S. Korea avoids being labeled currency manipulator, remains on watch list

By Bae HyunjungPublished : Oct. 18, 2018 - 16:48

South Korea has avoided being classified as a currency manipulator by the United States, but will remain on its monitoring list over the next six months, financial officials said Thursday.

“The foreign exchange market here will not receive much impact as we were not designated as a currency manipulating country,” said an official of the Ministry of Economy and Finance.

“But should China be named a currency manipulator (in April next year), there will then be significant indirect impact on Korea’s real economy.”

The comment came in the wake of the US Department of the Treasury’s semiannual foreign exchange policy report, released Wednesday, which put six major trading partners on the monitoring list.

The six countries on the list are South Korea, China, Germany, India, Japan and Switzerland. None were named currency manipulators.

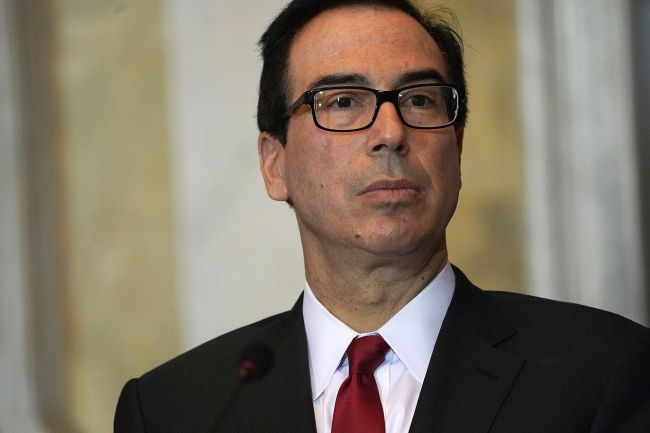

“The Treasury Department is working vigorously to ensure that our trading partners dismantle unfair barriers that stand in the way of free, fair and reciprocal trade,” Treasury Secretary Steven Mnuchin said in a statement.

The US policymaker especially pointed out to China’s lack of currency transparency and the recent weakness of its currency.

“The foreign exchange market here will not receive much impact as we were not designated as a currency manipulating country,” said an official of the Ministry of Economy and Finance.

“But should China be named a currency manipulator (in April next year), there will then be significant indirect impact on Korea’s real economy.”

The comment came in the wake of the US Department of the Treasury’s semiannual foreign exchange policy report, released Wednesday, which put six major trading partners on the monitoring list.

The six countries on the list are South Korea, China, Germany, India, Japan and Switzerland. None were named currency manipulators.

“The Treasury Department is working vigorously to ensure that our trading partners dismantle unfair barriers that stand in the way of free, fair and reciprocal trade,” Treasury Secretary Steven Mnuchin said in a statement.

The US policymaker especially pointed out to China’s lack of currency transparency and the recent weakness of its currency.

In order to be designated as a currency manipulator by the US government, a country should record a bilateral trade surplus of $20 billion or more and a current account surplus of at least 3 percent of its gross domestic product, as well as “persistent, one-sided intervention” in foreign currency interactions.

While Seoul meets the former two requirements, it has been making gestures to improve the transparency of its foreign exchange market by revealing the records on government intervention in an incremental pace, starting yearly next year.

The country’s goods trade surplus stood at $21 billion over the four-quarter reporting ending in June, which was down $7 billion and its current account surplus was 4.6 percent of the GDP.

Korea’s financial authorities have consistently denied their interference in the currency market and claimed to have carried out some “smoothing operations” against extreme movements.

Deputy Prime Minister and Finance Minister Kim Dong-yeon also reiterated the message during a bilateral meeting with his US counterpart, held on the sidelines of the Group of 20 Financial Ministers’ Summit held in Bali last week.

“The Treasury will continue to monitor closely Korea’s currency practices, including the authorities’ recently announced plans to increase the transparency of exchange rate intervention,” the US report said.

By Bae Hyun-jung(tellme@heraldcorp.com)

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)

![[Today’s K-pop] Stray Kids to return soon: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/16/20240416050713_0.jpg&u=)