[News Focus] Korea’s consumer index stays under OECD average for 2 years

Business sentiment in Korea falls to 11-year low in June

By Kim Yon-sePublished : Aug. 10, 2020 - 14:53

SEJONG -- South Korea was found to have fallen short of the average of Organization for Economic Cooperation and Development member countries in consumer sentiment for the 25th consecutive month.

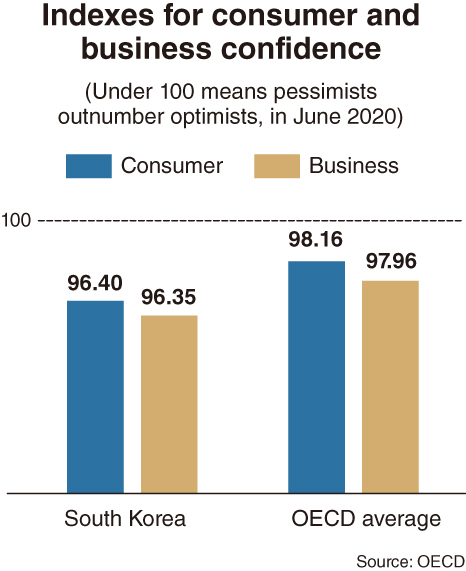

OECD data showed that Korea’s consumer confidence index stood at 96.4 as of June 2020. Figures below 100 indicate a pessimistic attitude towards future developments in the economy, possibly resulting in a tendency to save more and consume less, according to its definition.

For the Korean definition, any reading below 100 indicates that pessimists projecting an economic slowdown (or recession amid the epidemic-hitting era) outnumber optimists expecting economic vitalization.

The figure, anyway, lagged behind the OECD average of 98.16 for the corresponding month. The OECD currently has 37 members.

Further, the monthly publicized CCI for Korea has remained below the OECD average for 25 months in a row starting from June 2018.

The situation has reversed compared to the period between May 2017 and May 2018, when the index for Korea continued to outstrip the members’ average.

The past records suggested that Korea’s lackluster sentiment among ordinary households had already spread, irrespective of the novel coronavirus, which hit the world in 2020.

A survey from the Korea Agro-Fisheries and Food Trade Corp. showed that households scaled back on eating out in 2018, compared to the previous year.

A retail industry analyst said that a large portion of ordinary households are saddled with heavy debt involving mortgages for apartment purchases and credit-based borrowings for a variety of purpose. They fell short of the normal capacity to spend due to the burden of paying for monthly interest on borrowings and principle.

“Further, en masse business closure of the self-employed from the drastic spoke spike in minimum wages triggered livelihood crisis of households of the formerly self-employed people, who lost jobs,” he said.

A researcher noted that the consumer index -- locally in particular -- illustrates projected household spending trends six months into the future. “The figure is comparable to what it was about a decade years ago, when the nation’s consumption sentiment was the brightest among (then 30) OECD members,” said the official. In August 2009, Korea’s CCI reached 104.2.

A hopeful point, nevertheless, amid the sagging sentiment is that the index inched up after touching the bottom at 95.96 in April -- to 95.97 in May and 96.4 in June.

In a similar vein, the gloomy outlook was also seen among enterprises. The business confidence index for South Korea stood at 96.35 in June, which was below the OECD members’ average of 97.96.

According to the definition by the organization, numbers above 100 suggest an increased confidence in near future business performance, and numbers below 100 indicate pessimism towards future performance.

While the OECD average bounced back after touching the bottom in May at 97.5, the BCI for Korea fell further from 96.44 in May.

The index (96.35) for June 2020 marked the lowest in more than 11 years since it dipped to 96.23 in February 2009.

Meanwhile, the tally of unemployed or underemployed young people in Korea has reached a historic high in the wake of COVID-19.

According to the Supplementary Index III for Employment held by Statistics Korea, the number of de facto jobless (unemployed or underemployed) Koreans aged between 15 and 29 came to 1.31 million as of June. This marked the highest number since the nation began compiling the monthly data in January 2015.

They made up 26.8 percent of the 4.89 million economically active people in that age group.

By Kim Yon-se (kys@heraldcorp.com)

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240418181020)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)