[News Focus] Korea seeks to raise GDP, employment figures by spending more of taxpayers’ money

By Kim Yon-sePublished : June 9, 2019 - 17:41

SEJONG -- The Moon Jae-in government recently unveiled a policy to pay 3 million won ($2,550) over a six-month period, or 500,000 won a month, to a certain portion of jobless people aged 18-64 after assessing their household income levels.

It has also decided to provide financial support for self-employed people who have had to close their businesses, according to the Ministry of Employment and Labor.

Officials say the purpose of this support is to assist the recipients’ job-seeking activities or their efforts to re-establish businesses.

It has also decided to provide financial support for self-employed people who have had to close their businesses, according to the Ministry of Employment and Labor.

Officials say the purpose of this support is to assist the recipients’ job-seeking activities or their efforts to re-establish businesses.

On the macroeconomic front, the government has signaled further fiscal expansion by actively pumping taxpayers’ money into extra budgets.

The Finance Ministry has expressed willingness to tolerate the possibility that the ratio of South Korea’s national debt to its gross domestic product might exceed the 40 percent mark for the first time and approach 45 percent in the coming years.

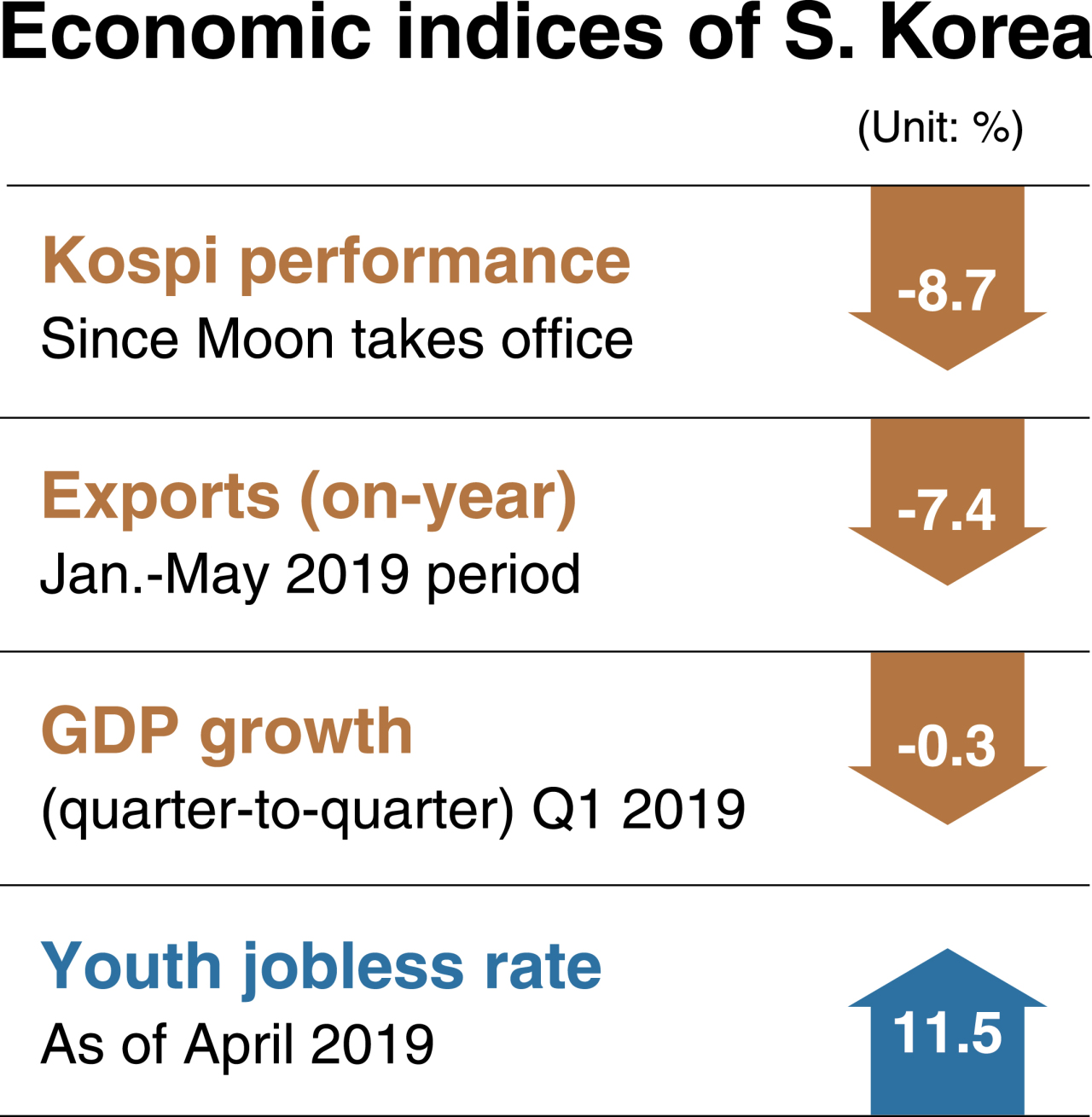

Worryingly, exports dropped 7.4 percent on-year for the first five months of 2019. In May, outbound shipments plunged 9.4 percent from a year earlier, according to the Korea Customs Service.

Apartment prices in the posh Gangnam area of Seoul are showing symptoms of bouncing back despite a series of anti-speculation measures imposed by the Moon administration over the past two years.

Under tight mortgage and housing purchase regulations set by the Land Ministry, the Finance Ministry and the Financial Services Commission, only the chosen few with huge cash reserves can easily purchase apartments in Gangnam, some online commenters and real estate agents have said.

Though the government introduced a housing supply system that gives priority to newlyweds, many young couples from low- and middle-income households have had to cancel contracts due to a spike in apartment prices in Seoul since early 2017. In many cases, the deposits and intermediate payments are too heavy a burden to bear.

So far this year, there have been only two or three months when the Korean won has lost ground to key currencies such as the dollar, yen or euro. Nevertheless, the Bank of Korea has kept the benchmark interest rate under 2 percent -- at 1.75 percent per annum -- for six months.

Few government officials are advocating rate hikes as a way to curb property prices in Seoul or to counteract the trend toward weakening purchasing power of ordinary citizens.

Despite the worsening purchasing power due to the cheap local currency this year, the central bank in a recent report declared that Korea had seen its per capita income level improved to surpass $30,000 in 2017 by citing its new caculation standards.

The Kospi, or the main bourse, has retreated about 200 points during the term of President Moon Jae-in -- down 8.71 percent from 2,270.12 on May 10, 2017, to 2,072.33 on June 7, 2019.

In addition, recent data from the Organization for Economic Cooperation and Development illustrates the serious situation facing the Korean economy.

Korea ranked lowest in first-quarter GDP growth among the 22 OECD members that were part of the analysis. (The org has 36 members altogether.) The nation posted negative growth of 0.34 percent, compared with the previous quarter, while 18 of the 22 countries recorded positive quarter-over-quarter growth.

Most online commenters expressed the view that the solution lies not in financial support for the unemployed, but in fostering a mood for job creation in the business sector by easing the burden of labor costs.

“Conglomerates have not been affected much by the radical minimum wage hikes,” said a research analyst in Seoul. “Those that suffered were small-scale businesses, including the self-employed.”

One commenter spoke out against the administration’s approach to financial support for the jobless. He said, “It is certainly acceptable if the government supports the underprivileged like seniors living alone and child breadwinners. But why do salaried workers have to pay for other ordinary citizens, who have no intention of working?”

Some macroeconomic researchers predict that per capita gross national income might fall below $30,000 this year, citing low GDP growth projections and the depreciation of the local currency.

To attain a level similar to 2018 in per capita GNI, the nation’s nominal GDP would need to hover around 3 percent and the value of the US dollar would need to stay at 1,130 won or less.

However, many research institutes at home and abroad have presented gloomy outlook figures, with some predicting that Korea’s economic growth will fall short of the 2.5 percent mark.

The greenback, which was traded at 1,129 won on March 21, ranged between 1,135 and 1,195 won over the past two months.

An expert forecast an on-year drop in per capita GNI in 2019 -- the first in four years if it takes place.

A foreign company executive residing in Seoul compared the situation today with the tenure of former President Roh Moo-hyun, saying Roh had the courage to admit policy failures and the confidence to reconsider his policy direction accordingly.

By Kim Yon-se (kys@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)