Drastic deregulation needed to boost FDI in Korea

By Korea HeraldPublished : March 13, 2016 - 19:14

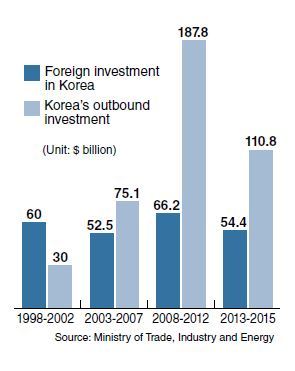

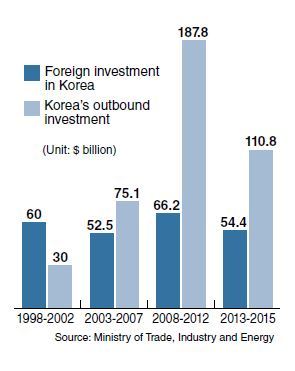

Foreign direct investment in Korea reached a record annual high of $20.91 billion last year on the reporting basis, according to recent data from the Ministry of Trade, Industry and Energy. In the period between 2013 and 2015, the amount stood at $54.4 billion.

But the record may well be seen as similar to the level in the late 1990s when the country began strengthening efforts to attract more investment from abroad while going through a foreign exchange crisis.

The FDI here in 2013-2015 was up some 37 percent from the sum for 1998-2000 at $39.6 billion. Given the expanded size of the country’s economy, the increase seems anything but significant, economists say.

The slow growth in FDI contrasts with a steep rise in overseas investment by Korean companies. The amount of investment by local corporations in foreign countries climbed nearly sevenfold from $5.82 billion in 1998 to $40.23 billion last year.

It is also noticeable that foreign investors have pulled more capital out of the country than put new investments in in recent years. According to the ministry data, the amount of FDI withdrawn from Korea over the past three years reached $110.8 billion, more than double the new foreign capital invested in the country.

Many economists note the unsatisfactory or worrying figures show that the government’s efforts to draw more foreign investment have been largely ineffective and misplaced.

Policymakers have focused on establishing a number of special zones designed to attract foreign investors while dragging their feet on drastic deregulation and fundamental restructuring of industries.

“Efforts should be accelerated to eliminate core regulations in the labor market and the services sector rather than designating special economic zones,” said Kim Joo-hoon, head of the Economic Information and Education Center at the Korea Development Institute.

More than 42 trillion won ($34.6 billion) has so far been poured into the project to build eight free economic zones across the country, which started in 2003 with the total cost set at 126 trillion won. But the amount of FDI pledged for the zones until last year remained at about 7 trillion won.

Dozens of other areas zoned for a similar purpose have also failed to attract a significant amount of foreign investment.

International comparisons show Korea remains far from being a place preferred by foreign investors.

In the 2014 FDI regulatory restrictiveness index, the country ranked sixth with a score of 0.135 among the 34 member states of the Organization for Economic Cooperation and Development. The OECD average was 0.068, with the figures for Germany and Japan down at 0.02 and 0.05, respectively.

One of the regulations put in place here hinders the establishment of hospitals and schools needed to induce more high-skilled foreign workers to stay in the country for longer periods.

The complicated set of restrictions poses barriers particularly to investment in the services sector, which currently accounts for more than 70 percent of FDI in Korea. The manufacturing industry’s FDI share shrank from 65.9 percent in 1998 to 21.8 percent last year. This trend makes it increasingly irrelevant to continue to put the policy focus on creating large-scale zones aimed at attracting foreign manufacturing firms.

In a survey of companies operating in a dozen special economic zones across Asia, conducted by a local research institute last year, respondents gave the lowest score to Korea in the categories of employment conditions, labor-management relations and government regulations.

Removing the obstacles that have kept foreign investors from the country would also result in encouraging Korean companies to increase their domestic investment, economists say.

In contradiction to the rise in their overseas investment, local corporations have remained passive on expanding investment at home, while piling up large amounts of cash.

An analysis by an opposition lawmaker and officials at the National Assembly Budget Office last year showed actual investment by the country’s 30 largest business conglomerates increased by a mere 3.5 percent from 62.4 trillion won in 2010 to 64.6 trillion won in 2014, with their cash reserves rising by 51.5 percent, or 170.1 trillion won, to 500.2 trillion won over the cited period.

In a meeting with a group of top corporate executives Wednesday, Industry Minister Joo Hyung-hwan pledged to make all-out efforts to help them carry out investment plans for this year. He said interministerial task forces would be formed to provide specific support for massive investment projects.

More importantly, many economists indicate, the government should not slack off their efforts at drastic deregulation and structural reform.

By Kim Kyung-ho (khkim@heraldcorp.com)

But the record may well be seen as similar to the level in the late 1990s when the country began strengthening efforts to attract more investment from abroad while going through a foreign exchange crisis.

The FDI here in 2013-2015 was up some 37 percent from the sum for 1998-2000 at $39.6 billion. Given the expanded size of the country’s economy, the increase seems anything but significant, economists say.

The slow growth in FDI contrasts with a steep rise in overseas investment by Korean companies. The amount of investment by local corporations in foreign countries climbed nearly sevenfold from $5.82 billion in 1998 to $40.23 billion last year.

It is also noticeable that foreign investors have pulled more capital out of the country than put new investments in in recent years. According to the ministry data, the amount of FDI withdrawn from Korea over the past three years reached $110.8 billion, more than double the new foreign capital invested in the country.

Many economists note the unsatisfactory or worrying figures show that the government’s efforts to draw more foreign investment have been largely ineffective and misplaced.

Policymakers have focused on establishing a number of special zones designed to attract foreign investors while dragging their feet on drastic deregulation and fundamental restructuring of industries.

“Efforts should be accelerated to eliminate core regulations in the labor market and the services sector rather than designating special economic zones,” said Kim Joo-hoon, head of the Economic Information and Education Center at the Korea Development Institute.

More than 42 trillion won ($34.6 billion) has so far been poured into the project to build eight free economic zones across the country, which started in 2003 with the total cost set at 126 trillion won. But the amount of FDI pledged for the zones until last year remained at about 7 trillion won.

Dozens of other areas zoned for a similar purpose have also failed to attract a significant amount of foreign investment.

International comparisons show Korea remains far from being a place preferred by foreign investors.

In the 2014 FDI regulatory restrictiveness index, the country ranked sixth with a score of 0.135 among the 34 member states of the Organization for Economic Cooperation and Development. The OECD average was 0.068, with the figures for Germany and Japan down at 0.02 and 0.05, respectively.

One of the regulations put in place here hinders the establishment of hospitals and schools needed to induce more high-skilled foreign workers to stay in the country for longer periods.

The complicated set of restrictions poses barriers particularly to investment in the services sector, which currently accounts for more than 70 percent of FDI in Korea. The manufacturing industry’s FDI share shrank from 65.9 percent in 1998 to 21.8 percent last year. This trend makes it increasingly irrelevant to continue to put the policy focus on creating large-scale zones aimed at attracting foreign manufacturing firms.

In a survey of companies operating in a dozen special economic zones across Asia, conducted by a local research institute last year, respondents gave the lowest score to Korea in the categories of employment conditions, labor-management relations and government regulations.

Removing the obstacles that have kept foreign investors from the country would also result in encouraging Korean companies to increase their domestic investment, economists say.

In contradiction to the rise in their overseas investment, local corporations have remained passive on expanding investment at home, while piling up large amounts of cash.

An analysis by an opposition lawmaker and officials at the National Assembly Budget Office last year showed actual investment by the country’s 30 largest business conglomerates increased by a mere 3.5 percent from 62.4 trillion won in 2010 to 64.6 trillion won in 2014, with their cash reserves rising by 51.5 percent, or 170.1 trillion won, to 500.2 trillion won over the cited period.

In a meeting with a group of top corporate executives Wednesday, Industry Minister Joo Hyung-hwan pledged to make all-out efforts to help them carry out investment plans for this year. He said interministerial task forces would be formed to provide specific support for massive investment projects.

More importantly, many economists indicate, the government should not slack off their efforts at drastic deregulation and structural reform.

By Kim Kyung-ho (khkim@heraldcorp.com)

-

Articles by Korea Herald

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[Today’s K-pop] Kep1er to disband after 2 1/2 years: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/25/20240425050792_0.jpg&u=)