Korea to draw contingency plans amid Ukraine tension

By Kim Yon-sePublished : Feb. 15, 2022 - 16:07

SEJONG -- Korea’s economic policymakers are mapping out contingency plans to minimize shocks from the possibility of worsening relations between Ukraine and Russia, the Ministry of Economic and Finance said Tuesday.

Their plans are mainly focused on protecting export-oriented enterprises and the financial market by carrying out a variety of emergency countermeasures.

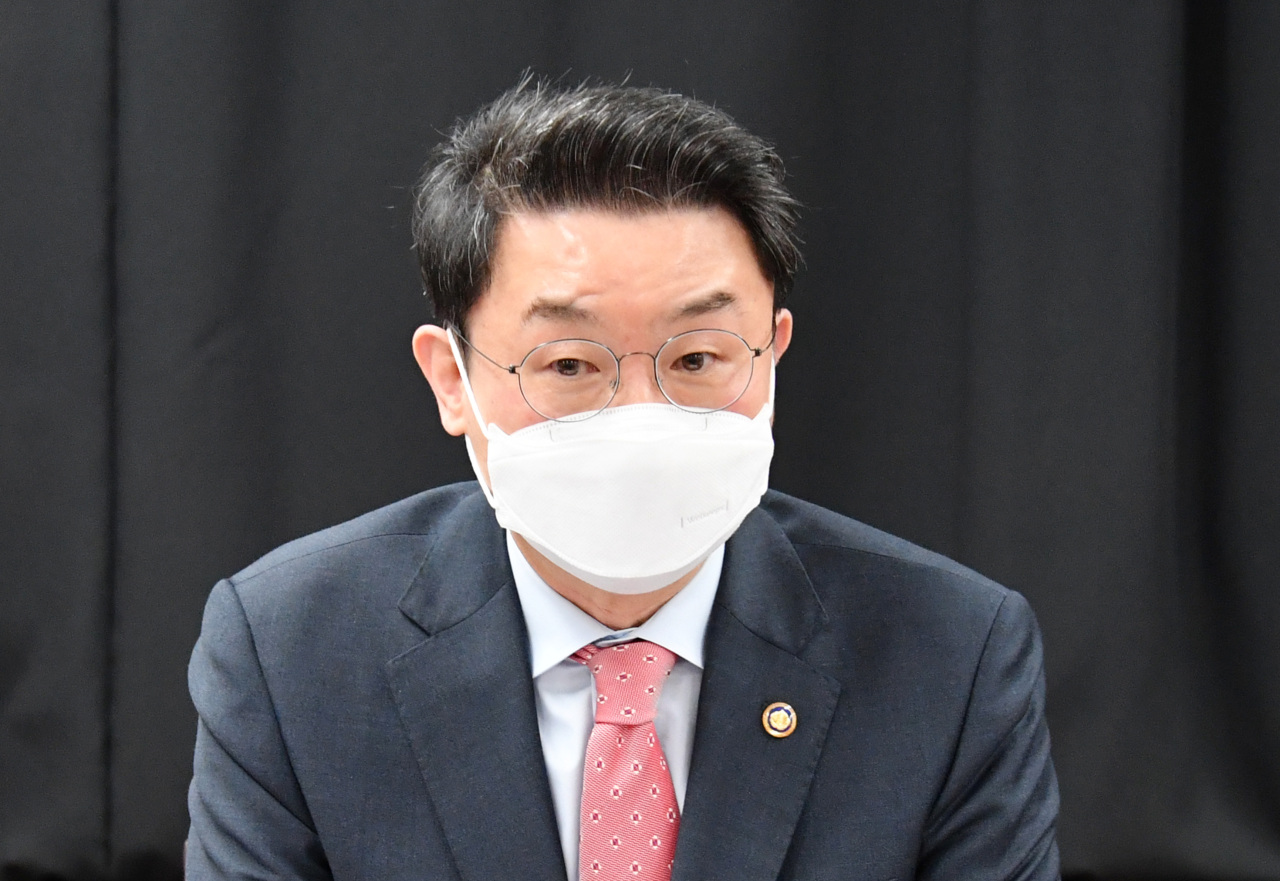

Vice Finance Minister Lee Eog-weon presided over a task force meeting during the day to cope with the geopolitical risk. Participants included senior officials from the Ministry of Foreign Affairs, the Ministry of Trade, Industry and Energy and the Financial Services Commission.

Participants shared the view that growing tension between Ukraine and Russia would possibly have negative effects on Korea’s economic sectors overall.

Among the main negative effects in the worsening scenario, they noted a glitch in supply of raw materials, hampering of economic recovery, and aggravated uncertainty in the financial market.

“In a bid to prevent contraction of economic activities and minimize volatility of the financial market, the government will mobilize all possible policy means,” said the Finance Ministry in a statement.

As a first step, the government is moving to look into international commerce routes for export-oriented firms or firms dependent on overseas orders for construction.

The government said it plans to build hotlines between trade-related agencies and businesspeople. Simultaneously, it will offer supports, if necessary, for exporters’ fundraising.

A day earlier, President Moon Jae-in instructed relevant ministries to come up with emergency measures in response to the Ukraine situation during an economy policy meeting he presided over at Cheong Wa Dae.

In the wake of the uncertainty over Ukraine-Russia relations, the local capital market has posted a bearish situation over the past several trading sessions, with the local currency showing weakness against the US dollar.

Amid the spike in international crude prices, safe havens including gold are gaining popularity among investors.

On Tuesday, gold traded at 72,437 won ($60.40) per gram, while its price stayed at around the 68,000 won range in December 2021. The benchmark price of gasoline has already surpassed the 1,700 won mark per liter.

Their plans are mainly focused on protecting export-oriented enterprises and the financial market by carrying out a variety of emergency countermeasures.

Vice Finance Minister Lee Eog-weon presided over a task force meeting during the day to cope with the geopolitical risk. Participants included senior officials from the Ministry of Foreign Affairs, the Ministry of Trade, Industry and Energy and the Financial Services Commission.

Participants shared the view that growing tension between Ukraine and Russia would possibly have negative effects on Korea’s economic sectors overall.

Among the main negative effects in the worsening scenario, they noted a glitch in supply of raw materials, hampering of economic recovery, and aggravated uncertainty in the financial market.

“In a bid to prevent contraction of economic activities and minimize volatility of the financial market, the government will mobilize all possible policy means,” said the Finance Ministry in a statement.

As a first step, the government is moving to look into international commerce routes for export-oriented firms or firms dependent on overseas orders for construction.

The government said it plans to build hotlines between trade-related agencies and businesspeople. Simultaneously, it will offer supports, if necessary, for exporters’ fundraising.

A day earlier, President Moon Jae-in instructed relevant ministries to come up with emergency measures in response to the Ukraine situation during an economy policy meeting he presided over at Cheong Wa Dae.

In the wake of the uncertainty over Ukraine-Russia relations, the local capital market has posted a bearish situation over the past several trading sessions, with the local currency showing weakness against the US dollar.

Amid the spike in international crude prices, safe havens including gold are gaining popularity among investors.

On Tuesday, gold traded at 72,437 won ($60.40) per gram, while its price stayed at around the 68,000 won range in December 2021. The benchmark price of gasoline has already surpassed the 1,700 won mark per liter.

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)