Samsung in shock upon Lee’s jail sentence

Court’s verdict jeopardizes Lee’s succession, raises uncertainty in Samsung’s strategies

By Cho Chung-unPublished : Aug. 25, 2017 - 16:16

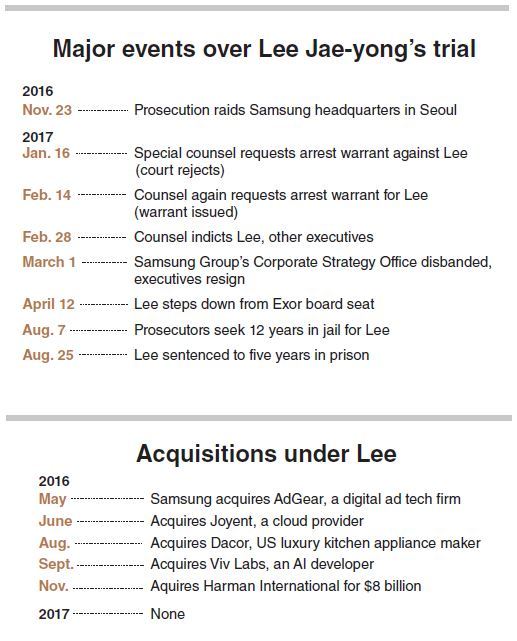

The five-year jail sentence of Samsung’s de facto leader Friday drove the world’s largest producer of smartphones and chips into a deeper quagmire, as Samsung Electronics Vice Chairman Lee Jae-yong was found guilty of all five charges over his involvement in the corruption scandal that led to the impeachment of the nation’s former president.

The court acknowledged a special counsel’s accusation that Lee and other executives were aware of President Park Geun-hye’s close relationship with her friend Choi Soon-sil, though he did not specifically request Park to lift regulatory hurdles for his succession plan.

Lee is the first member of Samsung’s owner family to receive a jail term.

In 2008, his father was sentenced -- in the same room where his son stood -- to three years in jail for creating illegal slush funds, but this was suspended for five years.

The court acknowledged a special counsel’s accusation that Lee and other executives were aware of President Park Geun-hye’s close relationship with her friend Choi Soon-sil, though he did not specifically request Park to lift regulatory hurdles for his succession plan.

Lee is the first member of Samsung’s owner family to receive a jail term.

In 2008, his father was sentenced -- in the same room where his son stood -- to three years in jail for creating illegal slush funds, but this was suspended for five years.

The heir apparent of Samsung returned to a detention center in Gyeonggi Province, where he had spent the last six months, to appeal his case.

The ruling is likely to test whether Samsung can keep its top global status without its heir.

It is the first time for the conglomerate to operate without any member of its owner family physically part of the top management. Lee’s father, Chairman Lee Kun-hee, has been hospitalized since 2014 after a severe heart attack.

Expressing bewilderment, Samsung insiders said they were disappointed with the court’s decision against Lee’s claim of having provided “unconditional” assistance to Choi and her family.

Although Samsung officials had been holding their breath, they said there would not be any drastic changes in the company’s management or a contingency plan for now. But they raised concerns on the possibility of a leadership vacuum that could suspend the conglomerate’s future strategies and investment plans.

Samsung Electronics has three CEOs who each run major business segments -- smartphones, consumer electronics and microchips. They are experts in their respective fields and have proven their leadership in each segment, but they lack the authority to make large-scale acquisition investments without the owner family’s approval.

“Making decisions on investing in new businesses, for which the return on investments is uncertain, or pushing for large-scale mergers and acquisitions, cannot be done by the hired executives, as they are too risky,” said a Samsung official, adding that these are the kind of decisions only Lee had been able to make.

Lee joining the boardroom last October was widely seen as the heir opening a new chapter for Samsung and adding a modern management style to the tech empire that had been led by his father, known as a charismatic leader.

There were mixed views on Lee, including whether he could change Samsung’s DNA from a manufacturing company to a software firm while completing his father’s unfinished plan of making Samsung a leader in bio and financial technologies.

Samsung was active in the M&A market, acquiring five companies, including Harman International, in six months last year. Since the bribery scandal that flared up late last year, Samsung’s M&A drive has been losing steam. There have been market rumors of potential M&A cases, but the tech giant has remained silent.

While some say it would be difficult for the group to paint a big picture without Lee, chaebol reformists call it an opportunity to end the long-standing problems of the chaebol model -- the opaque corporate governance and transfer of control within a group’s founding family, often involving illicit means.

The Lee family holds a less than 5 percent share, but controls the tech giant, worth 306 trillion won in market cap, through an enigmatic web of cross-ownership stakes. Lee Kun-hee has 3.44 percent in Samsung Electronics, while Lee Jae-yong has 0.58 percent and Samsung C&T has 4.8 percent. An additional 1 percent stake would cost him about 3 trillion won.

Samsung has been devising the most efficient way to consolidate the heir’s control within the group’s crown jewel that produces smartphones, computer chips and flat-screen TVs. Samsung Electronics contributes to nearly 75 percent of the group’s total revenue.

“I don’t think that Samsung will face a management crisis anytime soon because of Lee’s absence. But uncertainty over Lee’s hereditary succession will surely grow and this would put not only Samsung but other conglomerates under enormous public pressure to take legal and transparent steps in the course of their succession,” said Park Sang-in, a professor at Seoul National University’s Graduate School of Public Administration.

Although the de facto chief has been away since February, as he was held in a correction facility, Samsung Electronics has been flourishing. In the second quarter of this year, the electronics giant was set to become the most profitable company in the world, beating Apple for the first time. The share price of Samsung Electronics has surged 34 percent since Lee was arrested on Feb. 26.

Its thriving chip business driven by rising demand for smartphones and other IT devices has contributed mostly to the rapid share value growth, but Park Ju-gun, president of CEOScore, a Seoul-based corporate watcher, believes that there’s something more.

“Foreign investors appear to be taking Lee’s trial as a positive sign for Samsung Electronics. Though it might be a tragic case for Lee himself, many seem to be observing the issue as an opportunity to improve Samsung’s governance structure and corporate transparency,” said Park.

“Samsung now must take the road it never has been on before. The long-term leadership vacuum could be a risk but it could also be an opportunity for Samsung to grow into a ‘true’ global company,” he said, adding that the absence of Lee could make Samsung’s governance structure and management process more transparent, allowing individual units more independence in the decision-making process.

Despite its reputation as the world’s largest producer of microchip and smartphones, its governance structure and corporate transparency has long been questioned. Foreign investors hold more than a half of shares in Samsung Electronics.

Lee’s verdict also sends a strong warning to other chaebol families and conglomerates they control, as the new government has been pushing a reform drive to cut the decades-old back-scratching ties between politics and businesses.

It also signals stronger intolerance toward collusion between conglomerates and the politics.

“What we hope from the trial is to root out the government’s long-held practice of demanding money from conglomerates whenever they need,” said a source from one of the top five conglomerates in Korea.

“If companies disobeyed the government’s requests, it often responded by replacing the management, imposing taxes and investigating the firms through antitrust authorities. I hope this will not happen again,” he said.

By Cho Chung-un and Shin Ji-hye (christory@heraldcorp.com) (shinjh@heraldcorp.com)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)