affiliates and in Kojunsha, a small Tokyo-based family firm that sits at the apex of the group’s entire governance structure.

Kojunsha, or Kwang Yoon Sa in Korean, holds a 28 percent stake in Lotte Holdings, which owns 99 percent of Hotel Lotte, the de facto holding company of Lotte’s Korean operation.

Shin Dong-joo holds a 50 percent stake in Kojunsha, while Shin Dong-bin has 38.8 percent.

“Dong-bin faces risks to defend his management rights, according to the governance structure,” Park said. “But Dong-joo could never replace him. He has no foothold here, no one to trust.”

Mixed views

Although Shin Dong-bin started to handle Lotte’s Korean operation almost 30 years ago, few people knew who he was until last year.

He and his brother Shin Dong-joo were born from Shin Kyuk-ho’s second marriage, to Hatsuko Shigemitsu.

By the time Shin Dong-bin was born, his Korean father was already a successful entrepreneur with a chewing gum business in postwar Japan.

When Shin Dong-bin was 12, his father headed back home with the capital he had raised in Japan and launched a separate confectionery business in Seoul. He named the group after Charlotte, the heroine of an 18th-century Goethe novel.

In 1977, Shin Dong-bin, whose Japanese name is Akio Shigemitsu, entered Aoyama Gakuin University, majoring in economics. He later attended Columbia University to pursue an MBA degree, choosing a different path from his brother, who preferred to stay in Japan.

After graduation, he worked six years as an executive director for institutional research and sales in the London office of Nomura International Ltd.

He joined the Tokyo-based Lotte Trading in 1988 and was later ordered by his father to take an executive position at a petrochemicals unit in Korea in 1990.

Sending Shin Dong-bin to Korea instead of Shin Dong-joo seemed to be the natural choice. After all, he spoke better Korean than his brother, say some observers.

Since then, Shin Dong-bin has been aggressive in his business approach, growing the confectionary and retail business through a series of mergers and acquisitions, including those involving electronics chain Hi-Mart, Hyundai Logistics and the New York Palace Hotel.

In 2015, he carried out the largest M&A in the group’s history, taking over the chemical divisions of Samsung, estimated to be worth 3 trillion won.

Through his aggressive M&A strategy, Lotte became the nation’s fifth-largest conglomerate. The group owns affiliates in around 20 countries. Its annual revenues reached around 90 trillion won, 20 times larger than Lotte Japan.

Korean employees in Seoul hail Shin Dong-bin as the modern version of Shin Kyuk-ho -- ambitious and aggressive like his father, but more rational and globally minded.

“His management ability has been proven. He has grown the business this much. The numbers prove it all,” said a Lotte official who declined to be named.

Critics, however, point out Shin’s lack of innovative ideas, saying that he has only focused on Lotte’s external growth and nothing else.

“He has just enlarged the size of the group by raising the debt ratio,” said Jeong of Chaebul.com.

“Chemicals? The market is being oversupplied by Chinese rivals. Would Samsung sell that business if it wasn’t that bad?”

The costs of fraternal war

Experts warn the power struggle between the two brothers must end for the sake of Lotte’s future, particularly its more-than 180,000 employees and worldwide shareholders.

Furthermore, the impact of the ongoing prosecution’s probe will be significant, as the authorities are digging up dirt on the conglomerate.

The prosecution has been looking into the alleged creation of slush funds, embezzlement and lobbying by Lotte’s owner families and executives.

Investigators believe that Lotte may have sent secret funds to unlisted subsidiaries in Japan and borrowed-name bank accounts. They also suspect that Lotte lobbied government officials and politicians to win lucrative duty-free operational licenses, a controversial skyscraper project and other favors.

The group’s TV channel, Lotte Home Shopping, was ordered last month to suspend its six-hour prime-time broadcasts for six months, starting from late September, for submitting false documents to renew its business license.

One of its major duty-free store in Jamsil is set to shut down operations after the group lost its operational license last year. Lotte has been pinning hopes on winning the license back later this year, but market insiders say it would be difficult for it to do so. Lotte spent 100 billion won just on relocating the store from Lotte Department Store in Jamsil to the newly built Lotte World Tower, according to a Lotte official.

“The cases reflect how being a conglomerate with opaque corporate governance can have harmful consequences,” said Park of CEO Score.

“It also laid bare Lotte’s limits as a domestic-focused business entity -- that without lobbying officials, it would not have been able to survive.”

Foreign investors are also casting doubts over Lotte.

“Investors are worried about this kind of corporate governance, which partially resulted in the postponement of the IPO of its hotel unit,” said a Hong Kong-based asset manager on condition of anonymity.

“Investors will ask for a larger discount before this incident is fully settled.”

By Cho Chung-un (christory@heraldcorp.com)

-

Articles by Korea Herald

![[Robert J. Fouser] Social attitudes toward language proficiency](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050799_0.jpg&u=)

![[Graphic News] How much do Korean adults read?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050803_0.gif&u=)

![[Herald Interview] Byun Yo-han's 'unlikable' character is result of calculated acting](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/16/20240516050855_0.jpg&u=)