[News Focus] Korea’s gasoline prices climb to 32-month high

Price rise may slow down amid proliferation of virus infections

By Kim Yon-sePublished : July 23, 2021 - 05:45

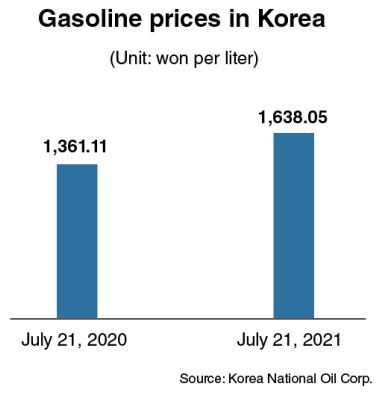

SEJONG -- Gasoline prices in South Korea reached the highest level in 32 months amid a spike in international crude prices this year.

According to the Korea National Oil Corp., gasoline prices climbed to 1,638.05 won ($1.41) per liter as of Wednesday, which marked the highest since Nov. 7, 2018 when it was 1,640.7 won. In a year, gas prices grew 20.3 percent compared to July 21, 2020.

This is due to the fast bounce-back in international crude prices over the past few months after a plunge in 2020, when COVID-19 initially hit the world.

Brent crude traded around $71.5 per barrel on July 21, having climbed 39.9 percent since Jan. 4 (the first trading session of the year), when it was $51.09.

Prices of Dubai crude, which accounts for the largest portion of Korea’s oil imports, rose 38.3 percent over the corresponding period to also hover around $71 per barrel -- from $50.61 to $71.28.

West Texas Intermediate crude recorded a 51 percent surge from $44.62 on Jan. 4 to $67.42 on July 21.

“Korea’s major industries, including oil refiners and overseas plant builders, generally gain profitability when crude prices go up,” a research analyst said. “However, stable profitability and favorable effects on the nation’s overall economy are possible when crude prices are stabilized at around $50.”

When the prices break through the psychological barrier of $65-70, refiners and other oil-sensitive industries usually see their profit margins deteriorate, he said. “In past decades, any surge in oil prices inevitably led to a spike in raw material import prices, which posed a heavy burden on the economy.”

A government official said ordinary households, based on common sense, would not welcome rising gas and diesel prices due to the growing burden of fuel costs.

Korean gasoline prices -- which remain under 1,700 won per liter -- might not be regarded as expensive, compared to past years. But the rapid climb would certainly increase the economic burden on ordinary households and small manufacturers.

A resident in Sejong said he “is still reluctant to use public transportation due to the pandemic. But it is unnerving to see higher price tags at gas stations as a car driver during commuting hours.”

Concerns are the same with drivers of sport utility vehicles. Diesel prices rose by 17.1 percent in five months -- from 1,224.63 won per liter on Jan. 1 to 1,434.09 won on July 21.

Some say the current situation, a price spike from a recovery in global demand, is better for the local market than a simultaneous surge in oil and dollar prices caused by geopolitical risks in the Middle East.

An analyst said the relatively weak US dollar “could be beneficial in terms of improving purchasing power of local households and businesses, as import prices of foreign-made consumer goods and raw materials, including crude oil, are expected to go down.”

Meanwhile, local energy-related analysts predict that another sharp increase in the number of coronavirus infections -- especially with the spread of the more contagious delta variant -- at home and abroad could hamper a further increase of oil prices.

Another proliferation of COVID-19 cases in Korea and some other countries could also stall or reverse the increase in prices of crude and gasoline in the local market. In Korea, the number of daily infections continued to renew record highs this month.

Further, the dollar has shown symptoms of gaining its value in the wake of investors’ preference for safe havens, amid rebounding infections worldwide: its price rose to 1,154 won on July 21, which marked the highest in about nine months.

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)

![[Today’s K-pop] Stray Kids to return soon: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/16/20240416050713_0.jpg&u=)