[News Focus] Korean won loses ground to major currencies

Capital market reflects President Moon’s coronavirus policy

By Kim Yon-sePublished : March 1, 2020 - 11:11

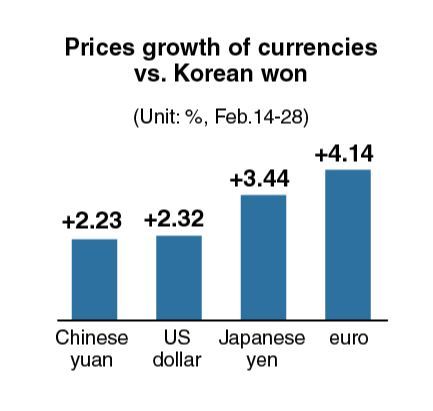

SEJONG -- The South Korean won has lost its value versus yuan as well as key currencies such as the US dollar, euro and yen over the past two weeks.

Despite the simultaneous epidemic shock in the region from the novel coronavirus (COVID-19) that originated in China, the recent weak position of the local currency against the yen and yuan is attributable to the rapidly growing number of infections here since the third week of February, according to market analysts.

The Chinese yuan traded at 173.08 won on Feb. 28, up 3.79 won (2.23 percent) from 10 trading session earlier, when it stayed at 169.29 won.

“The yuan could possibly reach the highest level during the Moon Jae-in administration (174.80 won on Sept. 8, 2017),” a currency dealer said. “Compared to a year earlier, the yuan has climbed about 10 won (6.25 percent).”

The Japanese currency rose 3.44 percent from 1,077.12 won per 100 yen on Feb. 14 to trade at 1,114.18 won on Feb. 28.

The euro climbed 4.14 percent over the corresponding period from 1,282.49 won to 1,335.67 won. It marked the highest level in about a half-year since late August.

The US dollar traded at 1,210.50 won on the last trading session of February, up 2.32 percent from 1,183.00 won on Feb. 14. The greenback peaked at 1,219.00 won on Feb. 24, when the number of the coronavirus infections started surging in South Korea.

“There is no doubt that investors want safety assets like dollars in this sort of situations. Nonetheless, the won’s depreciation against the yuan is somewhat reflecting Korea’s low-key countermeasures against China and the novel coronavirus outbreak,” a research analyst said.

Apart from worries over the cheap currency in the capital market, a dominant portion of online commenters say that the Moon administration should have accepted local doctors’ continuous request to issue an entry ban on travelers from most parts of China.

“Korea’s economy was already in the doldrums due to policy failures. It would be a nonsense if the government seeks to link the tolerance of inbound travelers from China due to economic relations,” said a commenter.

He said Moon’s choice is dealing a severe blow to tourism industry and the almost whole retailers though there was enough time for several weeks to minimize negative impacts.

“What further angers the people is that President Moon has yet to apologize to the public for not issuing a ban on inbound travelers from China, despite growing calls for it,” a commenter said.

The dominant opinion online was that “Moon’s policy has brought unprecedented disgrace on Koreans and doubts over sovereign credibility in the global community.”

Over the past month, foreign investors net-sold Korean stocks worth 4.43 trillion won ($3.65 billion) on the main bourse. They also posted a net-selling for the fifth consecutive trading session since Feb. 24.

Over the corresponding Feb. 14-28 period, the benchmark Kospi lost 256.58 points, 11.4 percent -- from 2,243.59 to 1,987.01.

Meanwhile, an online commenter criticized the Moon government for resorting to, or wasting taxpayers’ money, whenever the economy is hit, pointing out the mounting national debt.

Data from the National Assembly Budget Office showed that the national debt was estimated at 734.9 trillion won as of March 1. This marked an increase of 108 trillion won (or 17.2 percent) in 39 months, compared with 626.9 trillion won at the end of 2016, while Moon took office in May 2017.

It represents a surge of more than 100 percent from a decade ago, when the debt stood at 359.6 trillion won.

Parliamentary estimates also suggest that per capita national debt surpassed the 14 million won mark (14.17 million won) for a population of 51.8 million.

By Kim Yon-se (kys@heraldcorp.com)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[Graphic News] French bulldog most popular breed in US, Maltese most popular in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050864_0.gif&u=)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)