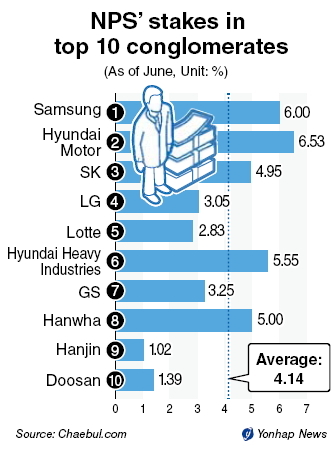

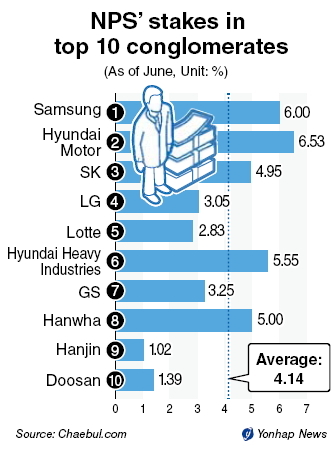

Pension fund’s stake in 10 largest groups surpasses 4 percent

The National Pension Service saw its average stake in 10 major business groups’ subsidiaries, listed on the stock market, come to an all-time high of more than 4 percent.

The pension fund, as a result, is expected to exercise its shareholder right in the conglomerate sector more actively, stock research analysts predicted.

According to Chaebul.com, a conglomerate-tracking website, the average stake held by the NPS in 93 companies of the 10 groups came to 4.14 percent at the end of June, up 0.48 percentage point from 3.66 percent a year before.

The fund holds a 6.53 percent stake in Hyundai Motor affiliates, compared to 4.97 percent a year earlier. Its stake in Samsung affiliates also increased to 6 percent from 5.28 percent.

Its stake in Hyundai Heavy Industries reached 5.55 percent, followed by Hanjin with 5 percent, SK with 4.95 percent, GS with 3.25 percent, LG with 3.05 percent, Lotte with 2.83 percent, Doosan with 1.39 percent and Hanwha with 1.02 percent.

“An investor with a minimum stake of 5 percent in a company is entitled to access details of the firm’s financial statements,” a Chaebul.com executive said.

He said the NPS has attained the shareholder position that could tackle management of conglomerate-based business units.

“Though the pension fund has been passive when it comes to management decisions of financial companies and conglomerates, it could actively exercise voting rights in the future under the willingness of policymakers,” an analyst said.

He noted that the NPS is the world’s fourth-largest pension fund with assets of more than 300 trillion won ($254 billion).

In addition, it has expanded its presence in the financial industry since the Financial Services Commission paved the way for the fund to increase its stake in commercial banks earlier this year.

Experts are divided over the national pension fund’s active buying of shares in the financial sector.

The FSC, the nation’s top financial regulator, has ruled that the NPS is regarded as financial capital which is entitled to hold up to a 10 percent share in banks without regulatory permission.

In a statement, the FSC said it decided to view the national pension fund as finance industry-oriented capital rather than business industry-oriented (or non-financial) capital.

This year, the NPS actively purchased banking shares on the Korea Exchange and became the largest shareholder of KB Financial, Shinhan Financial and Hana Financial.

For the state-run Woori Financial Group, the fund is the second-largest shareholder following the Korea Deposit Insurance Corp.

The possibility is growing that the fund will play a significant part in shareholder meetings of the nation’s four major financial groups.

The optimistic view involves the expectation that the NPS will play a role as a “white knight” against possible hostile takeover attempts by speculative investors for Korean banks.

“Its power will prevent the domestic financial industry from being damaged by foreign capital,” a senior researcher at the Korea Institute of Finance said.

On the contrary, critics forecast the NPS’ growing presence will ultimately invite frequent government intervention in the commercial banking sector.

By Kim Yon-se (kys@heraldcorp.com)

The National Pension Service saw its average stake in 10 major business groups’ subsidiaries, listed on the stock market, come to an all-time high of more than 4 percent.

The pension fund, as a result, is expected to exercise its shareholder right in the conglomerate sector more actively, stock research analysts predicted.

According to Chaebul.com, a conglomerate-tracking website, the average stake held by the NPS in 93 companies of the 10 groups came to 4.14 percent at the end of June, up 0.48 percentage point from 3.66 percent a year before.

The fund holds a 6.53 percent stake in Hyundai Motor affiliates, compared to 4.97 percent a year earlier. Its stake in Samsung affiliates also increased to 6 percent from 5.28 percent.

Its stake in Hyundai Heavy Industries reached 5.55 percent, followed by Hanjin with 5 percent, SK with 4.95 percent, GS with 3.25 percent, LG with 3.05 percent, Lotte with 2.83 percent, Doosan with 1.39 percent and Hanwha with 1.02 percent.

“An investor with a minimum stake of 5 percent in a company is entitled to access details of the firm’s financial statements,” a Chaebul.com executive said.

He said the NPS has attained the shareholder position that could tackle management of conglomerate-based business units.

“Though the pension fund has been passive when it comes to management decisions of financial companies and conglomerates, it could actively exercise voting rights in the future under the willingness of policymakers,” an analyst said.

He noted that the NPS is the world’s fourth-largest pension fund with assets of more than 300 trillion won ($254 billion).

In addition, it has expanded its presence in the financial industry since the Financial Services Commission paved the way for the fund to increase its stake in commercial banks earlier this year.

Experts are divided over the national pension fund’s active buying of shares in the financial sector.

The FSC, the nation’s top financial regulator, has ruled that the NPS is regarded as financial capital which is entitled to hold up to a 10 percent share in banks without regulatory permission.

In a statement, the FSC said it decided to view the national pension fund as finance industry-oriented capital rather than business industry-oriented (or non-financial) capital.

This year, the NPS actively purchased banking shares on the Korea Exchange and became the largest shareholder of KB Financial, Shinhan Financial and Hana Financial.

For the state-run Woori Financial Group, the fund is the second-largest shareholder following the Korea Deposit Insurance Corp.

The possibility is growing that the fund will play a significant part in shareholder meetings of the nation’s four major financial groups.

The optimistic view involves the expectation that the NPS will play a role as a “white knight” against possible hostile takeover attempts by speculative investors for Korean banks.

“Its power will prevent the domestic financial industry from being damaged by foreign capital,” a senior researcher at the Korea Institute of Finance said.

On the contrary, critics forecast the NPS’ growing presence will ultimately invite frequent government intervention in the commercial banking sector.

By Kim Yon-se (kys@heraldcorp.com)

![[News Focus] Lee tells Yoon that he has governed without political dialogue](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/29/20240429050696_0.jpg&u=20240429210658)

![[Music in drama] Rekindle a love that slipped through your fingers](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/01/20240501050484_0.jpg&u=20240501151646)