[News Focus] World’s 6th-largest exporter faces hurdles in early 2019

By Kim Yon-sePublished : Jan. 29, 2019 - 16:23

SEJONG -- The government and the business sector are closely watching indexes related to exports amid signs that the nation’s export volume is going downhill.

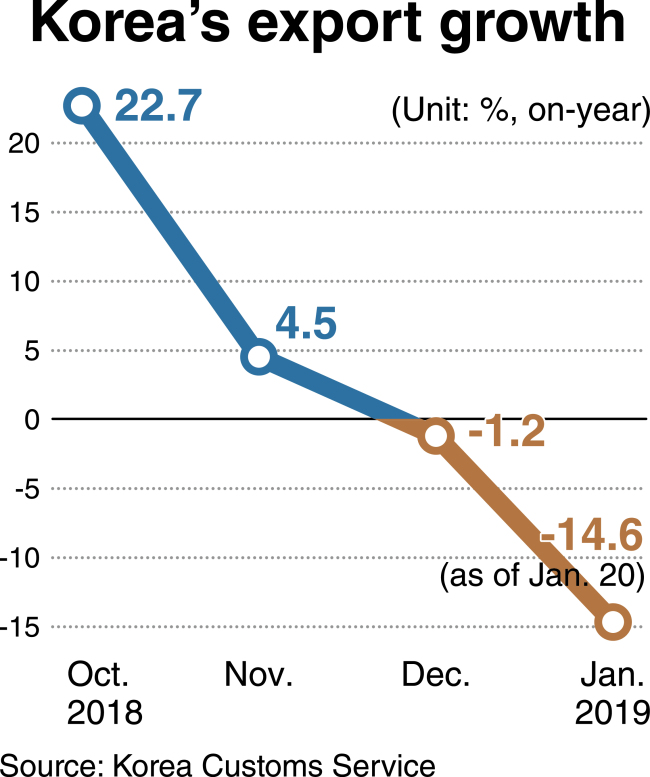

Though yearly exports hit a record of more than $600 billion in 2018, monthly export growth on-year suffered a slowdown in November (4.5 percent) and posted negative in December (minus 1.2 percent) after achieving a 22.7 percent increase in October, according to the Korea Customs Service.

The decline has continued at the beginning of this year. During the first 20 days of January, exports fell by 14.6 percent to reach $25.7 billion. A noteworthy point is that exports of semiconductors, South Korea’s No. 1 export item, dropped 28.8 percent.

Though yearly exports hit a record of more than $600 billion in 2018, monthly export growth on-year suffered a slowdown in November (4.5 percent) and posted negative in December (minus 1.2 percent) after achieving a 22.7 percent increase in October, according to the Korea Customs Service.

The decline has continued at the beginning of this year. During the first 20 days of January, exports fell by 14.6 percent to reach $25.7 billion. A noteworthy point is that exports of semiconductors, South Korea’s No. 1 export item, dropped 28.8 percent.

A Hana Financial Investment analyst highlighted that Korea’s semiconductor exports to China have dropped sharply, attributing the decline to “the slowdown in Chinese manufacturing industry growth and trade conflicts between China and the US.”

Exports to China, the largest export destination of Korea, fell 22.5 percent over the cited period, followed by minus 15.1 percent to Vietnam (third-largest) and minus 9 percent to Japan (fifth-largest), according to KCS data.

A poll of research analysts at eight securities firms by economic news provider Yonhap Infomax showed the average estimate for January exports fell 6.7 percent from a year earlier to stand at $45.9 billion. Their prediction indicates that exports are likely to drop for the second consecutive month, following December’s figure.

This would mark the first time in more than two years since exports fell on-year for two consecutive months in September and October 2016.

Lee Sang-jae, a research fellow at Eugene Investment & Securities, was quoted by the media outlet as saying that “it cannot rule out the possibility that 2019 exports will post negative growth on-year, unless overall international goods like oil prices bounce back as soon as possible or trade conflicts between economic powerhouses ease.”

Some officials at the Government Complex Sejong shared the view that a plunge in crude oil prices would deal a blow to the nation’s exports. A director general said, “The main issue of whether the difficulty can be resolved would be the result of the senior-level talks on tariffs between the US and China, slated for Jan. 30-31 in Washington, DC.”

South Korea is the world’s sixth-largest exporter as of 2018, closely competing with Japan (fifth), Hong Kong (seventh), France (eighth) and Italy (ninth). An export slowdown or downturn would pull down the ranking and gross domestic product growth.

From 1948 to 2017, Korea saw its yearly exports grow 16.1 percent on average to post 3.4 percent -- an all-time high -- in the percentage of the world’s collective exports in 2018.

As a countermeasure, the Ministry of Trade, Commerce and Industry has decided to offer semiconductor manufacturers and machinery businesses an extension of trade insurance, allowing them to enjoy the insurance ceiling up to twofold for the next two months.

On Jan. 21, Minister Sung Yun-mo held a meeting with executives from a group of conglomerates in an effort to support their exports, at Korea Trade Insurance Corp. in Seoul. Among the participants were executives of Hyundai Motor and LG Chem, and senior officials from the Korea International Trade Association and Korea Trade-Investment Promotion Agency.

Private sector participants called for the government to streamline procedures for exports and imports and further cut tariffs on export products.

“While the government is aiming to achieve $600 billion in exports for the second consecutive year, gloomy external factors are undermining the state’s goal from an early stage,” said a professor of Hankuk University of Foreign Studies.

He raised the urgent need to brace for the era of the “fourth industrial revolution,” saying that “items based on futuristic technologies and creativity will guarantee steady export performance in the coming decades.”

By Kim Yon-se (kys@heraldcorp.com)

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)