[News Focus] Delinquency among self-employed gets critical

By Kim Yon-sePublished : March 17, 2019 - 16:01

SEJONG -- A string of business closures of small enterprises -- particularly the self-employed -- has been increasingly drawing attention since last year amid the sluggish economy.

Their financial difficulty, in line with the drastic hike in minimum wage and weak consumer sentiment, is also seen from the lending data of commercial banks. Aside from the first-tier financial firms, a large portion of the self-employed were found to have borrowed from second-tier lenders.

According to the Bank of Korea, the outstanding loans, issued by commercial banks to the self-employed came to 313.8 trillion won ($276.9 billion) as of end-2018, up 8.7 percent (or 25 trillion won) from a year earlier.

This means that loans to the self-employed snowballed by 2 trillion won a month on the average throughout the year.

The figure exceeded the on-year growth rate -- 6.6 percent -- of mortgage loans issued to the household sector.

Their financial difficulty, in line with the drastic hike in minimum wage and weak consumer sentiment, is also seen from the lending data of commercial banks. Aside from the first-tier financial firms, a large portion of the self-employed were found to have borrowed from second-tier lenders.

According to the Bank of Korea, the outstanding loans, issued by commercial banks to the self-employed came to 313.8 trillion won ($276.9 billion) as of end-2018, up 8.7 percent (or 25 trillion won) from a year earlier.

This means that loans to the self-employed snowballed by 2 trillion won a month on the average throughout the year.

The figure exceeded the on-year growth rate -- 6.6 percent -- of mortgage loans issued to the household sector.

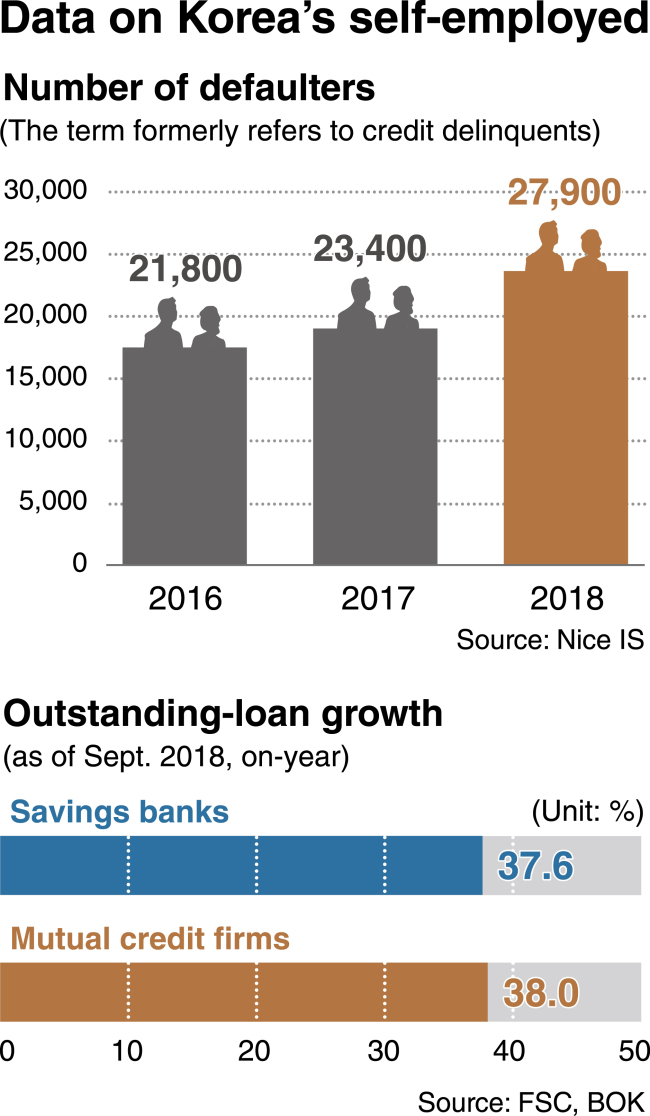

More serious in the data is that self-employed people actively have taken loans from second-tier financial firms. Their borrowings from savings banks and mutual credit firms surged by 37.6 percent and 38 percent, respectively, on-year as of September 2018.

Their lackluster business performance is resulting in growth of overdue loans. The entire financial industry saw the ratio of overdue loans to the self-employed post 0.65 percent as of end-2018, up 0.14 percentage point from 0.51 percent a year earlier.

The financial authorities are also alert to the situation in terms of asset-soundness of the first and second-tier financial firms.

Financial Services Commission Chairman Choi Jong-ku has called for the government, regulators and financial firms to simultaneously cope with the situation. “The self-employed loans from the mutual credit firms and savings banks are sharply increasing,” he said.

Financial Supervisory Service Gov. Yoon Suk-heun has also expressed worries over the rising delinquency rate in the nonbanking sector, saying that “preemptive measures are more important than ever as economic conditions are not favorable this year.”

Yoon cited feasible support options for the self-employed, such as adjusting their redemption schedules and consulting services for them.

According to Nice Investors Service, the number of defaulters among the self-employed, who failed to repay their debt within 90 days from the loan dues, came to 27,917 as of end-2018. This marked a 29 percent, or 6,249 individuals, increase in four years.

Data showed that the delinquency growth was the sharpest -- by 0.24 percentage point -- among those in their 40s, followed by those in their 30s. Payment defaults also snowballed among those with low credit scores.

The proportion of self-employed defaulters has continued to increase over the past year -- 1.36 percent in March 2018, 1.39 percent in June, 1.41 percent in September and 1.43 percent in December.

Market insiders share the view that their debt burden could further mount amid their falling return rates but higher lending rates, compared to past years.

According to Statistics Korea, only 30.2 percent of the lodging and food retailers were retaining their businesses after three years since starting operations. Their collective ratio of operating profit to sales are estimated to have sharply dropped compared to a decade ago.

A research fellow at LG Economic Research Institute was quoted by a news provider as saying that “state job data shows that the number of employed in the food, lodging and wholesale-retail sectors have been declining.”

“On the contrary, the outstanding loans to the sectors increased. This means that the self-employed people in the sectors are estimated to have been dependent upon borrowings for survival, rather than investment or business investment purposes.”

The nation’s statutory minimum wage has been hiked to 8,350 won per hour this year, up 10.9 percent from 7,530 won in 2018. It was 6,470 won in 2017, 6,030 won in 2016 and 5,580 won in 2015.

By Kim Yon-se (kys@heraldcorp.com)

![[Today’s K-pop] BTS pop-up event to come to Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050734_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)