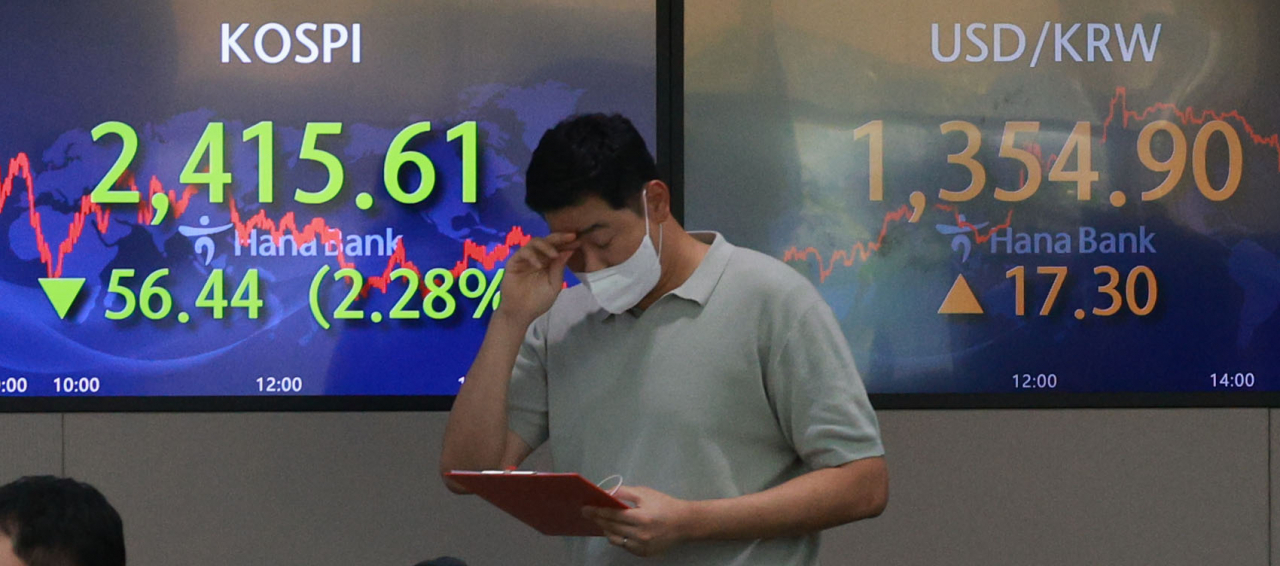

Seoul stocks dip over 2% on US rate hike woes; Korean won at 13-year low

By YonhapPublished : Sept. 1, 2022 - 16:12

South Korean stocks fell more than 2 percent Thursday on deepening concerns over aggressive rate hikes by the US Federal Reserve. The Korean won slid to a 13-year low against the US dollar.

The Korea Composite Stock Price Index (KOSPI) lost 56.44 points, or 2.28 percent, to close at 2,415.61.

Trading volume was moderate at 563.43 million shares worth 8.15 trillion won ($6.12 billion), with decliners outpacing gainers 827 to 78.

Institutions and foreigners shed shares worth 833.69 billion won and 358.58 billion won, respectively, while retail investors picked up a net 1.16 trillion won worth of shares.

"The market around the world has lost momentum particularly after the Jackson Hole meeting. Concerns over the US interest rates hikes and their impacts on the global economy are likely to continue to press the market for some time being," Yuanta Securities analyst Kang Dae-seok said.

Last week, Fed Chair Jerome Powell told the economic meeting that it will continue to raise interest rates for some time to curb inflation though it would "bring some pain to households and businesses."

On Wednesday (US time), Cleveland Federal Reserve Bank President Loretta Mester also said the Fed will need to raise the rate "up to somewhat above 4 percent by early next year."

In July, the Fed raised its key interest rate by 75 basis points for the second straight month to a range of 2.25 to 2.5 percent, and some forecast it would take such a big step once again this month.

Investor sentiment was also dampened by news that the country's exports growth slowed down and its trade deficit was extended into August, according to analysts.

Most big-cap shares lost ground, with tech and bio shares under heavy downward pressure.

Market bellwether Samsung Electronics sank 2.18 percent to 58,400 won, and No. 2 chipmaker SK hynix lost 2.94 percent to 92,400 won.

Major chemical firm LG Chem lost 1.42 percent to 623,000 won, and Samsung SDI dived 3.85 percent to 575,000 won.

Among major tech firms, key battery maker LG Energy Solution was the only gainer by inching up 0.11 percent to 463,000 won.

Samsung Biologics, the biotech arm of South Korea's Samsung Group, shed 1.08 percent to 826,000 won, and pharmaceutical giant Celltrion skidded 1.58 percent to 186,500 won.

Major carmakers also fell, with Hyundai Motor decreasing 0.26 percent to 195,500 won and its smaller affiliate Kia losing 0.74 percent to 80,200 won.

Internet portal giant Naver fell 1.67 percent to 236,000 won, and platform operator Kakao retreated 2.72 percent to 71,400 won.

The local currency ended at 1,354.9 won against the US dollar, down 17.3 won from the previous session's close. It marked the lowest figure since April 28, 2009, when it ended at 1,356.80 won. (Yonhap)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)