Online shopping in Korea expands 105 percent since 2017

Tour product sales via internet show signs of rebound

By Kim Yon-sePublished : Sept. 12, 2021 - 16:50

SEJONG -- The market volume of online shopping in South Korea, which has been sharply growing in recent years, has been further boosted by the pandemic, as more consumers rely on internet retailers, data shows. Shopping via the internet is estimated to have contributed largely to private consumption, and eventually the gross domestic product.

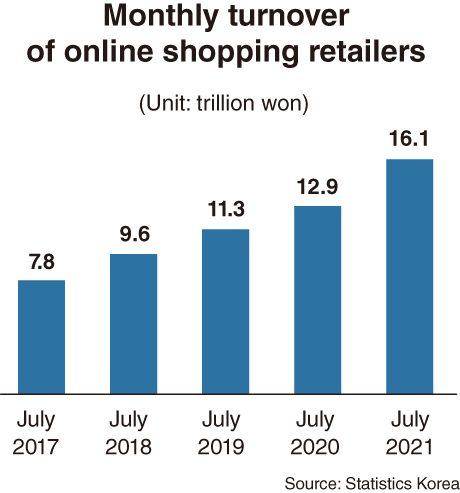

According to Statistics Korea, monthly online shopping transactions reached an all-time high of 16.19 trillion won ($13.8 billion) in July. This marked 24.9 percent growth from a year earlier, when turnover posted 12.96 trillion won.

Compared to July of 2017 when volume was 7.89 trillion, the growth marked 105.1 percent in just four years.

The monthly turnover continued to surge -- to 9.65 trillion won in July 2018, 11.3 trillion won in July 2019 and 12.96 trillion won in July 2020.

The comparison of figures for 2019 and 2020 indicate that online shopping transactions were robust despite the lackluster economic indices in the wake of the novel coronavirus.

By segment, agricultural, livestock and fisheries products posted growth of 242 percent during the July 2017-July 2021 period, from 182 billion won to 542 billion won, in online transactions. Turnover among online sellers of groceries and beverages increased by 223 percent from 638 billion won to 2.06 trillion won.

In particular, food delivery and takeout services via internet orders soared 961 percent from 224 billion won to 2.37 trillion won over the corresponding four years.

Turnover of all products online topped 15 trillion won for the first time in November 2020 after surpassing 10 trillion won in October 2018.

The surge has been backed by systematic parcel delivery services, which send products to consumers nationwide in one to three days, or even in under 10 hours in some urban areas.

While online sales for tours and transportation declined sharply in 2020 in the aftermath of the pandemic, the segment has shown symptoms of recovery.

After bottoming out at 474 billion won in December 2020, online sales for the tour-transportation sector rebounded to 822 billion won in July 2021. Turnover for the sector in July 2017 reached 1.37 trillion won.

Nowadays, almost any kind of product -- from drinking water, cosmetics and clothing to home appliances and furniture -- can be purchased online. A growing proportion of consumers were also found to have purchased goods at department stores and large discount chains via the internet.

The availability of goods online has recently expanded to local specialties, including fresh agricultural products in rural districts nationwide.

An official of the Ministry of Agriculture, Food and Rural Affairs said more urbanites are attracted to homemade food or liquor products from microbusinesses in rural areas on the back of direct deals online.

“Local farmers from nine provinces deliver consumers soy-sauce-marinated crab, leaf mustard kimchi, groundsel-flavored macaroons and makgeolli.

“The consumption trend is positive in terms of elevating the income level of farming, forestry and fishery households.”

A noteworthy point over the past few years is that a growing number of people aged 60 or over have joined the fray of online shopping.

“Seniors are the main buyers of goods with high price tags,” a retail services analyst said. “They purchase products such as luxury fashion items, couches and high-end air conditioners or TVs.”

Some critics, however, also point out that major internet portals maintain an oligopolistic status by providing settlement platforms to agricultural or industrial goods producers.

A cybermall operator said the sales disparity between large and smaller online retailers is widening, pointing out “brokerage service charges for consumers’ credit card payments are also a burden for micromall operators.”

By Kim Yon-se (kys@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)