Proportion of credit card purchases to household spending surpasses 60%

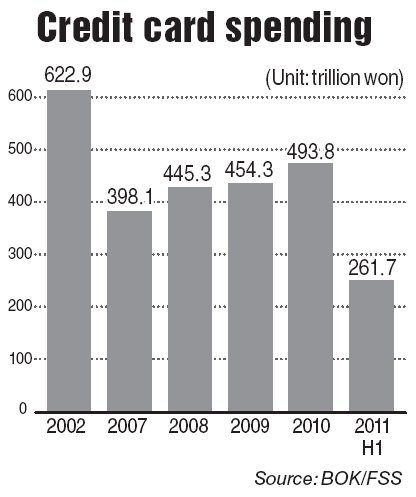

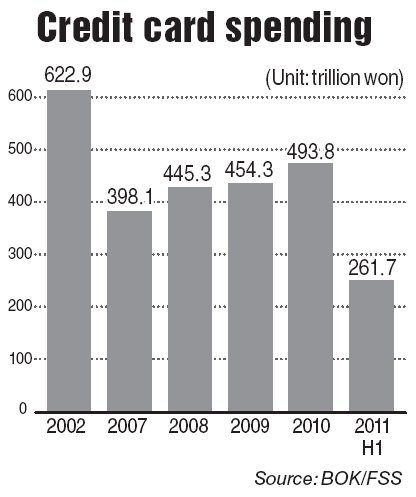

Korea’s credit card spending jumped nearly 10 percent on-year to 261.7 trillion won ($237.5 billion) in the first half of this year, data showed Monday, amid concerns that a credit card bubble might be in the offing again.

The latest data from credit card companies suggests that the total spending through plastic would top 500 trillion won by year-end. The figure was 493.8 trillion won last year, and 622 trillion won in 2002, a year before the credit card bubble burst with an impact that jeopardized the entire economy.

Credit card purchases made up 60.1 percent of household spending in the January-June period, breaking the 60 percent mark for the first time.

Back in 1991, credit card spending was just 13 trillion won. The Korean government, in the following years, introduced a set of policy initiatives to encourage people to use their credit cards in a bid to identify the hidden or hard-to-measure economic activities, a move aimed largely at increasing tax revenues.

The government’s policy worked far better than expected, but small retailers were increasingly dissatisfied with the snowballing commissions they have to pay to credit card firms.

In response to the public outcry, credit card firms agreed to lower the transaction fee rate to below 1.80 percent and broadened the criteria for small corporate clients who can apply for favorable commission rates.

The solid growth of credit card usage is now a concern for policymakers. The government has been steadily trimming tax benefits for credit card purchases as the original aim of identifying the formerly elusive tax revenue sources has been achieved.

A bigger concern for now is that excessive credit card spending is likely to worsen the country’s household debt, which is estimated at 876.3 trillion won as of the end of June.

The Bank of Korea said in a report issued on Oct. 30 that Korean lenders recently strengthened the marketing for their credit card units, resulting in a higher cost. The combined marketing cost of local credit card companies jumped 30.3 percent last year from 2009. The number of credit cards issued stood at 120 million as of the end of December last year. At the height of the credit card bubble in 2002, the figure was 104.8 million, suggesting that the credit card market has been heating up at a risky pace.

Particularly worrisome is the surging demand for credit card loans, which climbed 42.3 percent in 2010 from a year earlier. Many of the customers seeking such loans from credit card firms have shaky credit backgrounds.

By Yang Sung-jin (insight@heraldcorp.com)

Korea’s credit card spending jumped nearly 10 percent on-year to 261.7 trillion won ($237.5 billion) in the first half of this year, data showed Monday, amid concerns that a credit card bubble might be in the offing again.

The latest data from credit card companies suggests that the total spending through plastic would top 500 trillion won by year-end. The figure was 493.8 trillion won last year, and 622 trillion won in 2002, a year before the credit card bubble burst with an impact that jeopardized the entire economy.

Credit card purchases made up 60.1 percent of household spending in the January-June period, breaking the 60 percent mark for the first time.

Back in 1991, credit card spending was just 13 trillion won. The Korean government, in the following years, introduced a set of policy initiatives to encourage people to use their credit cards in a bid to identify the hidden or hard-to-measure economic activities, a move aimed largely at increasing tax revenues.

The government’s policy worked far better than expected, but small retailers were increasingly dissatisfied with the snowballing commissions they have to pay to credit card firms.

In response to the public outcry, credit card firms agreed to lower the transaction fee rate to below 1.80 percent and broadened the criteria for small corporate clients who can apply for favorable commission rates.

The solid growth of credit card usage is now a concern for policymakers. The government has been steadily trimming tax benefits for credit card purchases as the original aim of identifying the formerly elusive tax revenue sources has been achieved.

A bigger concern for now is that excessive credit card spending is likely to worsen the country’s household debt, which is estimated at 876.3 trillion won as of the end of June.

The Bank of Korea said in a report issued on Oct. 30 that Korean lenders recently strengthened the marketing for their credit card units, resulting in a higher cost. The combined marketing cost of local credit card companies jumped 30.3 percent last year from 2009. The number of credit cards issued stood at 120 million as of the end of December last year. At the height of the credit card bubble in 2002, the figure was 104.8 million, suggesting that the credit card market has been heating up at a risky pace.

Particularly worrisome is the surging demand for credit card loans, which climbed 42.3 percent in 2010 from a year earlier. Many of the customers seeking such loans from credit card firms have shaky credit backgrounds.

By Yang Sung-jin (insight@heraldcorp.com)

-

Articles by Korea Herald

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)