[News Focus] 9.5% of population paid national pension in Korea

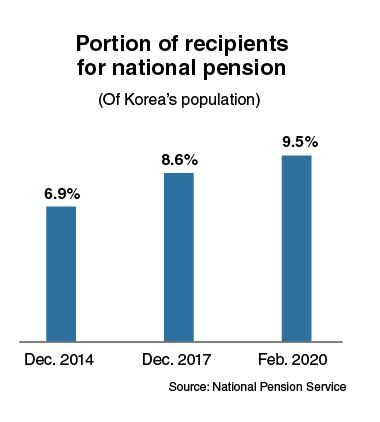

Portion of recipients sharply climbs from 6.9% in 2014

By Kim Yon-sePublished : July 21, 2020 - 15:39

SEJONG -- The number of national pension recipients has reached a historic high, while the tally of subscribers paying monthly premiums has fallen.

The situation is aggravating worries and discontent among ordinary citizens over policies of the government and the state-run pension operator.

According to data from the National Pension Service, the number of state pension policyholders fell from 22.31 million at the end of 2018 to 22.21 million at the end of 2019.

Further, the figure declined by more than 100,000 in only two months, to 22.11 million at the end of February 2020.

In contrast, the number of recipients for the national pension (old-age annuity mostly) came to an all-time high of 4.967 million as of February 2020, up 6,800 in two months from 4.961 million -- making up “9.5 percent” of South Korea’s population -- in December 2019.

The tally for recipients has continued to increase over the past few years -- 3.58 million in 2014, 3.82 million in 2015, 4.13 million in 2016, 4.47 million in 2017 and 4.59 million in 2018.

This showed that the number of recipients surged by 38.5 percent for less than six years, from December 2014 to Ferbuary 2020. In 2014, the portion of recipients stood at 6.9 percent.

By generation, people in their 60s (2.54 million) topped the list as of February, followed by those in their 70s (1.79 million) and those in their 80s (359,000).

By region, Gyeonggi Province topped the list with 1.03 million recipients, trailed by Seoul at 864,000, Busan at 395,000, South Gyeongsang Province at 362,000 and North Gyeongsang Province at 353,000. Sejong and Jeju Province posted the lowest and second-lowest number among 17 major regions at 20,300 and 63,200.

While the government’s total payments reached 1.96 trillion won ($1.64 billion) nationwide, recipients are paid 475,679 won a month on average.

Amid the contrasted situation between sliding number of policyholders vs. growing sums of payments, doubts have grown as to whether current salaried workers will really be given the amounts promised by the government when they hit pensionable age.

In addition, there are prevailing rumors that the government has been in looking into raising the pensionable age to 68 or 70, from the current 65.

Some online commenters say that any such scheme should be preceded by an extension of statutory retirement age for the private sector from the current 60 to 65.

But there are those who criticize both. A netizen claimed that “the policies would deprive young people of job opportunities.” A commenter said it is basically a scheme to keep citizens working until they die.

An analyst in Seoul expressed skepticism about the prospects of a higher retirement age, saying businesses would not welcome such a move given that they actively introduced the voluntary redundancy program and the wage peak system in efforts to save on labor costs.

More and more experts in the private sector warn that the ongoing retirement of the Korean baby boomer generation, born between 1955 and 1963 (or those aged 56-65), is a core threat to the financial soundness of Korea’s national pension funds.

Experts are calling for the society to reach a consensus on revamping the pension system as early as possible.

A demographic researcher said a significant point is how the government would placate young people and guarantee their stable receipt of annuity payments.

“Many online commenters demand an immediate refund of premiums. Due to depletion worries, they say they don’t need interest but just want repayment of the principal they have paid so far,” he said.

There have been a series of warnings that the state pension under the current the system could face depletion by the 2060s.

By Kim Yon-se (kys@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)